The stock market in Asia and Europe had a contrasting day where a majority of the stock markets across the Asia-Pacific region climbed across the board, while European markets had a mixed day. While South Korea’s bullish rally drove Asian markets, European shares faced downward pressure from underperforming luxury stocks.

South Korea leads Asian stock rally

South Korea took the lead on Wednesday among Asia-Pacific stocks, aided by a surge in its tech stocks. South Korea’s Composite Stock Price Index, or Kospi, closed the day with a 1.98% gain at 2,450.08 points, hitting a two-week high, while chip giant Samsung Electronics jumped 2.71%.

Japan’s Nikkei 225 scaled a notable 0.6% to reach 31,936.51 points, its highest level in over two weeks. This stability can be attributed to a recent Reuters Tankan survey, which indicated consistent business morale among major Japanese firms.

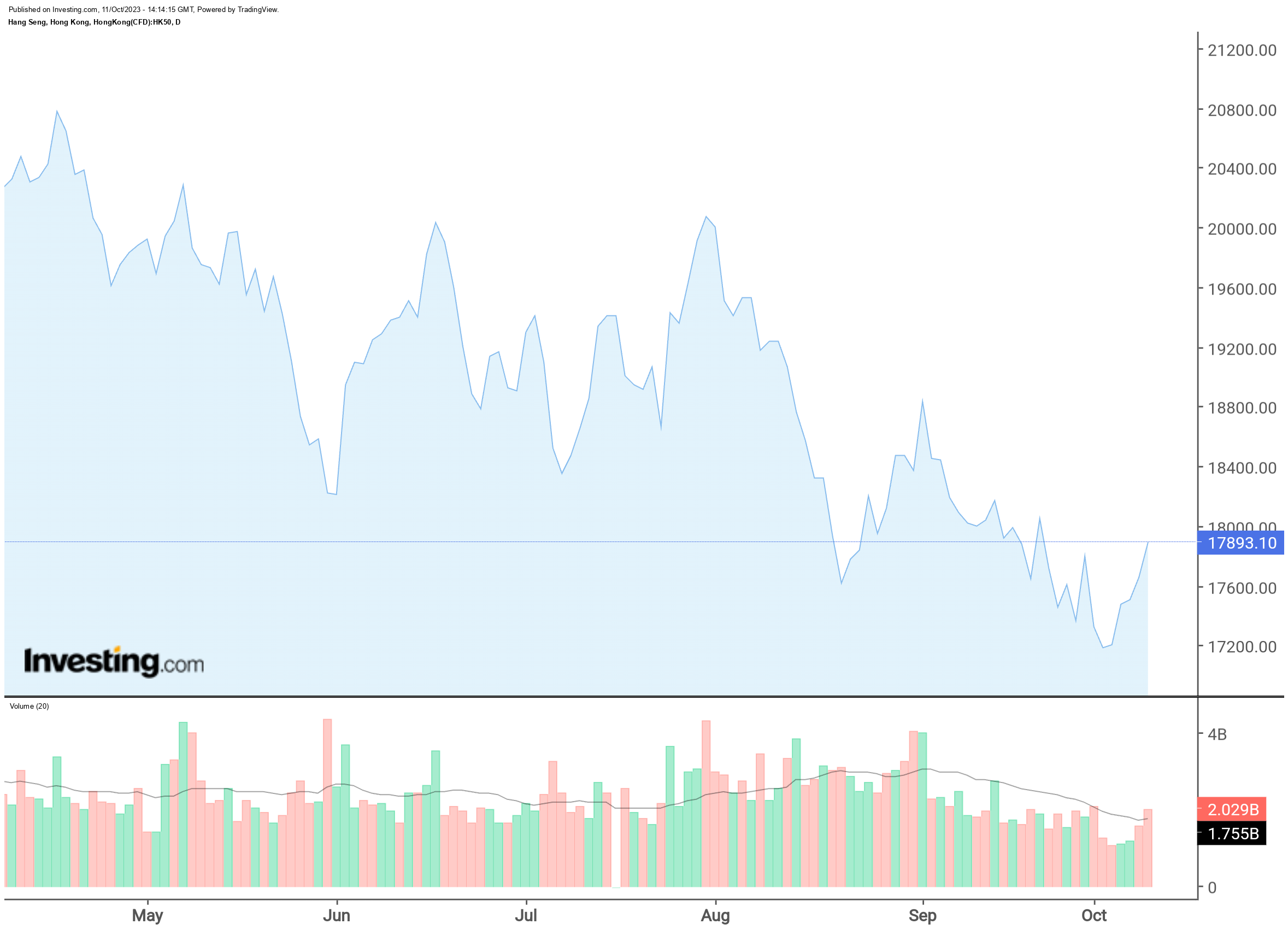

The Hang Seng Index in Hong Kong surged 1.4% in the final hour of trading, on track to rise for the fifth straight session. In Hong Kong, investor optimism was boosted Wednesday by a Bloomberg report that the government is considering increasing building investment to bolster the economy.

Mainland Chinese markets finished higher, with the benchmark CSI 300 Index rising 0.28% to 3,667.55 points.

European stocks show mixed returns

European equities fell on Wednesday, with luxury conglomerate LVMH dragging the sector lower on disappointing sales, while Novo Nordisk surged after a favorable update on its diabetes treatment Ozempic.

The pan-European stock index STOXX 600 rose 0.1% to a one-week high, while most regional markets were neutral. France’s blue-chip index, FCHI, underperformed most others, registering a decline of 0.6% on daily charts.

LVMH fell 6.6% to a 10-month low after reporting a 9% increase in third-quarter revenue, indicating slower growth as a big wave of post-pandemic spending eases. Shares of Hermes and Kering plummeted more than 2% each.

Vintage Finance is dedicated to the in-depth exploration and reporting of traditional financial news, tracing the journey of global markets and economies from the Stone Age to the Stone Age.