Bitcoin (BTC) starts the last week of February in a volatile mood as a crucial area of resistance fails to break.

After a classic “fakeout” during low-volume weekend trading, BTC/USD is back below $25,000 with bulls still lacking momentum.

The largest cryptocurrency saw what looked like the next stage of its 2023 recovery last week, making swift gains and even tapping new six-month highs.

The good times were not to continue, however, and February’s progress has been much slower and hard won than January’s 40% gains. How will the rest of the month pan out?

A critical monthly close is due, along with a potential external price trigger in the form of minutes from the United States Federal Reserve.

Meanwhile, Bitcoin network fundamentals are due to leap to yet another all-time high, and miners are in full recovery mode.

Cointelegraph takes a look at these factors and more in an overview of BTC price perspectives for the final week of February.

RSI “bearish divergence” causes alarm

After a mostly calm start to the weekend after days of macroeconomic data reactions, Bitcoin woke up late Sunday to rise back above $25,000.

This was not to last, however, and as Cointelegraph reported, signs on exchange order books pointed to manipulative moves by large-volume traders.

A subsequent comedown after the weekly close took BTC/USD below $24,000 before a bounce back to the same levels as Saturday, where the pair still traded at the time of writing, according to data from Cointelegraph Markets Pro and TradingView.

For traders, there was naturally cause to be wary.

“Not paying much attention to weekend PA.. BTC typically saves it’s meaningful moves for US stock market hours,” Crypto Chase wrote in part of a Twitter summary.

Monitoring resource Material Indicators, which originally flagged the order book activity, meanwhile queried how long the phenomenon might continue with bulls powerless to make inroads higher.

Do you think support will hold at the notorious bid wall to play the range again or will it spoof and dump?

Remember #TradFi Markets are closed Monday. If you’re playing the game with Notorious B.I.D., manage your risk accordingly. pic.twitter.com/ZyZlHTMFWM

— Material Indicators (@MI_Algos) February 19, 2023

An additional chart of the Binance order book confirmed that major bid support, known as a “bid wall,” had moved lower to $23,460, giving spot price room to drift lower alongside.

Fellow trader and analyst Matthew Hyland meanwhile admitted that it was “really hard to tell” whether Bitcoin could break higher on short timeframes.

Holding the area around $22,800 in the event of a pullback, followed by the key breakout, however, “wouldn’t surprise me,” he said on the day.

More concerned about the strength of the rally was Venturefounder, a contributor to on-chain analytics platform CryptoQuant.

In a Twitter thread, he warned that even external factors such as “macro weakness” could have an immediate bearish impact on crypto markets.

“Bitcoin bearish RSI divergence continues… Almost the exact opposite way of May-July 2021 period. I think any macro weakness can have BTC snap back to $19-20k real quick,” part of comments stated.

Venturefounder referenced the Relative Strength Index (RSI) metric, which measures how overbought or oversold an asset is at a given price point. In 2021, RSI was increasing versus a BTC price correction, this subsequently ending in current all-time highs of $69,000 in November that year.

All eyes on FOMC minutes and U.S. dollar

What form that “weakness” on macro markets might take remains to be seen.

The upcoming week holds considerably fewer potential macro triggers than the last, with a sprinkling of U.S. data releases including personal spending in the form of the Personal Consumption Expenditures (PCE) Index.

The event on most crypto pundits’ radar, however, is the release of the minutes from February’s Federal Open Market Committee (FOMC) meeting at the Fed.

This was where the latest benchmark interest rate hike was decided, and expectations now are for Fed Chair Jerome Powell to have included talk of a moratorium on rate hike policy — if only theoretically.

“We also have FOMC minutes releasing on Wednesday where Powell will describe what a rate hike ‘pause’ could look like,” Crypto Chase mentioned about the event.

“Middle of upcoming week is where I start considering swing entries.”

Not everyone is convinced that the FOMC minutes will be plain sailing, however. Among them is financial market research resource Capital Hungry, which this week warned that “sneaky hawkish revisions” may be revealed.

“Feds sneak in hawkish revisions out of the spotlight (not an active FOMC) with market already adjusted to CPI revisions and Jan report. PCE data feeds into elevated inflation sentiment,” it argued in part of Twitter commentary.

Any return of inflationary tendencies would be a boost to U.S. dollar strength, which spent the last macro trading day of last week erasing prior gains.

Matthew Dixon, founder and CEO of crypto rating platform Evai, spelled out the bearish scenario for the U.S. dollar index (DXY), in what would be a bullish tailwind for risk assets including crypto.

Looking the look of #DXY so far. If we are already on the way down to complete the Y wave then this will be positive for #Btc #Eth #Crypto and risk assets in general #Evai pic.twitter.com/9OEHTG1d1v

— Matthew Dixon – CEO Evai (@mdtrade) February 20, 2023

Analyst: moving average “cloud” is there to be broken

As Cointelegraph continues to report, Bitcoin bulls have a problem which is becoming increasingly obvious on short timeframes — the 200-week moving average (WMA).

A classic “bear market” trend line, the 200WMA has acted as resistance since the middle of 2022, and BTC/USD has spent more time below than ever before.

Reclaiming the level would mark a conspicuous achievement, but so far, all attempts have met with flat rejection.

“If Bitcoin manages to break above the 200-week MA cloud, which is becoming increasingly likely, we’re going to see a lot more TradFi coverage of crypto again,” Caleb Franzen, senior market analyst at Cubic Analytics, summarized at the weekend.

Franzen additionally showed the levels at stake in the short term, with $25,200 the ceiling in need of a breakout.

Short-term levels that #Bitcoin keeps wrestling with… pic.twitter.com/Qmx9UBKyht

— Caleb Franzen (@CalebFranzen) February 19, 2023

The “cloud” he referred to involves more than just the 200WMA, however — Bitcoin’s 50WMA is currently at $24,462, coinciding exactly with current spot price focus.

Additionally, asks on exchange order books are stacked around the 200WMA, increasing the challenges present in flipping it from resistance to support.

In research published on Feb. 18, Franzen described the WMA cloud as one of “two major signals to add more bullish fuel to the fire” alongside realized price.

“BTC was rejected on this dynamic range for the first time in August 2022 and was briefly rejected on this level earlier in the week. While it be able to break above on this second attempt?” he queried.

Hash rate, difficulty in line for fresh record highs

In a familiar silver lining, Bitcoin’s network fundamentals are keeping the bullish vibe firmly intact as the month draws to a close.

The next automated readjustment will see difficulty add an estimated 10% to its existing tally. This will cancel out the previous readjustment’s modest decline to send difficulty to new all-time highs.

This is a key yardstick for gauging Bitcoin miner sentiment, as such large increases suggest corresponding advances in competition for block subsidies.

It comes on the back of increasing coverage of so-called “ordinals” fees, with miner profitability clearly recovering after months of pressure.

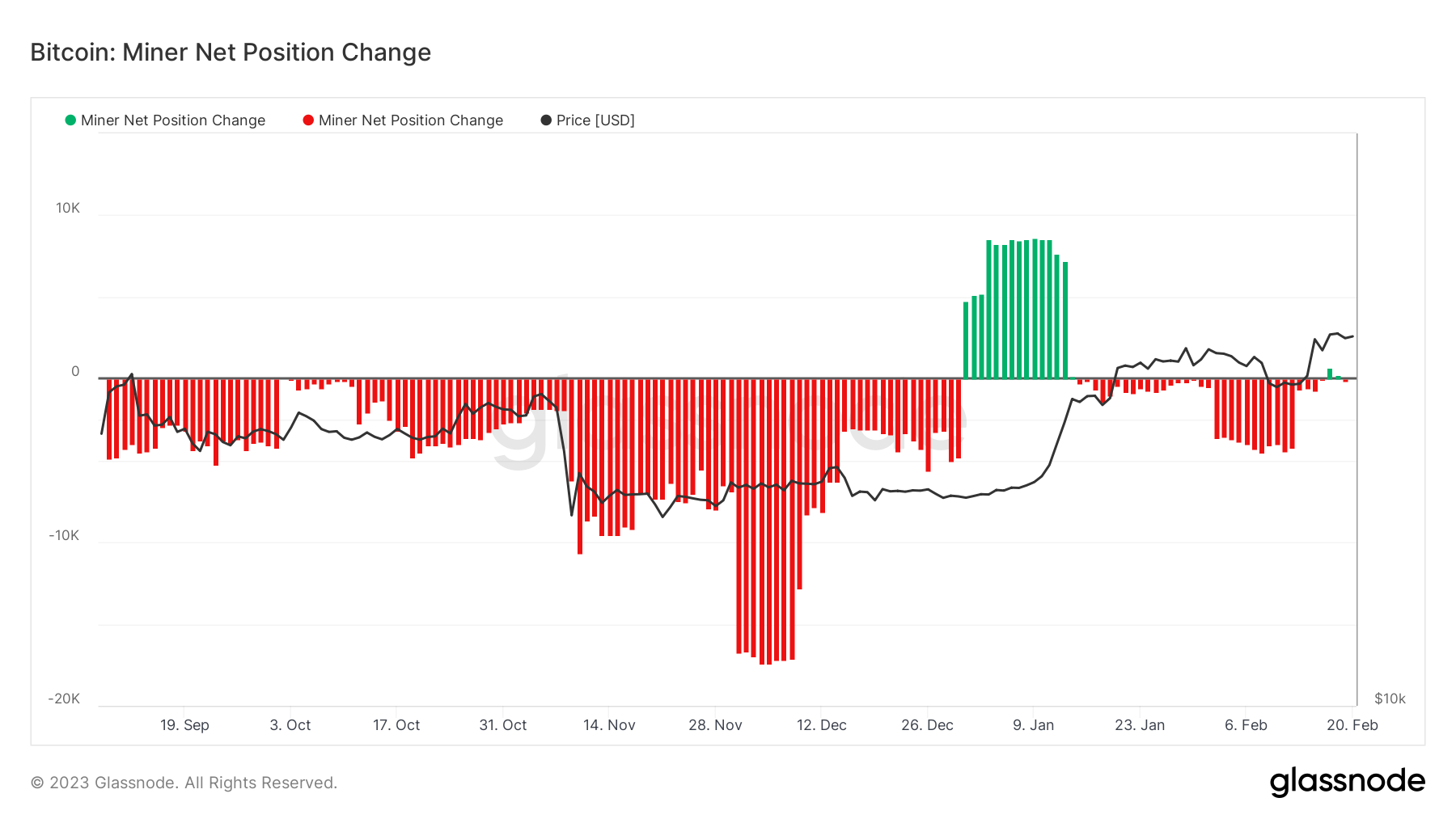

Data from on-chain analytics firm Glassnode bears this out. Miners have begun retaining more BTC than they sell on rolling monthly timeframes, it shows, reversing a trend of net sales in place from mid-January.

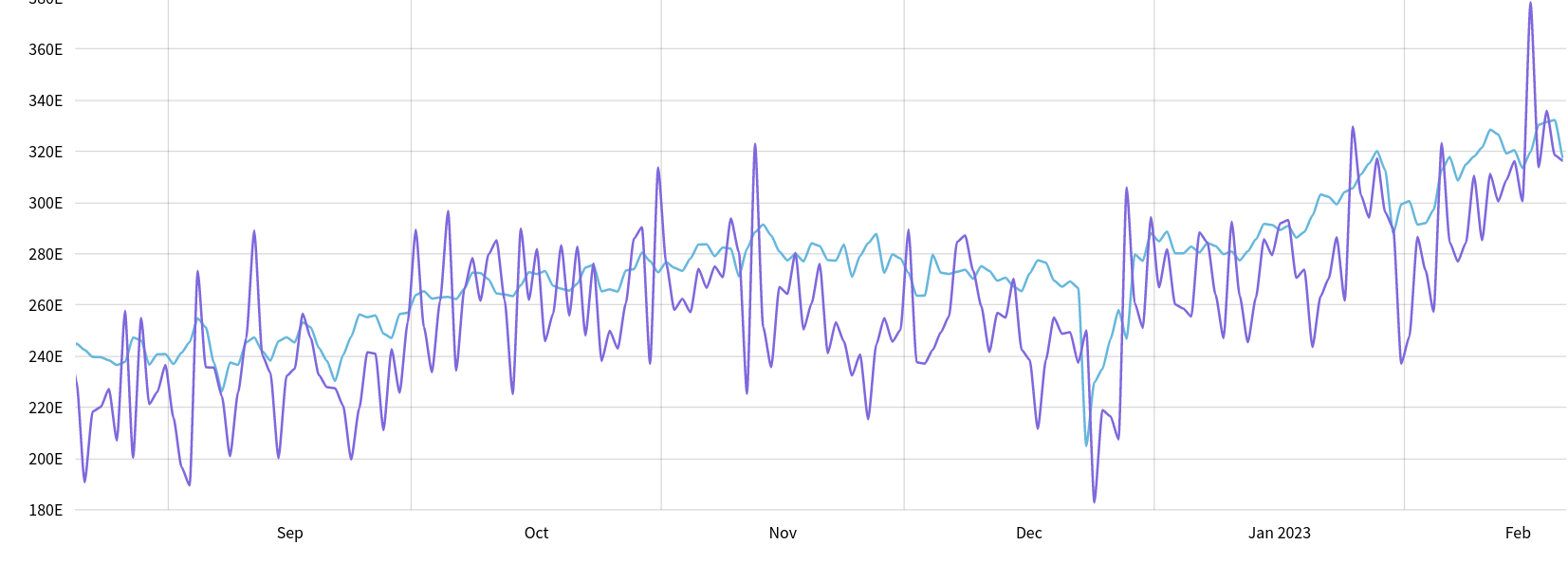

Raw data from MiningPoolStats meanwhile shows Bitcoin network hash rate also preserving its upward trend, remaining at over 300 exahashes per second (EH/s).

“Unstoppable!” economist and analyst Jan Wuestenfeld commented about the phenomenon as its 30-day moving average climbed to new all-time highs of its own last week.

Joe Burnett, head analyst at Blockware, described hash rate growth as “truly relentless.”

“The 14 day moving average of total global hashrate now sits at ~ 290 EH/s. Bitcoin miners are scavenging the Earth for cheap, wasted, excess energy,” he added alongside Glassnode figures.

Longtime Bitcoin market participants will recall the once popular phrase, “price follows hash rate,” which postulates that a large enough hash rate uptrend has inevitable bullish implications for BTC price action.

Most “greed” since Bitcoin all-time highs

$25,000 is a headache for reasons beyond solid resistance — breaking above it could be an unsustainable move for Bitcoin.

Related: Bitcoin’s bullish price action continues to bolster rallies in FIL, OKB, VET and RPL

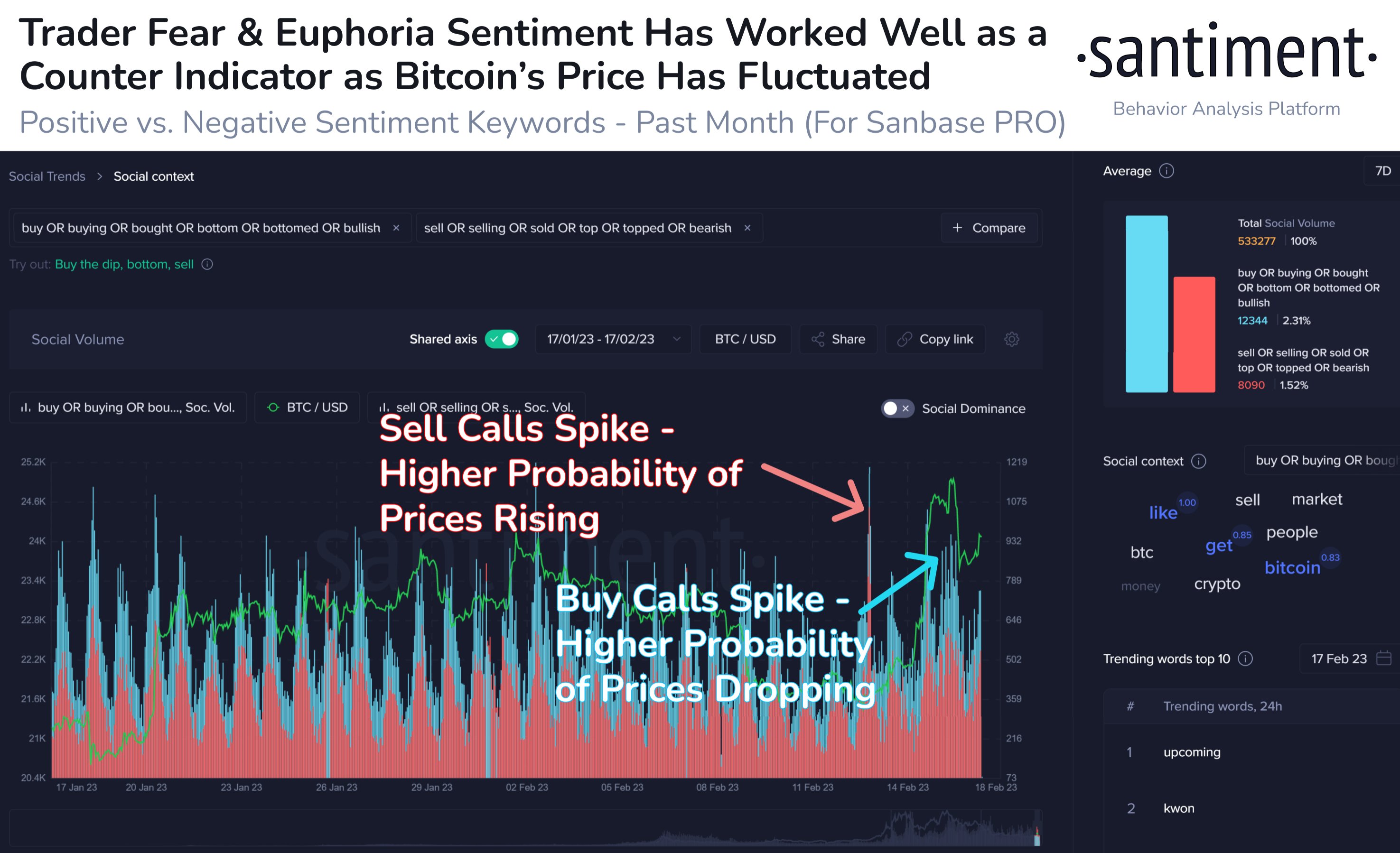

The latest findings from research firm Santiment suggest that at around those multi-month highs, crypto market sentiment simply becomes too greedy.

“Bitcoin’s 8-month high yesterday came with a great amount of euphoria,” it commented on a chart showing social media activity.

“Perhaps a bit too much, as the positive commentary on social platforms may have created a local top. Just as the negative commentary on Feb. 13th likely contributed to the bottom.”

The phenomenon is also visible on altcoins, with Santiment singling out Dogecoin (DOGE) as a key example this month.

“This pattern of social volume and highly positive sentiment toward Dogecoin perfectly illustrates how euphoria creates price tops. Regardless of your opinion on DOGE, hype on this asset in particular historically foreshadows market corrections,” it concluded.

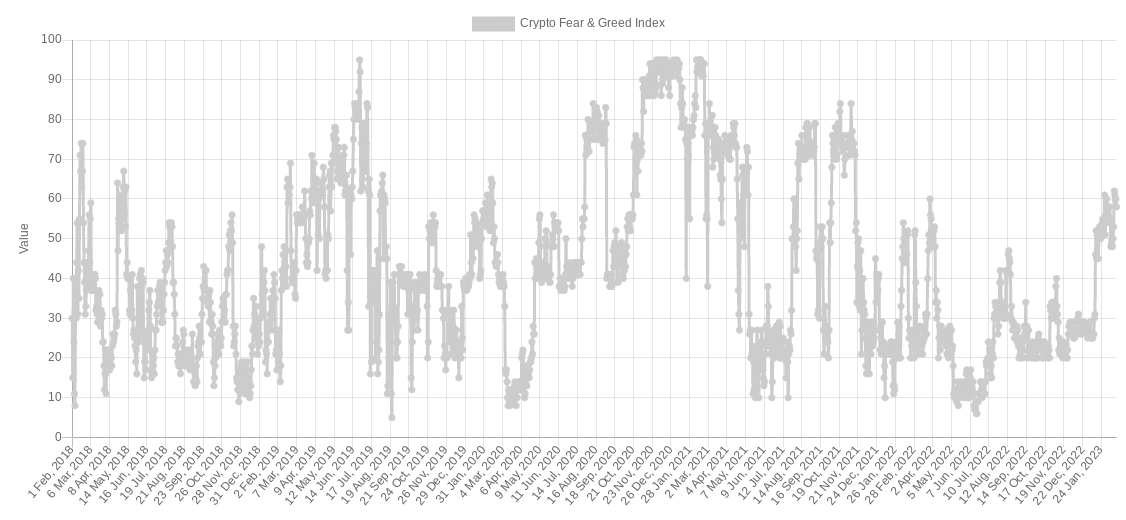

The ever-popular Crypto Fear & Greed Index meanwhile shows “greed” as the overriding sentiment flavor across crypto this week.

The push to the highs for Bitcoin coincided in a reading of 62/100 for the Index, marking new highs in the period since the November 2021 push to $69,000 on BTC/USD.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.