Bitcoin (BTC) starts one of the most important macro weeks of the year in a precarious position below $17,000.

After its latest weekly close, BTC/USD showed little upward momentum prior to the Dec. 12 Wall Street open.

With volatility yet to appear, the largest cryptocurrency continues to trade in a narrow range, and analysts are increasingly impatient for new catalysts.

These, they agree, should come in the next few days — United States economic data is due, and its content and impact on economic policy will likely have a significant impact on crypto markets.

Elsewhere, the uneasy status quo continues — Bitcoin miners are struggling, sentiment lacks inspiration and traders are increasingly drawing comparisons to the pits of previous bear markets.

Where could BTC price action head in the coming week? Cryptox takes a look at five factors set to influence trajectory.

“Most important” CPI print forms key focus

The phrase on everyone’s lips this week is Consumer Price Index (CPI) — the key measure of consumer prices inflation in the U.S.

While coming every month, the latest CPI print, due Dec. 13 for the month of November, has additional importance for the market. With two weeks to go until the end of the year, the chances of a risk asset “Santa rally,” for instance, now hang in the balance.

It is not just the CPI report itself; the Federal Reserve’s Federal Open Market Committee (FOMC) will decide on rate hikes this week, and Chair Jerome Powell will deliver a speech that market commentators will scrutinize for signs of policy change.

“CPI Report Tuesday, FED rate hikes and JPow speaks on Wednesday. Stay tuned for volatility,” on-chain analytics resource Material Indicators summarized at the weekend.

Popular trader MisterSpread added that further decisions outside the U.S. made for “one of the most (if not the most) important” weeks of the year.

“Tuesday’s CPI will yet again be ‘the most important CPI release ever’, this time because the market has set it up to be with its epic 2-month short squeeze rally,” trading firm QCP Capital meanwhile wrote in a market update.

QCP continued:

“A higher-than-expected CPI print and more hawkish Fed have the potential to invalidate this rally, like we saw in the April and August reversals. On the other hand, another disinflationary print could see many chase a continuation of the rally into year-end.”

Regardless of whether up or down, CPI tends to induce market volatility surrounding its release, with calm only returning after the rates decision Powell’s accompanying speech.

According to CME Group’s FedWatch Tool, current consensus calls for a smaller 50-basis-point hike in interest rates this month, signaling a comedown for the Fed in what could yet turn out to be a significant turning point in policy.

At the time of writing, the probability of 50 basis points stood at around 75%.

Also describing this week as the “biggest week of the year,” financial commentary resource The Kobeissi Letter nonetheless had a warning for investors.

“Imagine the madness if the Fed doesn’t pivot or November CPI is above October’s 7.7% print,” part of a tweet on Dec. 8 read.

“This is why you don’t want a Fed controlled market.”

BTC spot price waits for action

With everyone focused on the Fed, traders understand that policy and macro numbers will de facto dictate what happens to BTC/USD in the coming days.

Aside from force majeure, there may be little to do but sit and wait for data to roll in.

In the meantime, BTC/USD continues to range in all-too-familiar territory around the $17,000 mark, data from Cryptox Markets Pro and TradingView shows.

Unchanged for days, the pair seems directionless as the dust from the FTX implosion continues to settle.

“BTC has been bouncing between Realized Price (green) & Balanced Price (yellow) since June,” analytics resource On-Chain College summarized on the mid-term trend.

“I’m interested in a sustained movement outside of this range, which has yet to occur.”

Some had more categorical takes on BTC price performance. Matthew Dixon, founder and CEO of crypto ratings platform Evai, called for Bitcoin to “complete the overall correction higher” to cancel out most of the losses from FTX.

At the same time, popular commentator Profit Blue maintained that $10,000 would reenter the radar before the start of 2023.

“Bitcoin is headed to $10k and it will likely bottom out there soon. Pay attention to the details,” commentary on an accompanying chat read.

U.S. dollar teases renewed strength

Keenly anticipating a change of trend for the U.S. dollar, meanwhile, trader Bluntz warned that Bitcoin may yet deliver a bearish end to the year.

The U.S. dollar index (DXY), under pressure for weeks, has begun to seal higher lows on daily timeframes, potentially setting up dollar strength for a rebound.

This, thanks to inverse correlation, would spell trouble for crypto markets across the board.

“quite an ugly 4h about to close here, looking like a lower high on 4h timeframe and lots of catalysts upcoming this week,” Bluntz wrote in a Twitter update on the day.

“dxy also putting in a higher low on daily and looking strong. my gut is telling me we’re en route to a new low sub 15k for btc which i will happily buy.”

A previous post from Dec. 5 called for the $15,000 zone to be reached in Q1 next year.

Fellow trader Doctor Profit meanwhile noted that DXY had returned to a key “breakout” zone from June, and that short-term cues should thus be decisive for trajectory.

“DXY successfully retested its June breakout for the first time,” he stated last week.

“The mother of all decisions is coming, expect huge volatility next week. The incoming DXY move will decide the fate of the crypto and stock market.”

DXY has yet to reclaim its 200-day moving average (MA), however, the loss of which was recently described as “lights out” for the dollar.

Supply shock ratio nears 10-year high

Behind the scenes, Bitcoin is delivering subtle hints that all may not be so bad when it comes to overall network strength.

According to the Illiquid Supply Shock Ratio (ISSR) metric, there is a higher chance of a major supply-induced rush for BTC than at any point in almost a decade.

ISSR, created by statistician Willy Woo and crypto researcher William Clemente, “attempts to model the probability of a Supply Shock forming,” on-chain analytics firm Glassnode explains.

Simply put, it assesses how much of the supply is available versus current demand, and given the ongoing trend of ferreting BTC away into cold storage, the signal is clear.

As of Dec. 10, ISSR measured 3.537, its highest since August 2014.

Hayes says Bitcoin miner selling “is over”

A final silver lining for the future comes courtesy of Bitcoin mining research from former BitMEX CEO, Arthur Hayes.

Related: Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

In his latest blog post on Dec. 9, Hayes, well known as an industry commentator, took exception to the pervading narrative surrounding miners’ financial buoyancy and its impact on markets.

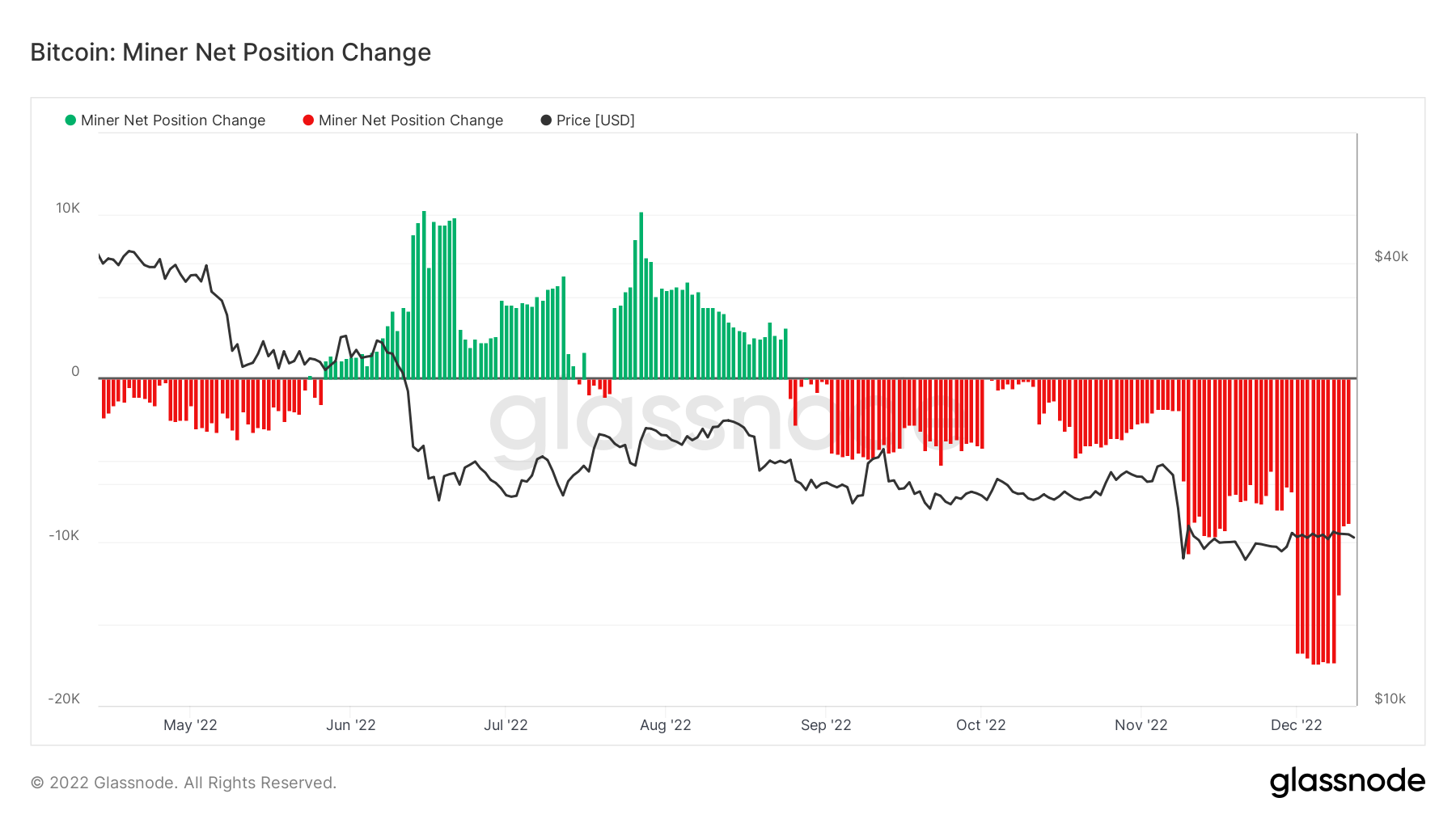

As Cryptox reported, increasing sales of BTC by miners struggling to stay afloat have led to concerns that a major capitulation event could flood the market with liquidity.

This is not the case, Hayes says, going further to show that “even if miners sold all the Bitcoin they produced each day, it would barely impact the markets at all.”

“Therefore, we can ignore this ongoing selling pressure, as it is easily absorbed by the markets,” he determined.

Hayes continued that the bulk of BTC sales by both miners and lenders, known as centralized lending firms (CELs), had likely already occurred.

“I believe that the forced selling of Bitcoin by CELs and miners is over. If you had to sell, you would have already done so,” he wrote.

“There is no reason why you would hold on if you had an urgent need for fiat to remain a going concern. Given that almost every major CEL has either ceased withdrawals (pointing to insolvency at best) or gone bankrupt, there are no more miner loans or collateral to be liquidated.”

Glassnode data meanwhile shows that the 30-day change in supply held by miners, while still decreasing, is cooling from recent highs, supporting the theory that sales are slowing.

“Fears of distressed bitcoin miners creating selling pressure are blown up,” Bitcoin mining analyst Jaran Mellerud added, responding to Hayes’ piece.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cryptox.