- The Dow Jones fell on Tuesday, even as the wider stock market rallied.

- Consumer confidence missed expectations by a significant margin, though the U.S. housing market remains strong.

- Exxon Mobil, Pfizer, and Raytheon Technologies are all being booted out of the Dow.

The Dow Jones tumbled on Tuesday after U.S. consumer confidence plunged to its lowest level since the start of the pandemic.

Dow Jones Slips After Big Consumer Sentiment Miss

After a volatile session, the Dow bounced off its lows in later afternoon trading. By 3:32 pm ET, the index had recovered to 28,250.17 for a net loss of 58.29 points or 0.21%.

It’s not enough to salvage a three-day winning streak, though.

Both the S&P 500 and Nasdaq managed to sneak into positive territory, leaving the Dow Jones as the weakest performer among Wall Street’s primary indices.

The S&P 500 rose 0.34% to 3,443.02, while the Nasdaq jumped 0.69% to 11,457.91.

U.S. economic data continues to demonstrate that the housing market is as hot as ever – or at least since the financial crisis. Rock-bottom mortgage rates and flight from densely-populated urban centers are fueling an incredible surge in both new and existing home sales despite depressed incomes nationwide.

Things are not so buoyant in other segments of the economy.

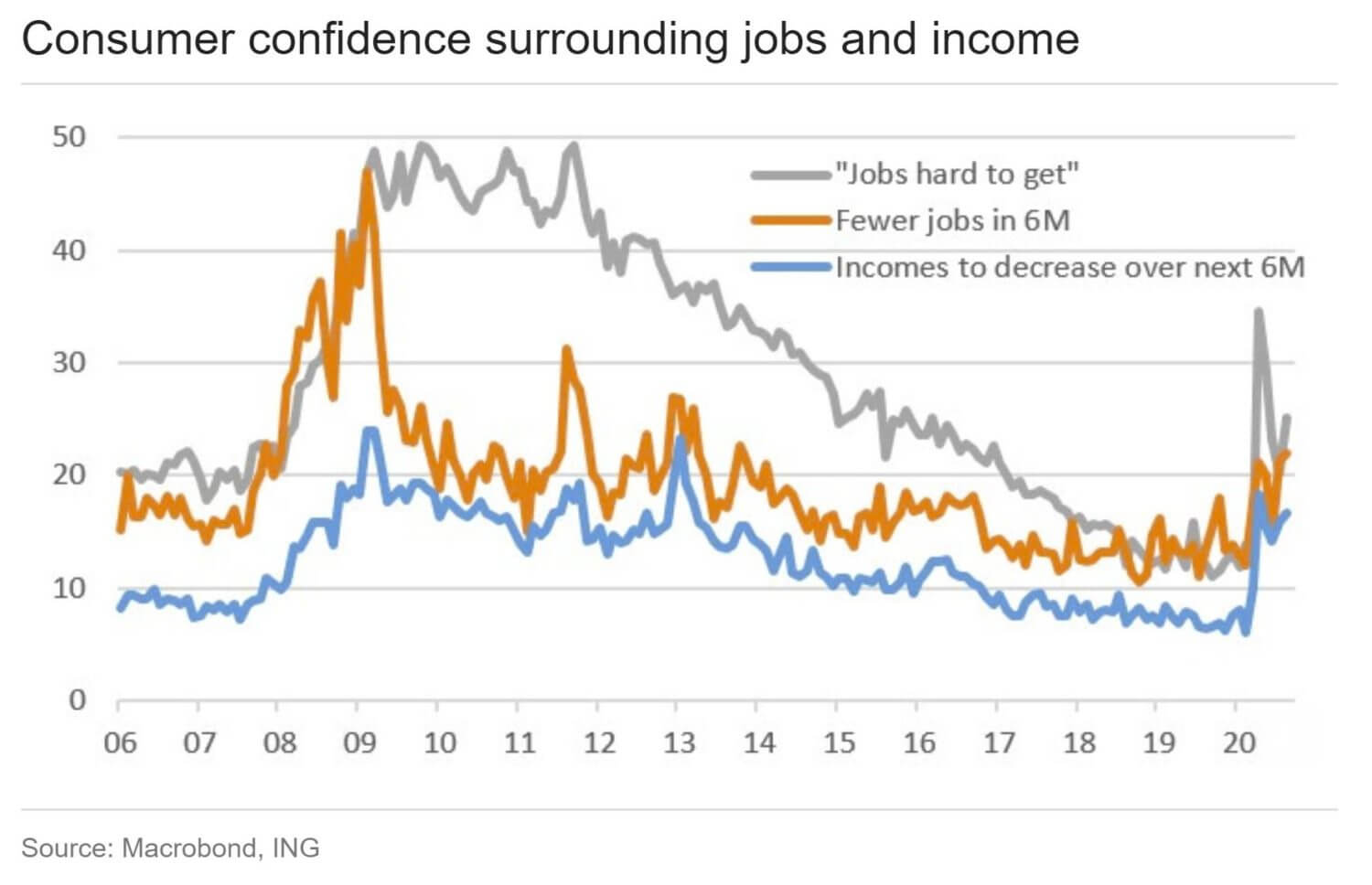

Consumer confidence remains stubbornly low – and it’s moving in the wrong direction. Today’s reading revealed an unexpected plunge to 84.8 (from 91.7 last month); economists had expected confidence to climb to 93.

The data hit the Dow hard because consumer sentiment is inextricably linked to spending – the most critical engine of economic activity.

ING economist James Knightley says it’s further proof that the economic recovery is losing momentum. Forget a V-shaped rebound: he doesn’t expect a full recovery until mid-2022.

He wrote today:

Renewed Covid containment measures and cuts to Federal unemployment benefits appear to be offsetting any positive boost from rising equity markets. With sentiment at its lowest point since the start of the crisis, it reinforces the view that the second phase of the recovery story will be slower going… This is going to be a more challenging situation and reinforces our view that a V-shaped recovery will not happen. The U.S. economy, which is 70% consumer spending, is unlikely to recover all of its lost output until mid-2022.

Dow 30 Stocks: Major Shakeup Underway

A rough day in the Dow 30 saw plenty of red throughout the index. Apple, its most heavily weighted stock (for a few more days, anyway), dipped 0.9% to $499.

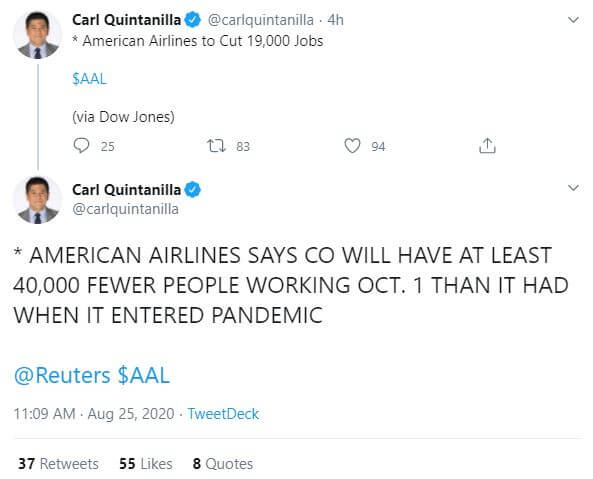

Boeing, which used to be the index’s heaviest component, was its second-worst performer on Tuesday. It suffered a 2.9% loss amid a deluge of headlines about significant layoffs at its partner airlines.

There was more going on today than simple moves in the market. The actual Dow Jones Industrial Average itself is set to get a major revamp.

When Apple stock’s four-for-one split becomes official after Friday’s close, the tech giant’s influence on the Dow will wane significantly. To ensure the index maintains sufficient exposure to the tech sector, its operators are adding Amgen, Salesforce, and Honeywell to its roster.

This means that Exxon Mobil, once the world’s largest company, is on the way out, as are Raytheon Technologies and pharmaceutical giant Pfizer. All three stocks fell at least 1% – and ranked among the index’s worst performers today.