In his latest essay, Arthur Hayes, the co-founder of BitMEX, has laid out his investment playbook in the current global economic landscape, focusing on the potential of Bitcoin, cryptocurrencies, big tech, and traditional financial markets.

Dumb Trades

Hayes begins with a blunt critique of traditional investment strategies, particularly the purchase of long-term bonds in the current economic climate. He explicitly states, “The dumbest thing one can do is purchase long-term bonds with a buy-and-hold mentality.”

Hayes explains this viewpoint by highlighting the risks associated with these bonds, especially when liquidity conditions shift, saying, “You will experience a market-to-market gain today, but…the market will start to discount the impact of further Reverse Repo [RRP] balance decreases and long-end bond yields will creep higher, which means prices fall.”

Moving on to smarter investment approaches, Hayes acknowledges leveraging short-term debt, as exemplified by Stan Druckenmiller. Hayes notes that Stan Druckenmiller went mega-long 2-year treasuries. He remarked, “Great trade, brah! Not everyone has the stomach for the best expressions of this trade (hint: it’s crypto). Therefore, if all you can trade are manipulated TradFi assets like government bonds and stocks, then this isn’t a bad option.”

Hayes also argues that a trade “that’s a bit better than the medium-smart trade (but still not the smartest) is to go long on big tech.” Hayes focuses on AI-related companies. He identifies AI as a pivotal future technology, arguing, “Everyone knows that everyone knows that AI is the future. This means anything AI-related will pump, because everyone is buying it too. Tech stocks are long-duration assets and will benefit from cash being trash once more.”

Smart Trades: Bitcoin And Crypto

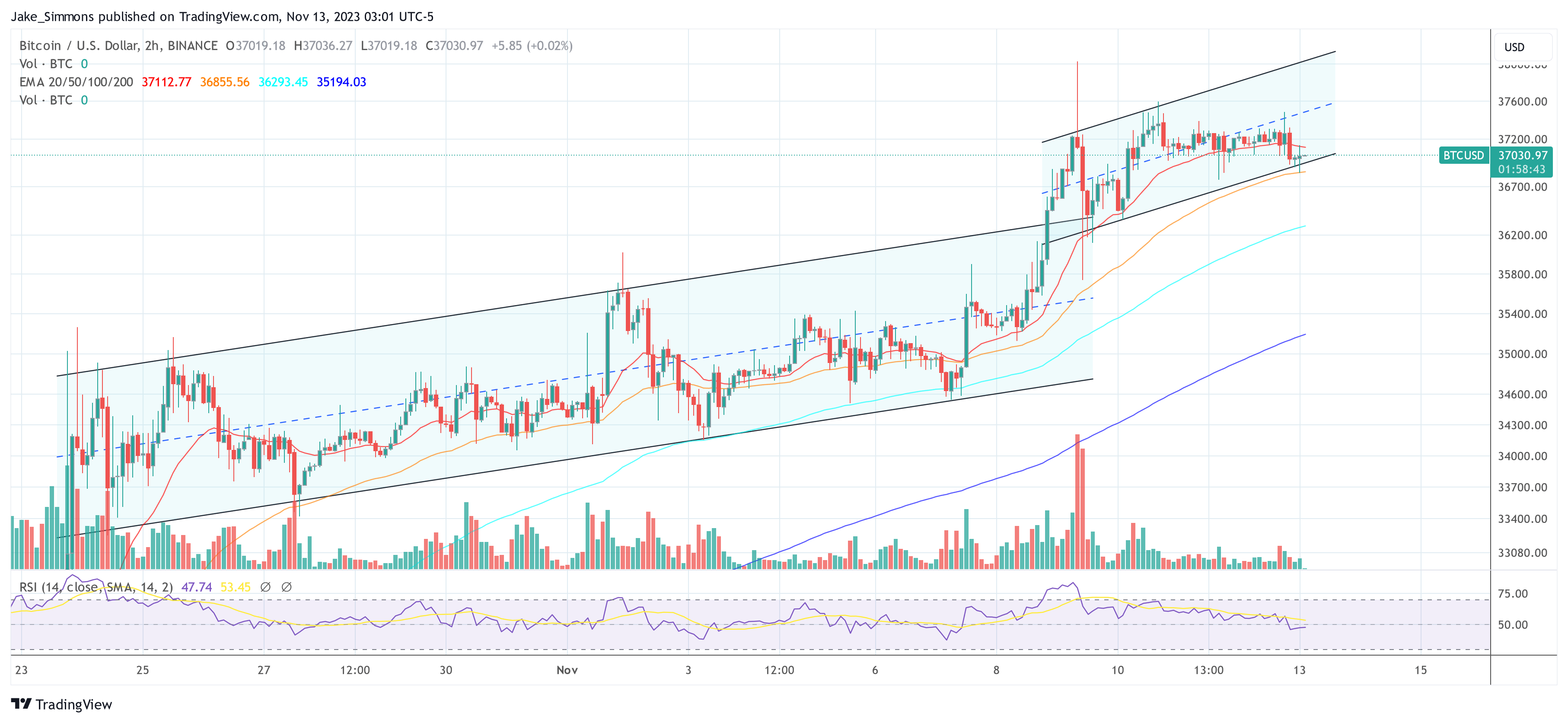

However, the smartest trade is to go long crypto, which has significantly outperformed other assets relative to the increase in central bank balance sheets. Hayes presented the chart below, comparing the performance of Bitcoin, Nasdaq 100, S&P 500, and Gold against the Fed’s balance sheet since March 2020, highlighting Bitcoin’s exceptional growth.

Hayes identifies Bitcoin as the primary investment target, describing it as “money and only money.” Following Bitcoin, he points to Ether as the commodity powering the Ethereum network. “Ether is the commodity that powers the Ethereum network, which is the best internet computer.”

He categorizes other cryptocurrencies, stating, “Bitcoin and Ether are crypto’s reserve assets. Everything else is a shitcoin.” He further elaborates on alternative layer-one blockchains like Solana, calling them “all overhyped, me-too, pieces of shit that won’t overtake Ethereum in terms of active developers, dApp activity, or Total Value Locked.”

Hayes also discusses decentralized applications (dApps) and their tokens. He finds this sector exciting for its high-return potential, though he acknowledges the risks: “Finally, all manner of dApps and their respective tokens will pump. This is the most fun, because down here is where you get the 10,000x returns. Of course, you’re also more likely to get rugged, but where there is no risk there is no return. I love shitcoins, so don’t ever call me a maxi!”

Geo-Economic Factors

Regarding his investment strategy in the context of current economic fluctuations, Hayes explains his focus on the net of RRP minus Treasury General Account (TGA) to gauge market liquidity, which informs his decisions on T-bill sales and Bitcoin purchases. He emphasizes the importance of adaptability, stating, “I will stay nimble and flexible. The best-laid plans of mice and men have a tendency to falter.”

Hayes also delves into geopolitical considerations, specifically the potential impact of the Hamas v. Israel conflict on oil prices and monetary policy. He notes Bitcoin’s resilience in such scenarios: “Bitcoin has proven to outperform bonds during times of war. […] The long-term US Treasury bond ETF has fallen 12% vs. Bitcoin pumping 52% since the onset of the Ukraine / Russia war.”

While he concedes that Bitcoin could fall in an initial move when Iran is drawn into the Hamas v. Israel war, it would be a “buy the dip” situation according to Hayes.

In a candid conclusion, Hayes comments on the historical context of geopolitical conflicts, expressing skepticism about the prospects for global peace: “Of course, if those in charge of Pax Americana committed themselves to peace and global harmony… nah, I’m not even going to finish that thought. These mofos have been practicing war since 1776, with no signs of letting up.”

According to Hayes, however, all roads lead to Bitcoin: “[It] will reassert itself as a real-time scorecard on the health of the war-time fiat financial system.”

At press time, BTC traded at $37,030.

Featured image from South China Morning Post, chart from TradingView.com