The bitcoin market bottomed out around $11,100 before bouncing back; DeFi continues an upward trend, garnering interest from traders and perhaps creating new ones.

- Bitcoin (BTC) trading around $11,467 as of 20:00 UTC (4 p.m. ET). Gaining 1.2% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,102-$11,593.

- BTC above its 10-day moving average but below the 50-day, a sideways-turning-bullish signal for market technicians.

Bitcoin’s price was able to hold above $11,100 Wednesday, going as low as $11,102 before jumping as high as $11,593.

Katie Stockton, analyst at Fairlead Strategies, sees $10,000 as a lower bound in trading because the world’s oldest cryptocurrency lacks market momentum. “The pullback in bitcoin appears healthy,” Stockton noted. “That said, there is room for further near-term downside with support in the $10,000-$10,055 area, where there was once resistance, and room to short-term oversold territory.”

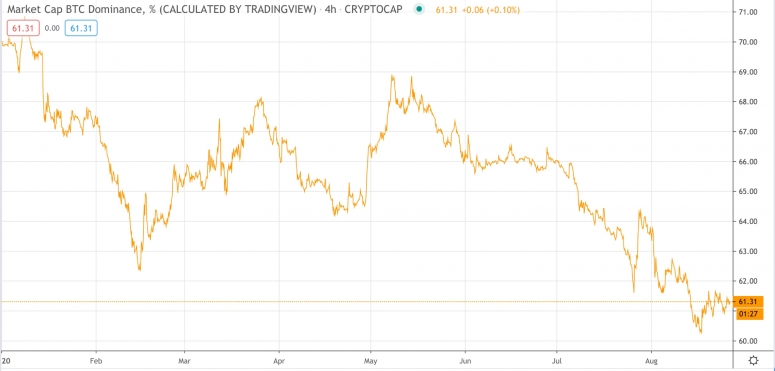

Jean Baptiste Pavageau, a partner at quantitative trading firm ExoAlpha, says bitcoin continues to be affected by gains in alternative cryptocurrencies, or altcoins. Indeed, one way to measure this is looking at bitcoin’s dominance, which hit a 2020 low of 60.26% in August.

”The flattishness of the bitcoin price since the beginning of August allowed the altcoin market cap to grow quickly with an inflow from bitcoin traders toward altcoins,” said Pavageau.

However, two key events looming over the balance of this week might increase bitcoin market action. One is Thursday’s speech from Federal Reserve Chair Jerome Powell. “The key thing to watch from Powell’s speech tomorrow is the possible shift of the inflation target from a unique figure, like 2%, to a range such as 1.75%-2.25%,” said Chris Thomas, head of digital assets for Swissquote Bank. “This would create a dovish feel to the market and we’d likely see some dollar weakness.”

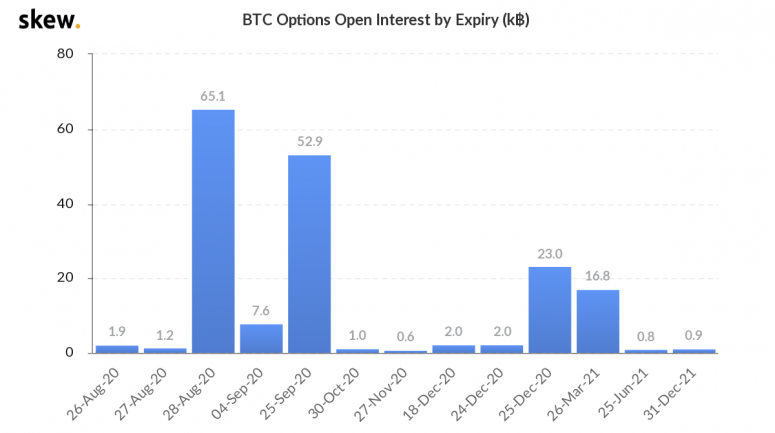

Another event is the expiration of 65,000 BTC options, over $700 million at current market values, on Friday. The vast majority of these options are on crypto derivatives platform Deribit.

“We may see some volatility as a few traders try to push the futures market towards the $11,000 or $12,000 strike,” said Swissquote’s Thomas, adding, “$11,000 would be a buying opportunity and $12,000 we’d likely see further selling.”

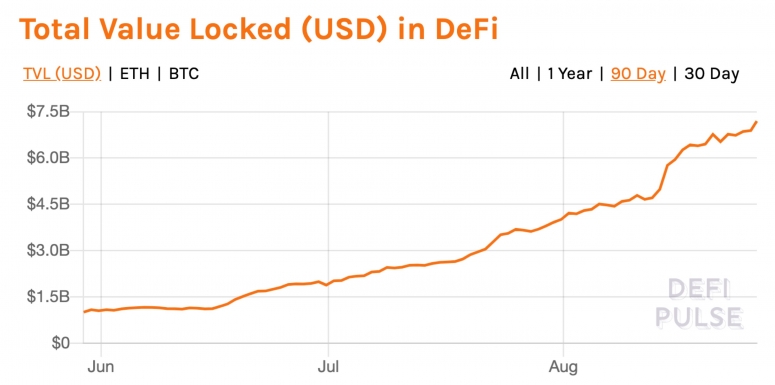

Value locked in DeFi at $7B

Ether (ETH), the second largest cryptocurrency by market capitalization, was up Wednesday, trading around $386 and climbing 1.4% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

The total value locked in decentralized finance, or DeFi, has surpassed $7 billion in value, according to aggregator DeFi Pulse. Over 4.8 million ETH and 49,248 BTC is currently “staked” in various DeFi services, gaining a percentage profit or “yield” in return.

Vishal Shah, founder of crypto derivatives platform Alpha5, says DeFi’s opportunities are captivating the interest of traders, and perhaps creating some brand-new ones. “Derivatives traders naturally look for complex risk to exploit, and, by comparison to DeFi, typical derivatives instruments are quieter,” Shah said. “I think the nuanced specifics of DeFi are probably even giving rise to a new breed of derivative traders.”

Other markets

Digital assets on the CryptoX 20 are mostly green Wednesday. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil is flat, down 0.03%. Price per barrel of West Texas Intermediate crude: $43.35.

- Gold was in the green 1.1% and at $1,952 as of press time.

- U.S. Treasury bonds were mixed Wednesday. Yields, which move in the opposite direction as price, were down most on the two-year, in the red 3.8%.