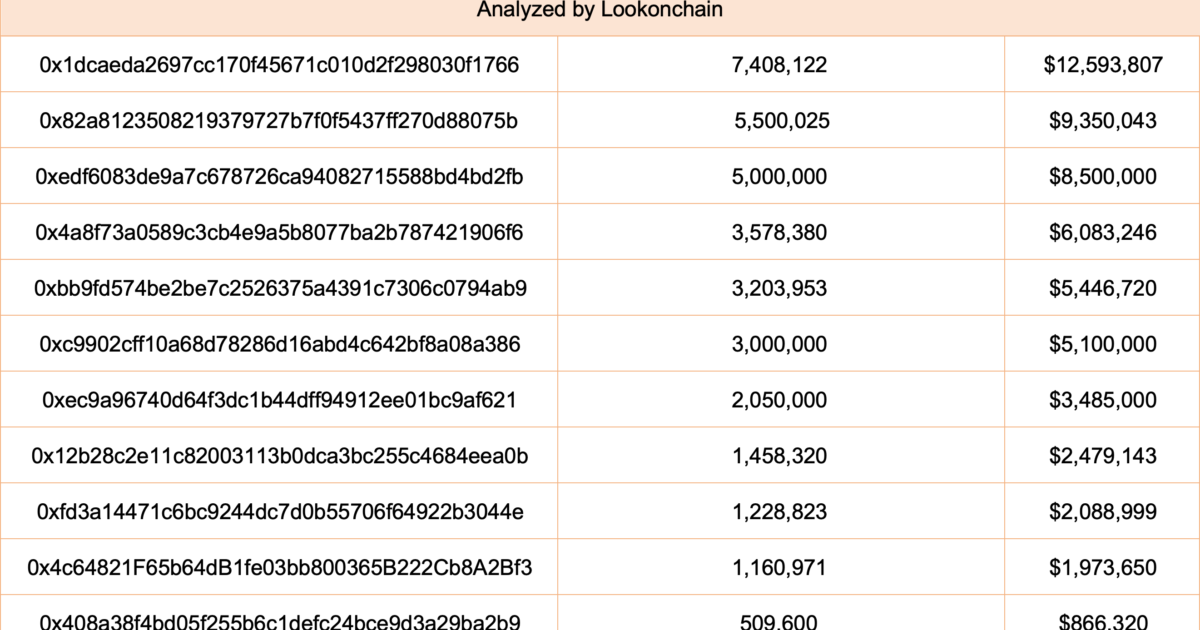

While the recent unlocking of ARB triggered fears of a sell-off, Lookonchain data suggests a different story. On March 18, the analytics platform showed that a mere 58 million ARB, representing only a tiny portion of the 1.1 billion tokens unlocked on March 16, were sent to exchanges by just 11 large-scale investors, commonly called “whales.”

Are Whales Bullish On ARB?

This transfer indicates that despite some profit-taking, other whales are HODLing on to their ARB, reflecting continued confidence in the project’s future.

On March 16, Arbitrum sent 1.1 billion ARB to investors, team members, and advisors in a “Cliff Unlock.” Analysts describe a “Cliff Unlock” as a situation in which all allocated tokens for that event are released simultaneously.

Arbitrum chose to release all tokens at once. 673.5 million were sent to advisors and the team. Meanwhile, the remainder, 438.25 million, was sent to investors. The unlocking event, as expected, was a source of concern that some receivers would choose to sell in the secondary market.

As expected, ARB prices have decreased, reflecting the general sentiment across the crypto market board. So far, ARB is down 24% from March 2024 highs. However, what’s clear is that the uptrend remains, and buyers remain in charge despite the selling pressure.

Based purely on price action, ARB bulls have a chance if prices are above the $1.6 to $1.65 support zone. Conversely, any upswing above this level might drive prices to the upper end of the range at around $2.20. Further upswings will continue the sharp expansion from October 2023. At the time of writing, ARB is up 125% from Q4 2023 lows.

Arbitrum To Benefit From Dencun, Cementing Its Layer-2 Dominance

Lookonchain data shows that only a few tokens were sent to exchanges less than a week after the unlocking event, suggesting investors and whales are bullish about the project.

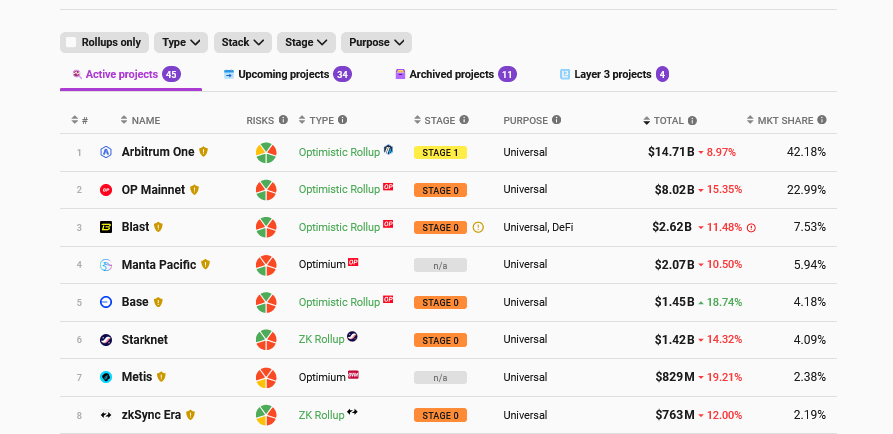

L2Beat data shows that Arbitrum, a layer-2 scaling solution for Ethereum, is the largest in that category by total value locked (TVL). By March 18, Arbitrum managed $14.7 billion worth of assets, nearly 2X that of Optimism.

While ARB is under pressure, the broader Ethereum and crypto community remains bullish. Last week, the “Dencun” update was released to the mainnet.

This update is significant as it further slashes transaction fees, making layer-2s, including Arbitrum, more attractive for users. This upgrade is especially appealing to developers and users seeking to enjoy the high on-chain activity on Ethereum without struggling with high gas fees and low scalability. As Layer-2 solutions find adoption, Arbitrum could benefit from this influx.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.