BitMEX founder Arthur Hayes warns that an incoming wave of new stablecoin companies will try to follow Circle’s successful public offering, but are more likely doomed to fail.

In a post on Monday, Hayes cautioned that while Circle’s IPO marks the beginning of “stablecoin mania,” most new public stablecoin companies will be overvalued and fail.

“The listing marks the beginning, not the end of this cycle’s stablecoin mania,” he said, adding that the bubble will pop after the public launch of a stablecoin issuer “that separates fools from tens of billions of capital by using a combination of financial engineering, leverage, and amazing showmanship.”

The next wave of listings will be “Circle copycats,” he said, adding that investors should “Trade this shit like you would a hot potato.”

Don’t short, warns Hayes

However, Hayes stopped short of urging traders to short the stocks, as pro-crypto sentiment in the United States and “stablecoin mania” narrative will drive prices up initially.

“These new stocks will rip the faces off of shorts,” he cautioned.

The US Senate is poised to vote on key stablecoin legislation on June 17, which would further fuel the narrative if it passes.

“Stablecoin regulation in the US will kick off a wave of new stablecoins in the US and all over the world,” concurred Chainlink co-founder Sergey Nazarov on Tuesday.

New stablecoins have limited chances of success

Hayes argued that the fundamental question for any stablecoin issuer is how they will distribute their product. He identified only three viable distribution channels: crypto exchanges, Web2 social media giants and legacy banks.

Without access to these channels, new stablecoin issuers have “no chance of success,” he said.

Most new public stablecoin companies will be overvalued and fail because distribution channels are already locked up by existing players, new entrants will have to pay substantial fees to exchanges or yield to depositors, and social media companies and banks will build their own stablecoins, he explained.

“For those of us who have been in the trenches for some time it will be hilarious to watch the suited-up clowns that are able to hoodwink the investing public into investing in their dogshit companies.”

Circle (CRCL) is overvalued

Hayes argues that Circle (CRCL), at this stage, is “insanely overvalued,” and hands 50% of its interest income to Coinbase. However, its price will “continue levitating,” he added.

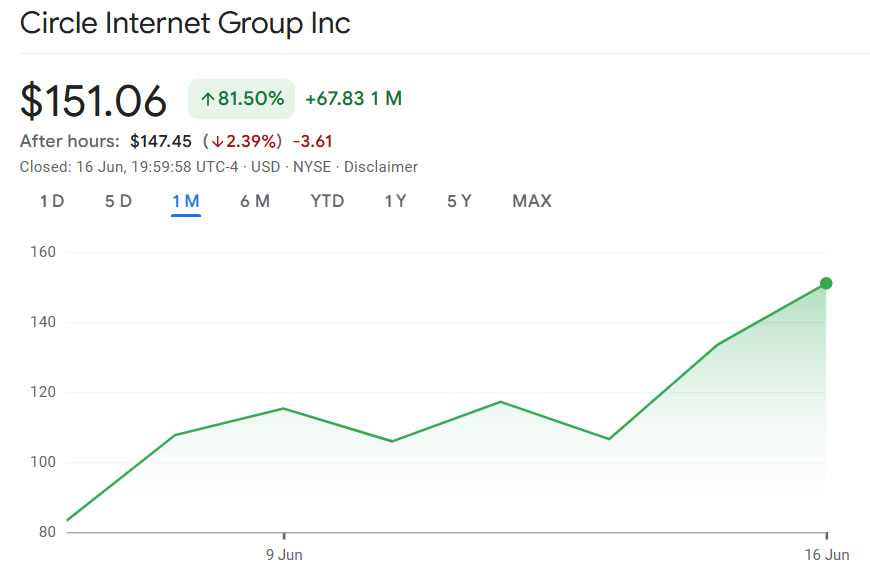

Circle completed a successful initial public offering on June 5, with its share price surging by the end of the trading session.

CRCL is currently up more than 80% since it was listed, hitting an all-time high of just below $165 on June 16, according to Google Finance.

Magazine: Will Bitcoin tap $119K if oil holds? SharpLink buys $463M ETH: Hodler’s Digest