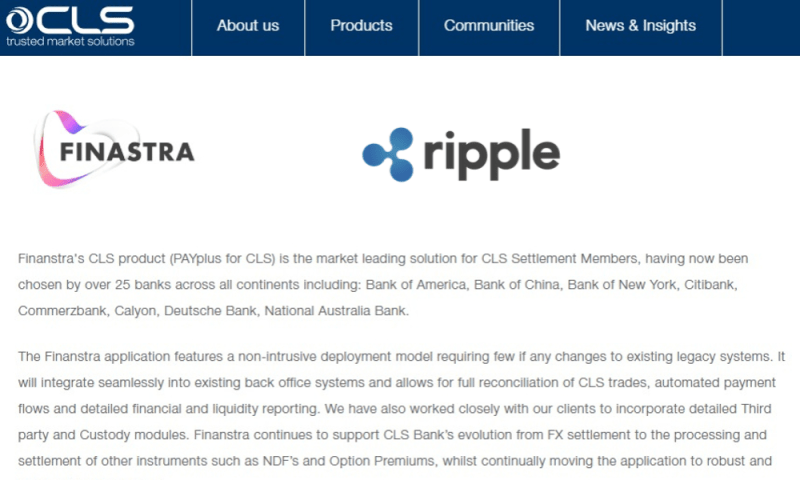

Earlier today Ripple reaffirmed their partnership with London based fintech firm Finastra, a major milestone in the SWIFT takeover.

The story dropped earlier this year, but the timing of the announcement from Marcus Treacher SVP of Customer Success seems rather prophetic.

Finastra is an established fintech player & works with the majority of the worlds top banks. This partnership will enable Ripple to expand the reach and solutions for our partners, and the footprint of RippleNet while allowing customers to transact directly with each other.

Although Finastra lacks the superstar status of Apple or Amazon, they are a big deal with offices across 42 countries employing 10,000 people.

Their banking services alone drive a yearly revenue of $2 billion from 9000 customers and 90 of the world’s top 100 (SWIFT) banks.

So why is this signing so important, as @XRP_OWL puts it so eloquently, Finastra = CLS = SWIFT, and boy is he right on this one.

Basically Finastra runs the very service the elite banks use to pay each other and it all runs on RippleNet, BOA, BOC, Deutsche Bank, et al.

Finanstra’s CLS product (PAYplus for CLS) is the market leading solution for CLS Settlement Members, having now been chosen by over 25 SWIFT banks across all continents including: Bank of America, Bank of China, Bank of New York, Citibank, Commerzbank, Calyon, Deutsche Bank, National Australia Bank

Finastra’s full list of partnerships is available HERE, we don’t have time to list every single financial system and national bank in the world.

Once elite banks ramp up RippleNet/XRP usage and liquidity, will be a walk in the park for XRP to handle the $trillions SWIFT handles daily…

Earlier this week a magazine revealed SWIFT has been testing Ripple Tech, was happy with its speed but is not ready for mainstream use.

Clearly Ripple is very much ready for mainstream use it is a case of higher liquidity and that is what Ripple is focusing on right now.

We were at Sibos, meeting with a bank we don’t work with today, big transaction correspondent bank (SWIFT?) we were sitting down and one of the guys said its become a question of not if we are going to work with Ripple its when because 26 of our correspondents are working with Ripple

We spoke to Evans Nortey who was a host at the Sibos ’19 event, he told us that SWIFT and the banks are scared, they don’t want to be left behind.

Add to that, most of Finastra’s clients use the SWIFT system also, Ripple is clearly preparing for a global takeover of monumental proportions.