Bitcoin Cash price peaked at $496 on March 25, up 44% in the last five days, but BCH miners’ strategic maneuvers ahead of the upcoming halving threaten to scuttle the rally.

Bitcoin Cash has witnessed intense market volatility over the past week as investors gear up for the 3rd halving event slated for April 4.

Miners have offloaded 1.5 million BCH in 2024

Bitcoin Cash is a peer-to-peer payments network founded in 2014 as a lightweight alternative to Bitcoin (BTC). With cheaper fees and higher transaction throughput, Bitcoin Cash has grown rapidly to become one of the leading decentralized Proof of Work (PoW) blockchain networks.

Bitcoin Cash’s third halving event is now 10 days away, and as widely expected, key stakeholders have been spotted making strategic moves to front-run the possible price impact.

Notably, there has been a paradigm shift in Bitcoin Cash miners’ reserve flows since the turn of the year.

IntoTheBlock’s miner reserves data and tracks the total number of coins held in wallets controlled by recognized miners and mining pools.

At the start of the year, the miners held 7.72 million BCH in their cumulative reserves, as depicted in the chart above. But after 3 months of intense selling, that figure has dropped to 6.25 million BCH, the lowest since 2018.

This implies that the miners took advantage of the recent price rallies by selling 1.5 million BCH, worth approximately $741 million, between January and March 2024.

The selling trend is likely to intensify in the days ahead as more miners look to cash in on high prices ahead of the April 4 halving date.

Bitcoin Cash price forecast: Bull to defend $400 support

Drawing insights from the miners’ $740 selling frenzy, Bitcoin Cash price currently appears primed for a further downswing below $400 ahead of the halving event.

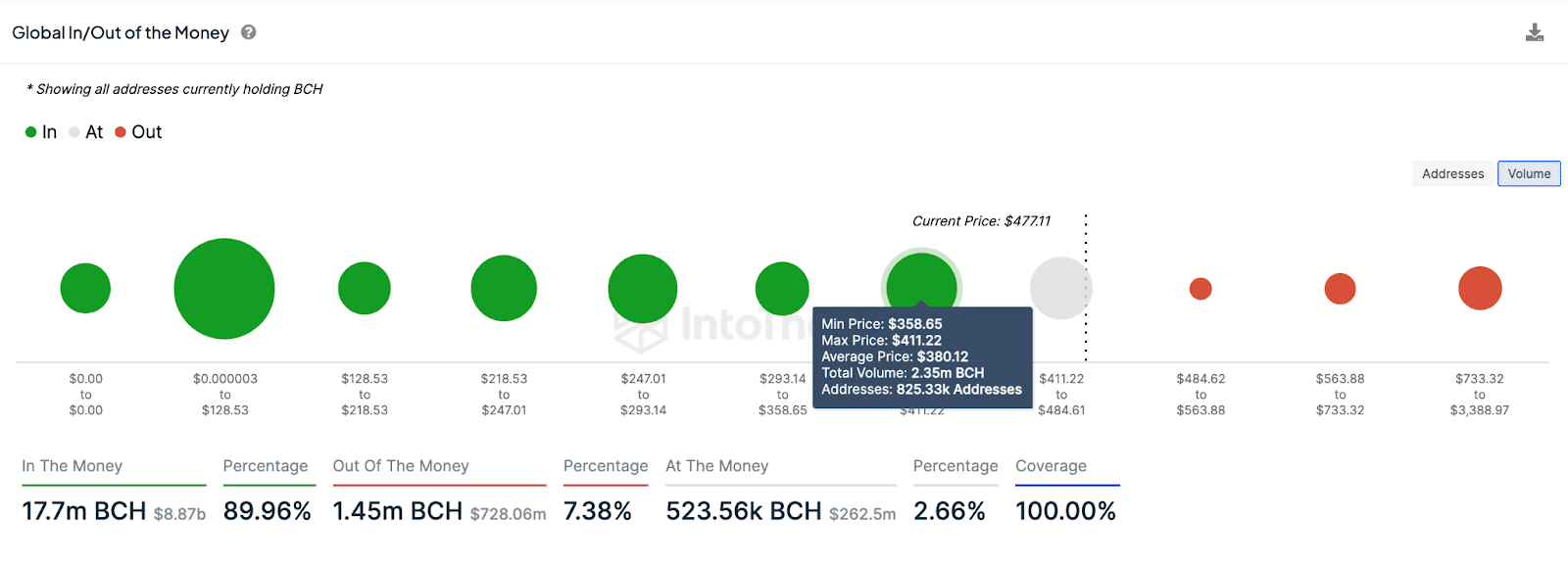

First, BCH bears must breach the support buy-wall around $400. However, IntoTheBlock’s global in/out of the money data shows a cluster of 825,330 addresses that acquired 2.4 million BCH at a maximum price of $411.

Breaking below this critical support level could set the stage for further BCH price reversal toward $350.

On the downside, the bulls could invalidate this pessimistic BCH price prediction by staging another breakout above $500. However, as observed in the past week, the sell-wall at the $490 territory poses significant short-term resistance to the BCH price rally.