This article is a deep dive investigation into Ecoin Finance (ECOIN): a suspicious project based on the smart contract of what many consider to be a fraudulent platform, Safemoon (SAFEMOON), that keeps promoting its token with the name of a now-defunct company that was registered in the United Kingdom.

Ecoin Finance is a project that, according to its website, was founded in May 2021 and “is a decentralized & deflationary BEP20 token powered by BNB Chain network.” The company seemingly aims to become “an online payment platform replacing conventional fiat currency through our integrated debit card.”

The Ecoin Finance website’s homepage cites the misspelled name of its corporation, “Ecoin Finance LTD” in its footer and continues carrying the incorporation documents on the website for E-Coin Finance LTD, a company based out of London founded back on June 2, 2021.

What Ecoin Finance apparently fails to disclose is that this company was dissolved by UK authorities back in December last year after a warning was issued in August 2022.

According to official records, Ecoin doesn’t exist

While the reason for the dissolution of the company is not explicitly mentioned in the documents, the fact that no publicly-listed documents have been added by E-Coin Finance LTD management to its filing history since the incorporation suggests that the company has never been really active.

The data also suggests that the firm was dissolved over simply failing to ever file any of the compulsory paperwork.

One interesting statement from the document is the following:

“Upon the Company’s dissolution, all property and rights vested in, or held in trust for, the Company are deemed to be bona vacantia, and will belong to the Crown.”

First Gazette Notice, E-Coin Finance document filing history

Cal Evans — the managing associate at crypto legal and compliance firm Gresham International — confirmed that since the website still claims “their business as being conducted from the UK” from the dissolved company, it is “definitely in breach of the Companies act.”

“Where a company is dissolved, it is no longer allowed to do business. This means all of their contracts and services are now defunct, as the actual company no longer exists.”

Cal Evans, Gresham International managing associate

Evans also pointed out that the United Kingdom Financial Conduct Authority (FCA) has strict rules for crypto companies under its jurisdiction. Consequently, if Ecoin Finance is claiming to be based out of the UK and selling tokens, “it is most likely they would have to be registered with the FCA.”

“If you sell a token through a company that no longer exists, then that can be seen as fraud. Where a company no longer exists, the directors/shareholders become personally liable (such as in the instance of a strike off),”

Evans concluded.

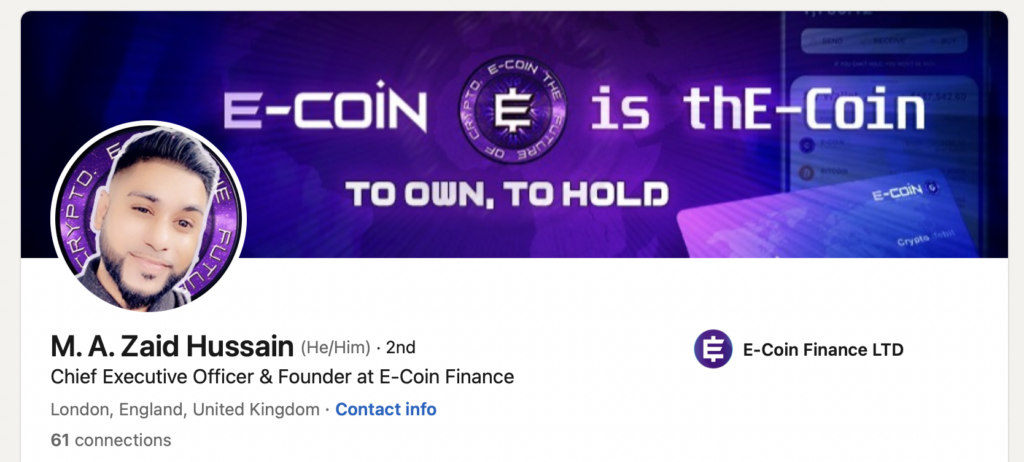

The incorporation document lists UK resident Mohammad Anowar Hussain as the firm’s sole director — a person not mentioned anywhere on the current version of the Ecoin Finance website. Ronaldo Guedes — the person listed as the current CEO on the website — is only listed as a 50% stakeholder, with the rest of the company being owned by Hussain.

Hussain’s LinkedIn profile claims that he is a former Google senior business analyst — a statement that the tech giant did not confirm or deny when contacted — with no other work experience before or after launching E-Coin Finance.

He was listed on the original website as a founding partner alongside Ronaldo Guedes, but subsequently, all mentions of him were simply removed; the current version of the website claims that Guedes has always been the company’s sole founder.

‘Extremely busy’

Hollywood actress famous for starring in Modern Family, Dr. Dolittle 3, and other movies, Darcy Donavan serves as the firm’s chief marketing officer.

When contacted with questions concerning the questionable nature of E-Coin Finance Darcy’s representative Dylan Nelson said:

“During Ms. Donavan’s time with Ecoin Finance, the only issue that she had seen was last year, when the company parted ways with one of the original founders. Beyond that, Ms. Donavan has not seen anything else.”

When asked for details, Nelson suggested that she knows little on the subject and that inquiries should be directed to Guedes instead.

Guedes did not respond to crypto.news’ requests for comments, while the firm’s strategic planning consultant Flavio Moura said that “Guedes will not be able to pay attention to you, he is extremely busy.”

Moura also claimed that E-Coin Finance’s operations are completely compliant with regulations and that the future payment card, which the company has been purportedly working on despite its company being forcibly dissolved, is being developed in partnership with a company that cannot be revealed due to a non-disclosure agreement.

In fact, he claimed that the wallet and dedicated financial platform are “89% complete.”

Darcy Donovan’s representative also claims “the company has been developing this technology [the debit card] in-house, handling all coding and design. This all takes time and money. As a startup company in an already new sector, this can take an extended amount of time,” Nelson said.

The data indicates that tweets mentioning the ECOIN ticker at the time of the review were receiving more likes and retweets than impressions. Interestingly, ECOIN seems to have a higher engagement on social media than leading coins such as ethereum (ETH). Furthermore, it stands out in terms of both the average age of Twitter accounts mentioning it and the overwhelmingly positive sentiment expressed.

When confronted with Twitter data suggesting likely widespread bot activity among tweets that mention the ECOIN ticker on Twitter, Moura called it “blasphemy.”

In a subsequent message, the company’s strategic advisor Moura warned crypto.news:

“As a famous phrase says, ‘Who shouldn’t, doesn’t fear.’ But beware of saying inconsistent things about the ECOIN organization, as you may know, even journalists having freedom of the press, a lawsuit for blasphemy can be filed.”

This sentence suggests that Moura believed blasphemy to actually mean libel in a show of lack of knowledge of the U.K. legal language that also manifests itself in the firm’s documents. Evans noted that he does not believe “the website terms were written by an English/British lawyer.”

The lawyer explained,

“They are written in ‘English,’ not American style and language. This says to me it was a commonwealth lawyer. I would suggest Egypt or India by the language. […] We would never say a company is British, because there is no such thing. There is England and Wales or Scotland, among others. That says whoever wrote these terms doesn’t understand English law but does use English grammar and is legally trained.”

crypto.news followed Evans’ advice and took steps to contact the United Kingdom Companies House, the FCA, and the National Crime Agency. Evan believes these organizations “would love to take a look into this company.”

Evans also noted the discrepancies in the company’s official address, explaining that “the company director has listed an actual address for their home/service address (which seems strange). The address is also spelled wrong. Both the shareholders list this as their service address.”

Not FTX, but big enough

Poopcoin data suggests that Ecoin Finance’s current market cap is just over $431,616 at its current price of $0.00123232 per token.

CoinMarketCap data shows that the coin had seen its all-time high back in early April 2022 — at the time, the price was $0.007737, nearly six times higher, which suggests that unless the supply has seen drastic changes, the market cap at its highest stood at about $2.7 million.