- Ray Dalio claimed “cash is trash” in late January just before markets tanked 30%.

- Now, with stocks back near all-time highs, he’s calling for a “lost decade” in stocks.

- While he may be right over the next few months, a lost decade seems unlikely.

2020 has been a humbling year for professional money managers. Among them, billionaire fund manager Ray Dalio is a standout.

Back on January 21 at Davos, Dalio made the now-infamous statement that “cash is trash.”

His meaning? Investors shouldn’t sit out of the stock market. His statement came out just weeks before the stock market peaked in February.

The resulting drop was the fastest bear market in history, with a speedy 30% plunge in shares. Bridgewater, Dalio’s hedge fund, saw a 15% decline due to performance-related losses.

Dalio Back for More Pain with a New “Lost Decade” Prediction

Now, it sounds like the fund manager is back for another helping of humble pie.

That’s because Bridgewater is now calling for a “lost decade” in stocks.

Could it happen? It’s certainly possible. At the bottom of the housing bust in early 2009, stocks reached levels last seen in 1997. That’s a 12-year period of losses for investors.

But the market surpassed its pre-crash peak of 2007 in 2012—a mere five years later. And that’s the playbook the Fed is following today.

Today, according to Dalio, we could be looking at a similar trend.

That’s based on factors like declining corporate profit margins. Companies are likely to see a strong bounce back from the recent pandemic-driven pain, but not anywhere near prior levels.

Worst of all, this is a trend that started before the pandemic. The gap has been growing for years, and last occurred during the tech bubble years of the 1990s.

Profit margins could remain compressed for years until consumer demand returns, which would likely weigh on further stock market appreciation.

Another problem is the potential dangers to the economy from excessive government intervention right now.

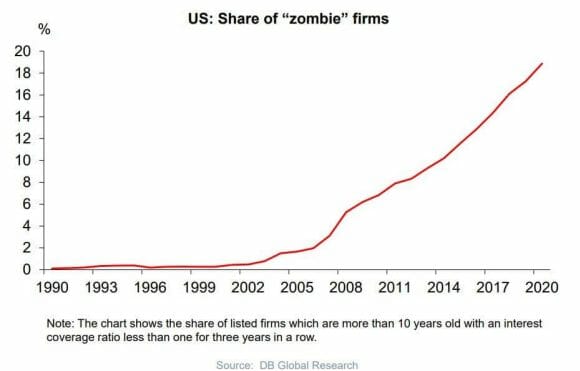

Thanks to the funds available to keep companies going right now, there’s been a sharp rise in the number of zombie companies.

These firms have just enough capital coming in to pay the bills and keep the lights on—but not enough to shake off all their debt or truly grow and prosper.

Bridgewater sees this as a catalyst for a slower-moving market from here—and why stocks may end up suffering for years as a result.

Long-Term, Retail Investors Will be Right

So, who’s right here? The fund manager who made a poor prediction at the start of the year? Or the retail investors who took his “cash is trash” advice after a big market plunge?

Perhaps Dalio will be right this time. From the fundamentals he’s citing, there’s a strong case for poor investment returns going forward.

But retail investors are looking at the government and central bank policy response to that problem.

It’s a classic case of the optimists versus the pessimists. Long-term, the optimists tend to win. But when the pessimists are right, things can hit pretty hard.

Dalio’s view is wrong over the long haul, but he may briefly be right before the year is out.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.