SEC to Possibly Reevaluate Grayscale Spot Bitcoin Application at November 2 Closed Meeting

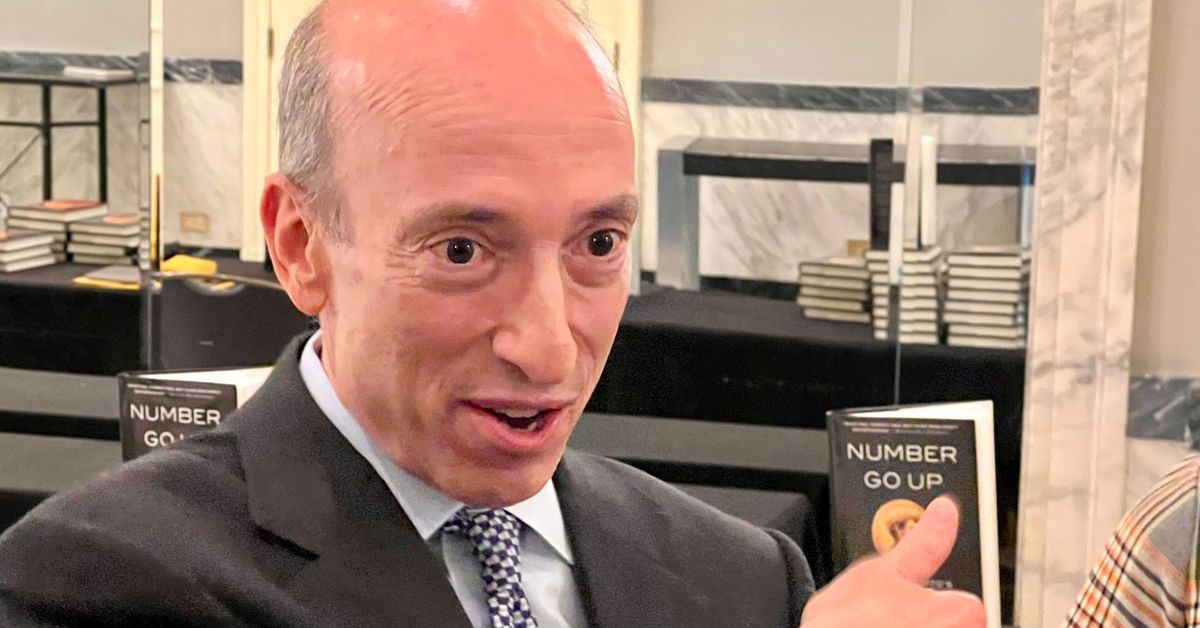

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be. The United States Securities and Exchange Commission (SEC) appears to be gearing up to reexamine Grayscale’s application to convert its Bitcoin trust into a spot exchange-traded fund (ETF). This comes after a recent

Read More