Soon after the United States Commodity Futures Trading Commission (CFTC) sued crypto exchange Binance and its CEO Changpeng “CZ” Zhao for regulatory violations, the entrepreneur sought damage control measures while rejecting allegations of market manipulation. However, investors responded by pulling over 3,400 Bitcoin (BTC) from Binance within 24 hours of the announcement, anticipating market fluctuations.

“Binance.com does not trade for profit or “manipulate” the market under any circumstances,” stated CZ, responding to the CFTC’s allegations. However, episodes involving crypto entrepreneurs such as FTX’s Sam Bankman-Fried and Terraform Labs’ Do Kwon have shaken investor confidence in the crypto ecosystem.

My Response to the CFTC Complaint | Binance Blog https://t.co/TadyotM7HN

— CZ Binance (@cz_binance) March 27, 2023

Investors have started moving assets away from Binance to lessen the impact of a shutdown if it were to happen. As a result, Binance saw a reduction in its total Bitcoin balance while other exchanges registered an increase, as shown below.

Binance’s Bitcoin balance was reduced by over 3,900 BTC in the past week, of which 3,400 BTC were pulled out in the last 24 hours alone.

Competing exchanges, including Coinbase, Bitfinex and Gemini, recorded an increase in BTC reserves during the 24-hour timeframe.

It is important to note that Bitcoin balances on crypto exchanges have declined since March 20. Over the last seven days, nearly 27,000 BTC left major exchanges.

Related: 7 details in the CFTC lawsuit against Binance you may have missed

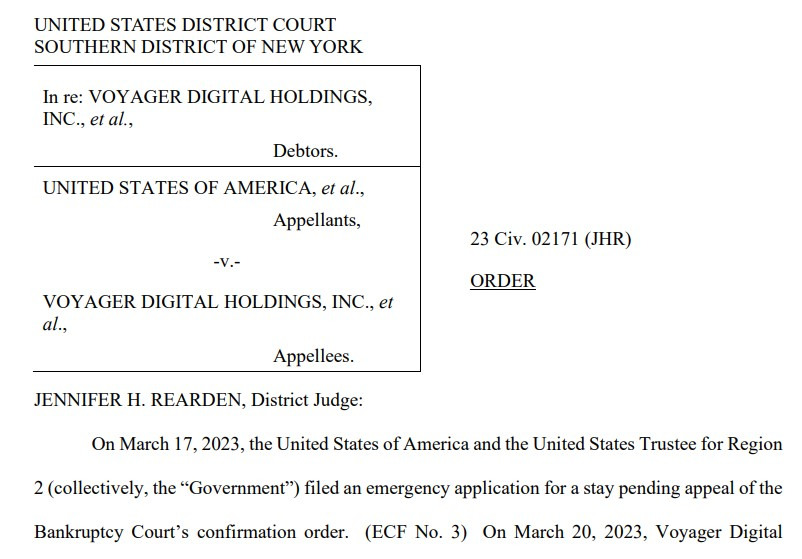

Alongside the CFTC’s lawsuit against Binance and CZ, a federal judge temporarily halted a proposed deal between Voyager and Binance.US.

As Cryptox reported, Judge Jennifer Rearden of the U.S. District Court for the Southern District of New York granted the emergency stay on March 27, halting the potential deal between Voyager and Binance.US until a decision is made on the Department of Justice’s appeal against the bankruptcy plan.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime