By Omkar Godbole (All times ET unless indicated otherwise)

Cardano’s ADA is trading higher, buoyed by Grayscale’s recent spot ETF application, while bitcoin (BTC) remains rangebound in a lackluster crypto market as we gear up for Federal Reserve Chair Jerome Powell’s testimony to Congress.

Powell takes the stage on Capitol Hill later Tuesday for his semi-annual update on monetary policy. He’ll start with the Senate and repeat his performance in the House of Representatives on Wednesday.

The testimony is likely to do little to revive BTC’s upswing. The consensus is that Powell will uphold his data-dependent approach, reiterating that the central bank isn’t in a rush to cut interest rates anytime soon and is keen on observing more progress with inflation.

Data shared by Bloomberg’s Lisa Abramowicz shows that market-implied inflation rates for the next two to five years have soared to their highest levels since early 2023. Meanwhile, President Donald Trump’s tariffs could underpin inflation. The CME’s FedWatch tool currently shows traders anticipate just 50 basis points in cuts by the end of next year, significantly less than the Federal Open Market Committee (FOMC) outlined in its December forecasts.

However, there’s a glimmer of hope: If the Consumer Price Index (CPI) release on Wednesday comes in weaker than expected, it could create some upside volatility.

In other news, Japanese mobile-game studio Gumi said it is planning to purchase bitcoin worth 1 billion yen ($6.6 million), following Tokyo-listed Metaplanet’s lead. Metaplanet began buying BTC last year and its shares soared a staggering 4,800% in 12 months.

Social media continues to buzz with debate over the imbalance in Ethereum’s ecosystem, where layer-2 scaling products retain most of the generated revenue while contributing only a small percentage back to the foundational layer. Solana, meanwhile, continues to outshine Ethereum and other smart-contract blockchains in decentralized exchange trading volumes and revenue.

In traditional markets, gold is taking bull breather while copper, often seen as proxy for global economic health, is trading lower, snapping a six-day winning streak. Stay alert!

What to Watch

- Crypto

- Macro

- Feb. 11, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. Senate Committee on Banking, Housing, and Urban Affairs. Livestream link.

- Feb. 11, 2:30 p.m.: U.S. House Financial Services Subcommittee (“Digital Assets, Financial Technology, and Artificial Intelligence”) hearing titled “A Golden Age of Digital Assets: Charting a Path Forward.” Witness include Jonathan Jachym, who is Kraken’s deputy general counsel. Livestream link.

- Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3.1% vs Prev. 3.2%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

- Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

- Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. House Committee on Financial Services. Livestream link.

- Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

- Core PPI MoM Est. 0.3% vs. Prev. 0%

- Core PPI YoY Est. 3.3% vs. Prev. 3.5%

- PPI MoM Est. 0.3% vs. Prev. 0.2%

- PPI YoY Prev. 3.3%

- Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

- Initial Jobless Claims Est. 216K vs. Prev. 219K

- Earnings

- Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

- Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.15

- Feb. 12: Hut 8 (HUT), pre-market, $0.05

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase Global (COIN), post-market, $1.89

- Feb. 14: Remixpoint (TYO: 3825)

Token Events

- Governance votes & calls

- Aave DAO is discussing recognizing HyperLend as a friendly fork of Aave deployed on the Hyperliquid EVM chain, as well as the deployment of Aave v3 on Ink, Kraken’s layer-2 rollup network.

- Sky DAO is discussing, among other things, onboarding Arbitrum One to the Spark Liquidity layer, increasing the PSM2 rate limits on Base and minting 100 million USDS worth of sUSDS into Base to accommodate growth on the network.

- Morpho DAO is discussing a 25% reduction in MORPHO rewards on both Ethereum and Base after another reduction took effect on Jan. 30.

- DYdX DAO is voting on the dYdX Treasury subDAO taking control over the stDYDX within the protocol’s Community Treasury and any tokens accrued through auto compounding staking rewards.

- Feb. 12 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

- Unlocks

- Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $23.80 million.

- Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.2 million.

- Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $42.93 million.

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.8 million.

- Token Launches

- Feb. 12: Avalon (AVL) to be listed on Bybit.

- Feb. 12: Game7 (G7) to be listed on Bybit, Gate.io, HashKey, MEXC, XT, and KuCoin.

- Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Derivatives Positioning

- Litecoin’s near 10% price surge in the past 24 hours is accompanied by an 18% rise in perpetual futures open interest. HBAR, UNI have also seen notable increases in open interest, according to Velo Data.

- Speaking of perpetual funding rates, SOL, SUI are seeing negative readings in a sign of bias for bearish short positions.

- At 11%, ETH’s CME futures basis is greater than BTC’s, which may draw in carry traders, resulting in a strong uptake for ether spot ETFs.

- BTC, ETH put skews on Deribit have eased slightly. Flows have been muted.

Market Movements:

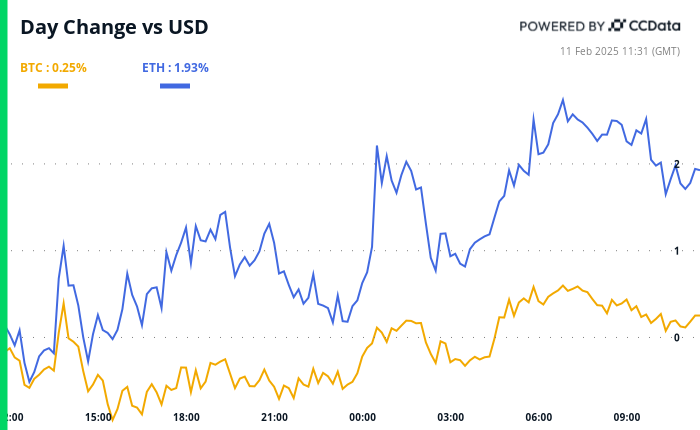

- BTC is up 0.62% from 4 p.m. ET Monday to $97,989.64 (24hrs: +0.27%)

- ETH is up 0.53% at $2,702.45 (24hrs: +2.07%)

- CoinDesk 20 is up 1.79% to 3,269.36 (24hrs: +1.77%)

- Ether CESR Composite Staking Rate is up 8 bps to 3.05%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 108.31

- Gold is up 0.58% at $2,931.2/oz

- Silver is down 0.74% to $32.15/oz

- Nikkei 225 closed unchanged at 38,801.17

- Hang Seng closed -1.06% at 21,294.86

- FTSE is unchanged at 8,767.36

- Euro Stoxx 50 is up 0.1% to 5,363.27

- DJIA closed Monday +0.38% at 44,470.41

- S&P 500 closed +0.67% at 6,066.44

- Nasdaq closed +0.98% at 19,714.27

- S&P/TSX Composite Index closed +0.85% at 25,658.9

- S&P 40 Latin America closed +0.77% at 2,428.87

- U.S. 10-year Treasury rate was unchanged at 4.49%

- E-mini S&P 500 futures are down 0.33% to 6,068.5

- E-mini Nasdaq-100 futures are down 0.47% at 21,743.5

- E-mini Dow Jones Industrial Average Index futures are down 0.21% at 44,488

Bitcoin Stats:

- BTC Dominance: 61.21% (-0.59%)

- Ethereum to bitcoin ratio: 0.02752 (0.77%)

- Hashrate (seven-day moving average): 802 EH/s

- Hashprice (spot): $53.19

- Total Fees: 4.58 BTC / $445,648

- CME Futures Open Interest: 166,695 BTC

- BTC priced in gold: 33.3 oz

- BTC vs gold market cap: 9.46%

Technical Analysis

- BTC’s monthly chart serves as an excellent illustration of how trendlines drawn from major price points act as support levels.

- Over the past two months, the downside has consistently been capped at around $90,000. This level is defined by a trendline connecting the twin peaks from 2021.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $334.62 (+2.16%), up 0.15% at $335.11 in pre-market.

- Coinbase Global (COIN): closed at $280.22 (+2.09%), up 0.23% at $280.86 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.24 (+1.3%)

- MARA Holdings (MARA): closed at $16.76 (unchanged), up 0.36% at $16.82 in pre-market.

- Riot Platforms (RIOT): closed at $11.63 (-0.1%), down 0.1% at $11.62 in pre-market.

- Core Scientific (CORZ): closed at $12.82 (+2.07%), up 0.1% at $12.83 in pre-market.

- CleanSpark (CLSK): closed at $11.18 (-1.32%), down 0.54% at $11.12 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.50 (+1.51%), unchanged at $23.5 in pre-market.

- Semler Scientific (SMLR): closed at $49.61 (+0.83%), up 2.6% at $50.90 in pre-market.

- Exodus Movement (EXOD): closed at $51.18 (+5.81%), down 2.31% at $50 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$186.3 million

- Cumulative net flows: $40.52 billion

- Total BTC holdings ~ 1.177 million.

Spot ETH ETFs

- Daily net flow: -$22.5 million

- Cumulative net flows: $3.16 billion

- Total ETH holdings ~ 3.791 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- Solana-based decentralized exchanges have hosted more trading volume than Ethereum since October.

While You Were Sleeping

- Ether Has Underperformed, but Total Value Locked on Ethereum Is Rising: Citi (CoinDesk): A Citi research paper says ether has underperformed bitcoin this year, despite Ethereum’s improving fundamentals, rising total value locked (TVL), continued ETF inflows and potential for crypto-friendly U.S. regulation.

- Hedge Funds Are Short Ether CME Futures Like Never Before. Is It Carry Trade or Outright Bearish Bets? (CoinDesk): Hedge funds hold record ether futures shorts on CME, mainly for carry trades profiting from the difference between spot ETH ETF and ETH futures pricing. Bearish bets may also be contributing.

- Trump Sets 25% Tariffs on Steel, Aluminum, Widening Trade War (Bloomberg): President Trump placed a 25% tariff on all imported steel and aluminum, effective March 12, with the aim of boosting domestic production and creating new jobs.

- Chinese Companies Don’t Know Where to Put Their Cash — and It’s Sparking a Record Rise in Dividend Payouts (CNBC): Chinese companies are offering record dividends and share buybacks, encouraged by government reforms to improve shareholder returns.

- UK Inflation Threat Receding, Says BoE Rate-Setter Who Voted for Big Cut (Financial Times): Catherine Mann, an external member of Bank of England’s Monetary Policy Committee, said she had voted for a 50 basis point rate cut last week, citing reduced inflationary pressures.

- WazirX Offers 85% of Stolen User Funds as Rebalancing Ends (CoinDesk): Indian crypto exchange WazirX, hacked last year, hopes to start initial fund distribution in April, aiming to return 85% of the dollar value of users’ crypto holdings, with more to come later.