Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

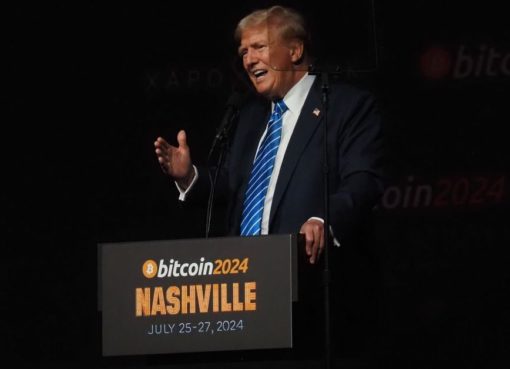

According to recent reports, President Donald Trump’s crypto venture, the decentralized finance (DeFi) platform World Liberty Financial (WLFI), has unveiled a new stablecoin called USD1.

This token, pegged to the US dollar, is now live on the Ethereum (ETH) and Binance blockchains, although the launch was not officially announced by the company on Monday March 24.

World Liberty Financial Launches New Stablecoin

The news comes via a report from Fortune, which highlights the expanding crypto portfolio of the President, now serving his second term in the White House’s Oval Office.

On social media, Changpeng Zhao, the former CEO of Binance, shared a link to the USD1 token with his 10 million followers on X, prompting World Liberty Financial to implicitly confirm its legitimacy. However, the company cautioned that USD1 is not currently tradable and warned users to be vigilant against potential scams.

Related Reading

Stablecoins such as USD1 are becoming increasingly prominent in the crypto market, with notable traction in the US Congress, where lawmakers have introduced several bills to further support the sector.

Major players such as Tether, the issuer of the world’s largest stablecoin, USDT, reported $13 billion in profit for 2024, while Circle, the company behind USDC, is planning to go public.

These companies back their stablecoins with US treasuries, allowing them to earn significant yields, which has proven lucrative given their relatively low operational costs compared to traditional corporations.

Ethical Concerns Arise

World Liberty Financial, announced in August, is part of Trump’s broader foray into the cryptocurrency world, which also includes non-fungible tokens (NFTs) and a memecoin named after the President, TRUMP.

The project is positioning itself within the decentralized finance sector, which aims to replicate traditional banking services—such as lending and borrowing—on blockchain platforms. However, details about the project’s specific offerings remain vague, with little information available on their website.

The project’s “gold paper” outlines ambitions to create a comprehensive hub for various DeFi applications, including decentralized lending platforms and crypto exchanges. Trump himself holds the title of “Chief Crypto Advocate” for World Liberty Financial, underscoring his involvement in the initiative.

Related Reading

In a show of investor confidence, the project recently announced it had raised $550 million in token sales, attracting attention from various stakeholders, including Trump family members and loyalists.

Barron, Eric, and Donald Jr. have been designated as World Liberty Financial’s “Web3 Ambassadors,” while real estate magnate Steve Witkoff and his sons are listed as co-founders alongside DeFi developers Zak Folkman and Chase Herro, who previously faced challenges with their project, Dough Finance, which suffered a $2 million hack.

Despite the enthusiasm surrounding the project, it has raised ethical concerns among experts, particularly regarding the potential for influence peddling.

Critics have pointed to instances like Justin Sun’s public purchase of $75 million worth of World Liberty Financial tokens, suggesting that such activities could blur the lines of regulatory compliance.

At the time of writing, TRUMP memecoin is trading at $11.58, down 30% on a monthly time frame and 84% off its current record high of $73.43 reached on the same day of its debut on January 19.

Featured image from DALL-E, chart from TradingView.com