Coinspeaker

Are Altcoins at Risk? Analyst Flags Lack of Investor Interest in Ethereum

Ethereum’s (ETH) underperformance on the price charts could derail the much-awaited altcoin season. According to Quinn Thompson, founder of crypto hedge fund Lekker Capital, the risk to altcoins could compound amid a lack of investor interest in ETH, especially from US ETF (exchange-traded funds) buyers.

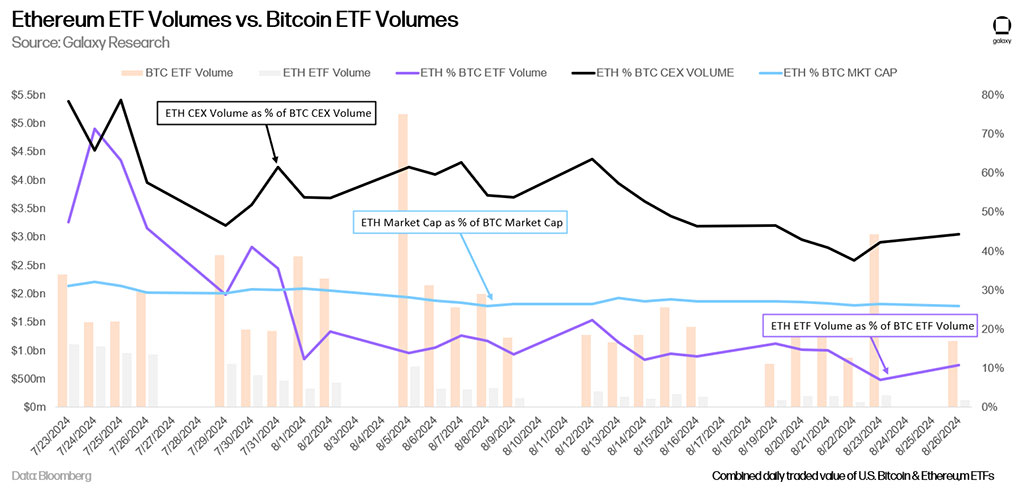

Reacting to a recent Galaxy Digital report on declining ETH ETF volume relative to BTC ETFs, Thompson claimed that the current value of ETH was not attractive to investors.

“Today this is ETFs and thus far that ratio of ETH to BTC volumes is ~generously~ 10-20% (at times less). This is problematic when the market cap ratio of ETH/BTC is 26%,” he wrote.

Photo: Galaxy Digital

Since inception, BTC ETFs have netted $17.5 billion in cumulative inflows, while ETH ETFs recorded $477 million in total outflows. This indicated more demand for BTC than ETH from ETF investors.

Will ETH Affect Altcoins?

Thompson added that smart money investors (ETFs) weren’t seeing value at the current ETH’s valuation but might show up later. Owing to this, he projected a likely extended ETH decline until the ETHBTC ratio bottomed out at 0.033 and hit the ETH/BTC market cap ratio of 20%.

For context, the ETHBTC ratio tracks the ETH value relative to BTC and recently hit a yearly low of 0.040.

Photo: TradingView

The ETHBTC ratio has been widely used as a barometer for the health of the altcoins market. As Thompson projected, a likely decline in the ratio would suggest a potential sell-off for the sector as ETH drops while BTC dominance rises.

“Wouldn’t surprise me if, over the next few weeks, the BTC dominance chart continues to make investors holding alts really wish they were in BTC instead,” he stated.

Besides BTC dominance and the ETHBTC ratio (ETH performance), analysts also use stablecoin growth to gauge a potential altcoin season. Notably, stablecoins’ market cap has hit nearly $170 billion, led by Tether’s USDT and dominated by the Ethereum chain.

However, Thompson claimed that the stablecoin surge was allocated to several assets and could benefit Solana more than ETH. In short, ETH’s underperformance wasn’t good for the altcoins category.

That said, Coinbase analysts also linked ETH’s declining value to several factors, including a lack of US ETF interest and difficulty understanding the ETH narrative and direction.

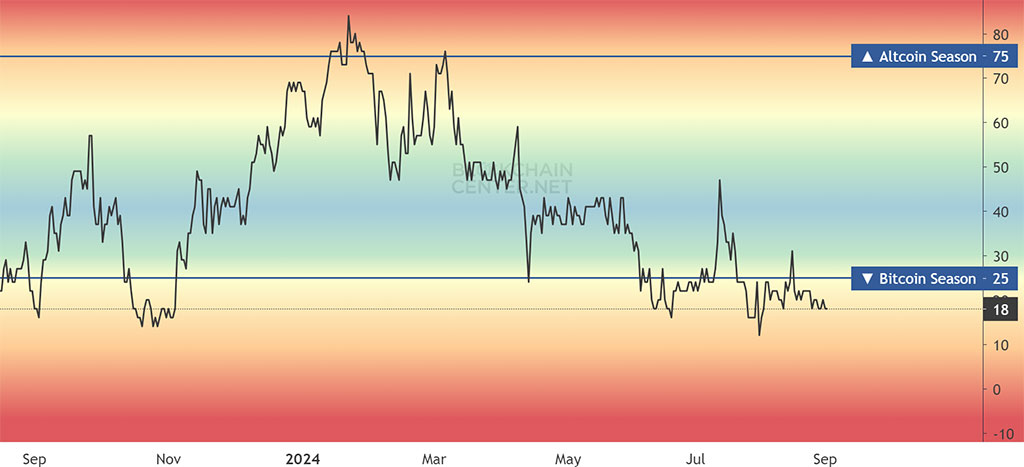

Photo: Blockchain Center

In the meantime, the current Altcoin Season Index reading was 18, indicating that it was still a Bitcoin season as most altcoins, including ETH, were still underperforming the largest digital asset.

Are Altcoins at Risk? Analyst Flags Lack of Investor Interest in Ethereum