Solana (SOL)

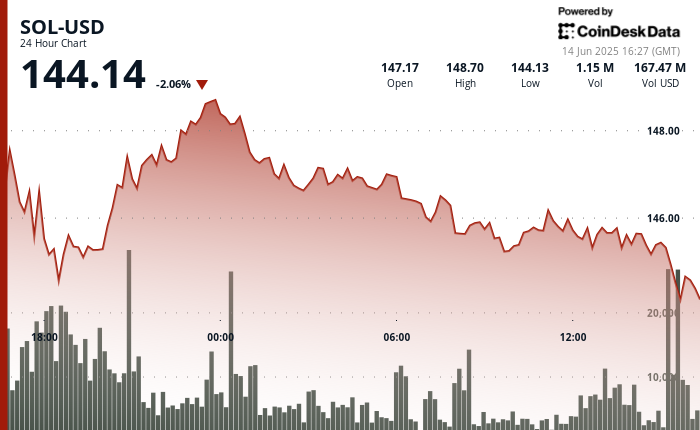

traded at $144.14 on June 14, down 2.06% over the past 24 hours, but showed resilience as long-term institutional activity offset retail-driven weakness. Price action remains pinned near the lower end of its recent $145–$149 consolidation zone, following a broader multi-day correction across crypto markets tied to rising geopolitical tension.

Despite recent weakness, two major institutional developments suggest deepening engagement with the Solana ecosystem.

First, Bloomberg’s James Seyffart confirmed on Friday that this week that all seven spot Solana ETF issuers — i.e. including Fidelity, Grayscale, VanEck, 21Shares, Franklin, Bitwise and Canary Marinade —submitted updated S-1 filings with the SEC. Each filing now includes staking provisions, making them structurally aligned with solana’s on-chain economics.

Second, DeFi Development Corp, a Nasdaq-listed Solana treasury firm, announced on Thursday that it entered into a $5 billion equity line of credit (ELOC) agreement with RK Capital. The facility allows DeFi Dev Corp to issue shares gradually to fund additional SOL accumulation, rather than relying on a single, fixed-price offering.

This follows a minor regulatory setback: on Wednesday, the company applied to the SEC for the withdrawal of registration statement on Form S-3. It said it wanted to withdraw a prior S-3 filing due to technical eligibility issues flagged by the SEC. The firm said it would file a resale registration statement in the future to raise the capital it needs.

Despite the filing hiccup, the company emphasized its continued commitment to growing its SOL treasury, which currently holds over 609,190 tokens — valued at more than $97 million. CEO Joseph Onorati said in Thursday’s press release that the new capital structure offers a “clean, strategic path” to scale exposure while compounding validator yield.

SOL’s price appears to be stabilizing as these institutional tailwinds strengthen, even as retail activity remains subdued.

Technical Analysis Highlights

- SOL traded in a 24-hour range of $4.57 (3.08%), from $144.13 to $148.70.

- Initial strength faded, with price drifting toward the $144 support level.

- Resistance remains firm near $149, while short-term rejection hit $145.78.

- High-volume selling occurred between 13:41–13:47 UTC, with a sharp drop from $145.95.

- A volume spike at 13:23 UTC aligned with the failed breakout.

- Whale accumulation continues below $146, though follow-through remains limited.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CryptoX’s full AI Policy.