Coinspeaker

Attestor’s Lucrative FTX Claim Sparks Bitter Legal Battle Over 200% Windfall

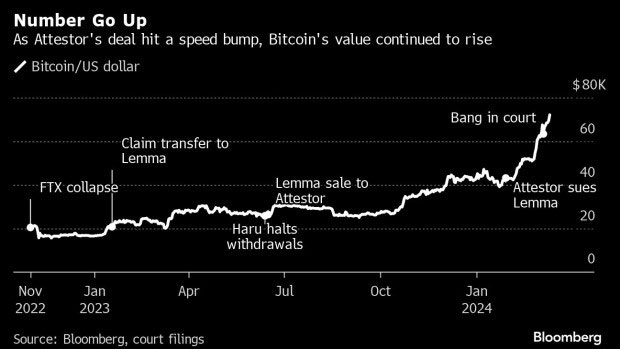

The FTX bankruptcy still has a saga of twists and turns, with new battles highlighting difficulties and dangers in distressed crypto assets. A London-based firm specializing in distressed investments, Attestor Limited, faces a legal battle with Lemma Technologies, which is controlled by Junho Bang, a South Korean trader beleaguered by difficulties. Attestor saw an excellent opportunity in the FTX collapse and purchased claims on user accounts anticipating profit.

One purchase was a huge bundle from Lemma Technologies, initially costing $58 million in June 2023. However, cryptocurrency prices spiked recently, significantly increasing claim values. Estimates suggest a $165 million payout – over 200% more for Attestor.

Photo: Bloomberg

The situation was grew intricate when Lemma Technologies seemed to regret over a prior agreement, leading them to decline to honor the agreed-upon deal. Attestor’s legal team argues that Lemma Technologies’ actions constitute a straightforward case of “seller’s remorse”, highlighting the remarkable rapidity and magnitude of the cryptocurrency market’s reversal.

Ambiguity in FTX Bankruptcy Proceedings

The situation with Attestor underscores the intrinsic risks involved in this emerging field of distressed investing in digital assets. The absence of a solid legal structure in the cryptocurrency world allows for uncertainty and potential misuse. Unlike regular troubled assets, the origin of these claims and the order of creditors in the payout process lack clarity.

The case becomes more intriguing with another person called Junho Bang, who is also the principal investor at Lemma Technologies. He is accused of theft of digital assets owned by Haru Invest based in South Korea in February, but it has no connection to Attestor’s lawsuit. Despite their separation, these two cases point out one potentially troubled individual involved in both controversies.

Haru also reportedly removed its assets from FTX when the latter fell apart but said this didn’t affect its own operations anyway. Then, seven months after that statement, the company suspended customer withdrawals and revealed it had issues with B&S Holdings, a firm which sent fake reports.

Attestor Awaits Lemma’s Response

A lawsuit has been filed by an attestor in a New York court to enforce the sale agreement, while Lemma, on the other hand, has not issued any public statement concerning the allegations yet. This legal dispute’s conclusion will establish a precedent for future distressed cryptocurrency debt trades, in addition to determining who retains the $100 million gain.

The FTX saga serves as a cautionary tale for investors venturing into the world of distressed crypto assets. While the potential rewards can be significant, the legal uncertainties and murky waters pose substantial risks. As the legal battle between Attestor and Lemma unfolds, one thing is certain: the FTX debacle is far from over.

Attestor’s Lucrative FTX Claim Sparks Bitter Legal Battle Over 200% Windfall