- Tesla stock has officially entered a technical correction, having fallen by 10% since a peak of $498 on Monday.

- The stock could decline further as negative news surrounding shareholder selloffs drives it lower.

- Tesla may collapse by more than 20%, particularly as its EV market share declines, and the stock market enters bearish territory itself.

The Tesla stock correction has begun. The carmaker’s shares fell by 5.8% Wednesday, with the drop to $447.37, marking a 10% decline from Monday’s peak. This puts the stock in official “technical correction” territory.

More pain is likely to come for Tesla. One of the company’s biggest shareholders sold a third of its shares on Wednesday, while Tesla itself is also planning to sell $5 billion of its shares to Wall Street firms. A big selloff is likely–one that will be made worse short-sellers, who are beginning to enjoy appetizing gains.

Tesla Stock Enters Correction; Bear Market Next?

Tesla stock is, in fact, very close to entering “bear market” territory, which is defined as a 20% drop from a recent high. It declined 7% in pre-market trading and was off more than 5% after the open. If the stock drops below $399, it will officially enter a bear market.

Several factors have caused this dive. First was Tesla’s plans to sell $5 billion in its stock, announced on Tuesday. Next was an SEC filing showing that Scotland-based fund Baillie Gifford–Tesla’s biggest independent shareholder–had cut its stake in the company from 6.3% to 4.25% of total outstanding shares.

The worst is yet to come. For several months now, short-sellers have lost massively at the hands of Tesla. Now the tide is turning, with U.K.-based fund provider GraniteShares enjoying a 40.5% rise on Wednesday for its 3X Short Tesla Daily Exchange-Traded Product.

Short interest in Tesla is rising again after being dampened by the stock’s meteoric rally. The volume of shorts was down to 4.2 million as recently as August 20 but has now jumped to 14.3 million.

What this means is that traders are increasingly sensing that the long-awaited collapse in Tesla’s stock will finally arrive. It has already begun a correction and is on the verge of entering a bear market. It may not be long before it crumbles.

Shaky Fundamentals, Bearish Sentiment

This means that many of the millennial traders who piled into Tesla via Robinhood are the brink of losing big. Arguably, many of them should have known better, given that more sober commentators have been warning of a massive Tesla crash for days, weeks, and months.

Much has been said about how Tesla’s modest fundamentals don’t support its sky-high valuation. Yet these fundamentals are getting worse in some respects.

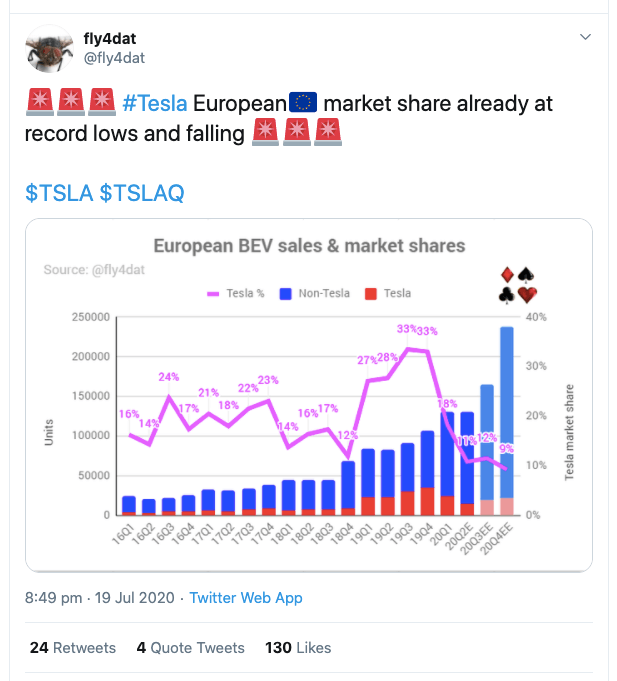

Tesla’s share of the electric vehicle market in Europe–set to become the biggest in the world–is declining, as more established car manufacturers step up their production of EVs. Its sales in the United States declined in 2019, also belying its rising market cap.

As investors become more negative in their attitudes towards Tesla, figures showing a decline in EV market share will have a significant effect. The market cannot ignore mediocre commercial performance forever, and the situation is made more serious by the fact that many analysts are now predicting a general stock market correction.

The European Securities and Markets Authority (ESMA) is the latest to offer a bearish warning. Speaking Wednesday, the EU regulator predicted that the fragile global economy would eventually catch up with over-exuberant stock markets:

[There is a] prolonged period of risk to institutional and retail investors of further — possibly significant — market corrections.

This isn’t good for Tesla, particularly when the wheels are already falling off its rally.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.