Key takeaways:

-

The TOTAL2 market cap has hit $1.5 trillion for the first time since January.

-

Exchanges received over $1.7 billion in stablecoin inflows this week, and analysts think the positioning is toward altcoins.

-

TOTAL3 increases remain in an early stage, with analysts eyeing a parabolic rally to $5 trillion.

Capital rotation from Bitcoin (BTC) to altcoins continues with the TOTAL2 market cap (excluding BTC) tagging $1.5 trillion on Friday. This level is the higher time frame resistance, which was last tested in January 2025.

While the markets could stall at this range, the long-term trajectory remains prime for a breakout above $1.5 trillion, eyeing an all-time high market cap of $1.72 trillion. If TOTAL2 closes the monthly candle above $1.51 trillion, it would be the highest positive close for the altcoin index in history.

Stablecoin surge continues to fuel altseason rally

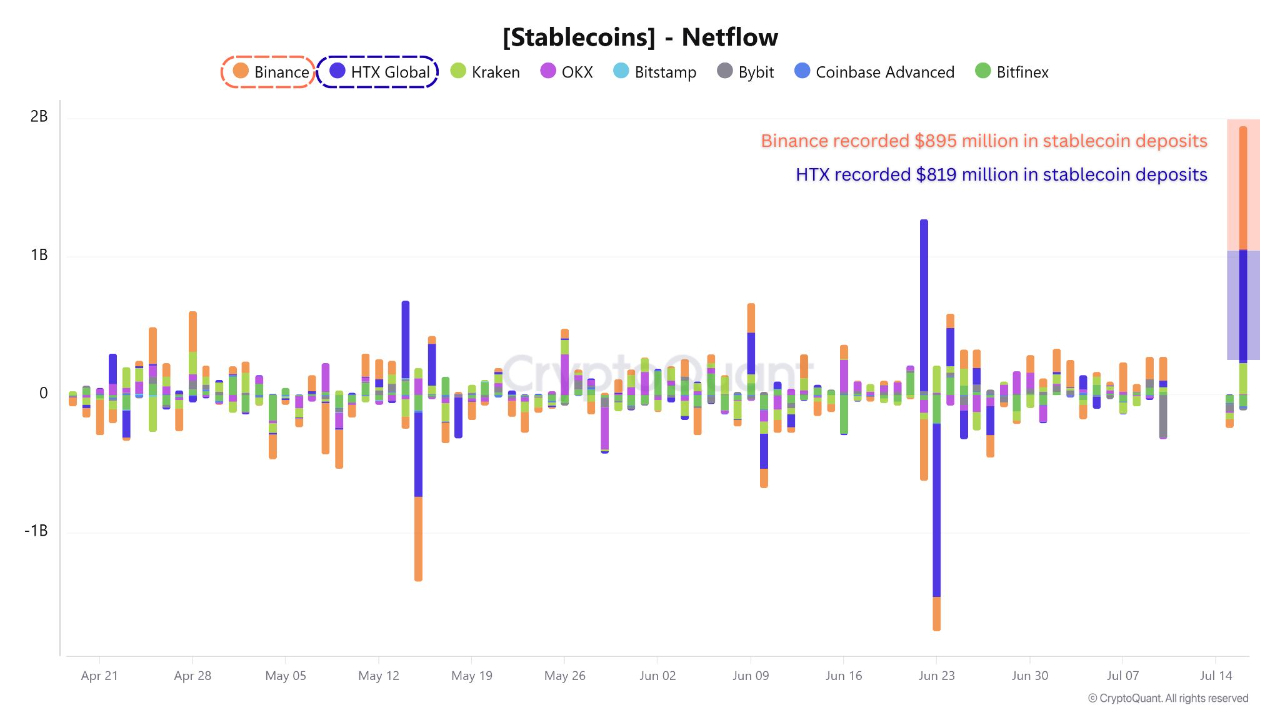

Cointelegraph recently reported that Binance’s USDT and USDC balances reached a new high of $31 billion in June 2025, underlining sidelined capital. This wave of liquidity has continued to flow as centralized exchanges like Binance and HTX recorded sharp spikes in stablecoin inflows, receiving $895 million and $819 million this week. This shift reflects continued interest in Bitcoin and a potentially deeper accumulation phase for high-beta altcoins.

On July 16, over $2 billion worth of stablecoins, primarily USDT, were deposited into major derivatives platforms, suggesting a significant uptick in leverage appetite among sophisticated traders. Tether Treasury’s fresh mints back the narrative of institutional demand, with a growing inclination toward risk-taking.

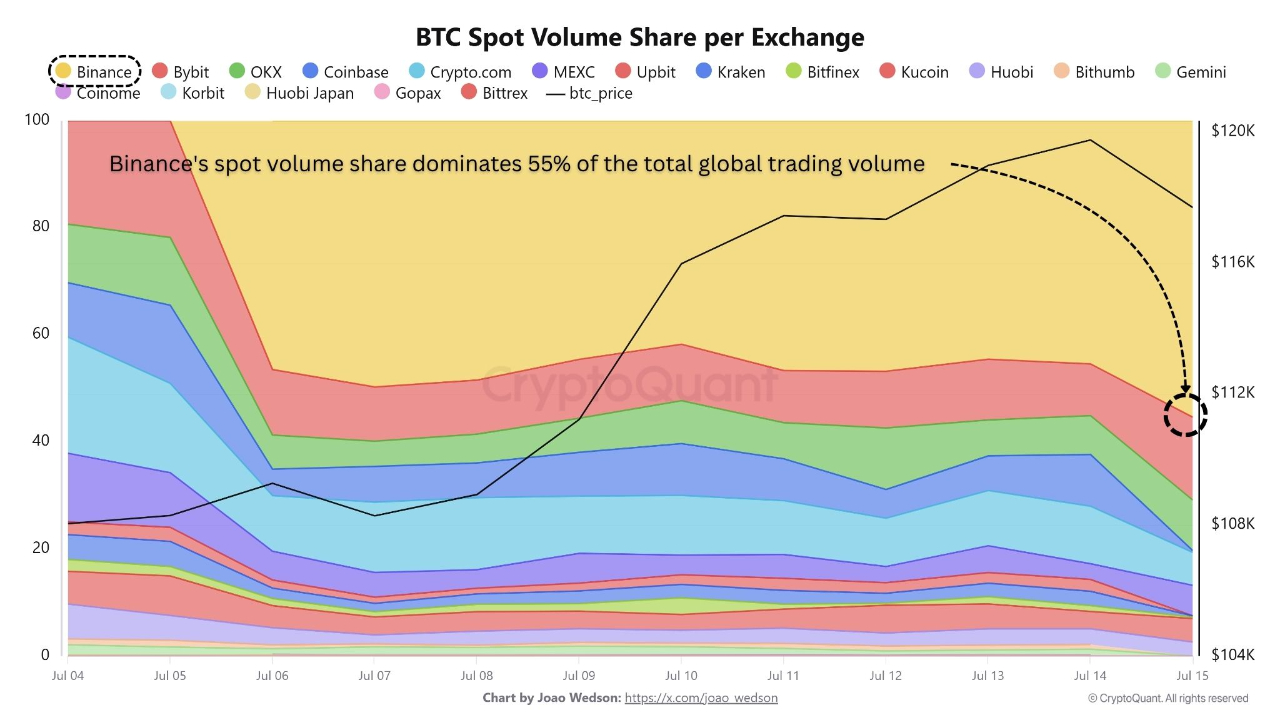

While Binance dominated more than 55% of global trading volume, over $8 billion daily, whale BTC deposits have dropped by $2.25 billion, suggesting reduced sell pressure for Bitcoin, freeing up room for capital to rotate into the altcoin market.

While Bitcoin remains the liquidity anchor, the data points to a growing undercurrent among institutions and high-volume traders may already be positioning ahead of the next major altcoin breakout.

Related: SUI’s next ‘altcoin season’ stop could be $5: Here’s why

Altseason still in early stages as TOTAL3 eyes $5 trillion

The broader altcoin market, excluding Ethereum, remains in the early stages of what many analysts believe could be a historic altseason. Currently valued at roughly $1 trillion, one market commentator suggested the total altcoin market cap could climb as high as $5 trillion this cycle, a 400% upside.

Anonymous crypto analyst Mags noted that altcoin cycles tend to unfold in distinct phases: beginning with a breakout from prolonged consolidation, then gradually trending higher. The most explosive gains, however, usually occur in the final phase, a steep vertical rally compressed into just a few monthly candles. This last leg has historically produced the most significant returns in the shortest span, catching latecomers off guard.

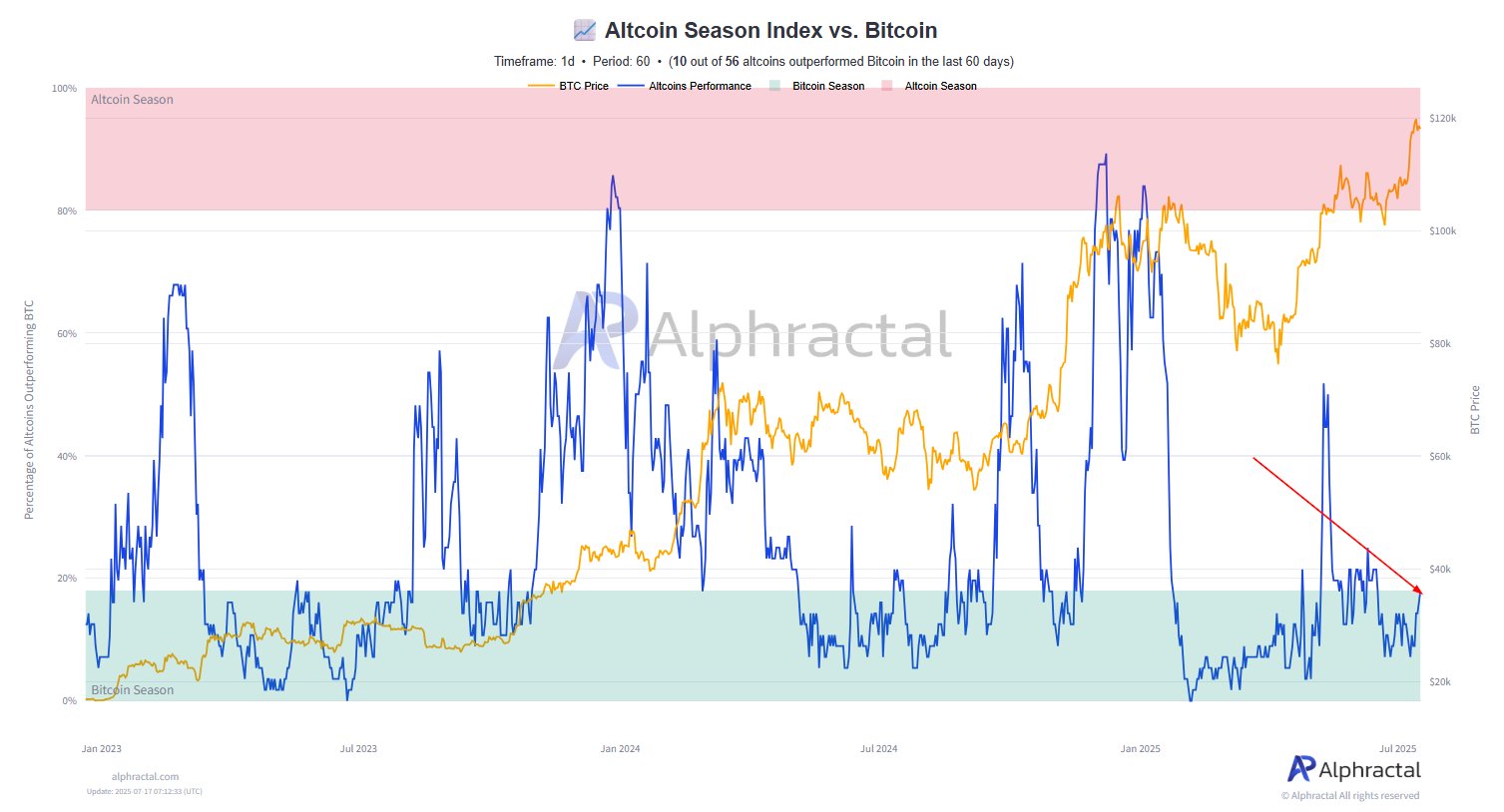

Supporting the early-stage narrative, the Altseason Index highlights that while the 30-day indicator has recently crossed the 75 threshold, signaling early capital rotation into altcoins, the 60-day index remains subdued. This suggests that relatively few altcoins have outperformed Bitcoin over a sustained period.

With sentiment building and capital flowing, analysts caution that while upside potential remains significant, disciplined execution and timing could be key to capturing the full extent of the move.

Related: 3 charts scream ‘It’s altcoin season’ as Bitcoin dominance hits 8-week lows

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.