Despite Bitcoin’s (BTC) steep rally in November, the price is consolidating above $15,000 as on-chain analyst, Willy Woo says a blow-off top is unlikely for three main reasons.

The three factors are the growing outflow of funds from exchanges, increase in “HODLers,” and data showing that investors already took profit.

Bitcoin is moving from exchanges to individual wallets

According to the data from Glassnode, a large amount of Bitcoin has been moving out of centralized exchanges in late October.

Woo says this metric is optimistic because it shows investors are transferring funds from trading platforms to personal wallets. This indicates that users are holding their BTC with a long-term investment strategy.

The analyst noted that Bitcoin saw the highest number of Bitcoin moved out of exchanges in a single day in the past five years. He explained:

“A ridiculous amount of coins were scooped up and moved off to individual wallets. Zooming out, putting this into perspective, it’s the largest one day scoop up in this 5-year chart.”

The number of “HODLers” is rising

In the cryptocurrency market, analysts refer to long-time Bitcoin holders as “HODLers.” They tend to hold onto BTC for prolonged periods, oftentimes for over a year.

Before the steep Bitcoin rally began that resulted in new multi-year highs, Woo said the number of Bitcoin HODLers was significantly increasing. It recorded the biggest spike since October 2017, which was just a few months before BTC rallied to its all-time high in December. Woo noted:

“Prior to this pump, the influx of new HODLers seen on the blockchain was going through the roof. Repeat, through the roof, I’m not kidding. This size of uptake was last seen in October 2017; that was one month before BTC entered its 2017 mania phase.”

The high number of HODLers is an important metric because it shows genuine retail demand behind the uptrend. A BTC rally could become vulnerable to a major pullback if it is primarily led by the futures market.

Lower risk of deep correction

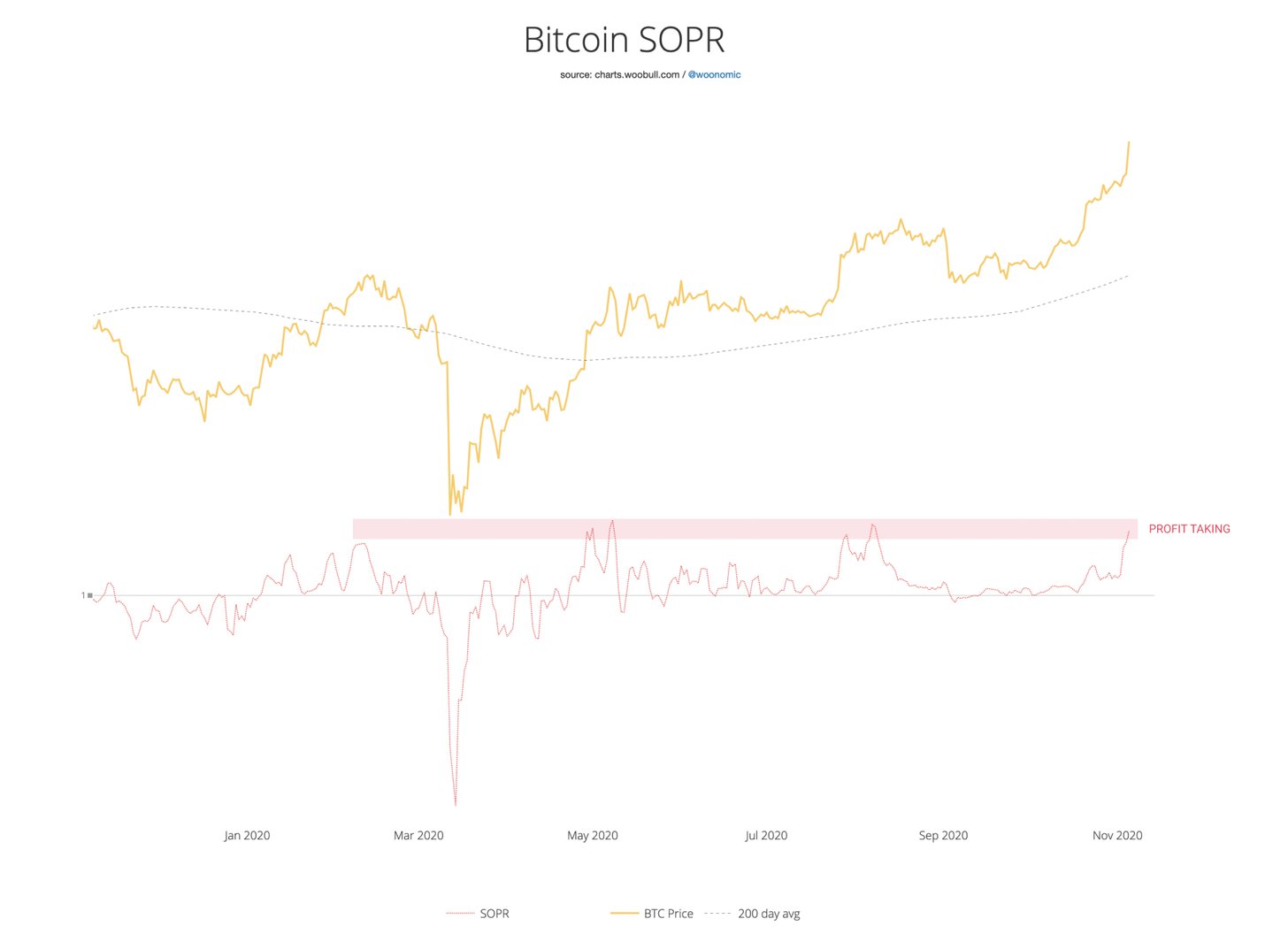

The Bitcoin Spent Output Profit Ratio (SOPR) is an indicator that shows whether investors are taking profit on their unrealized profits.

Glassnode’s data shows a fairly high number of investors took profit in the past week. This shows the threat of a major profit-taking pullback is lower because investors have already started to realize their profits as these coins have been absorbed by market buyers.

Based on the three data points, Woo emphasized that he does not see a blow-off top occurring. The term blow-off top refers to a technical formation wherein an asset’s price declines steeply after hitting a heavy resistance level. Woo wrote:

“Overall conclusion: Not expecting a blow off top. Waiting for a consolidation to complete, then more bullish action.”

In the short term, the risk to the ongoing Bitcoin rally remains the overcrowded derivatives market. As such, analysts anticipate some consolidation but not a deep correction, at least for now.