Bitcoin (BTC) was down for a fourth straight day, though changing hands well above Monday’s low around $30,000. After soaring to a new all-time high around $40,000 last week, prices have tumbled about 13% since Saturday, the most for a three-day stretch since March 2020, according to TradingView.

“Volatility is the price you pay for performance,” as the investing-legend-turned-bitcoin-bull Bill Miller put it last week to CNBC.

In traditional markets, Asian shares rose on Tuesday and European indexes were little changed. U.S. stock futures pointed to a higher open. The possibility of further economic stimulus and turbulent U.S. politics helped push yields on 10-year U.S. Treasury notes to 1.16%, the highest since March, according to CNBC.

According to Bloomberg News, that political situation could entail the U.S. House of Representatives impeaching President Donald Trump with fewer than 10 days to go in his presidency, since Vice President Mike Pence appears unlikely to invoke constitutional authority to remove the president from office.

Gold strengthened 0.9% to $1,861 an ounce.

Market Moves

A high price does not a market make. But guess what does? High trading volume.

One of the important things to note about the bitcoin market during this year’s rally is the record amount of cryptocurrency changing hands. That was true of the rapid ascent to new all-time highs above $40,000, and it’s also been true on the way down.

What it means is that the market is staying liquid, seen as a healthy attribute, especially when prices are on the move. You might be a buyer at what might seem like nosebleed levels, but you’re not the only one.

As reported Monday by CryptoX’s Muyao Shen, trading volumes and active addresses for bitcoin have now surpassed their previous all-time highs during the last crypto bull run of 2017.

“This is first and foremost a sign of how much bigger and mature the industry is, with a lot more money flowing on these exchanges,” Bendik Norheim Schei, head of research at the Norwegian cryptocurrency analysis firm Arcane Research, told CryptoX. “It is great to see higher volumes, making the market more liquid and efficient.”

The surging volume due to Monday’s sell-off came in part from newcomers to the market, according to Schei.

“Some of this volume is definitely from new and unexperienced investors entering the market for the first time and panicking when the price starts falling,” he told Shen. “These corrections are necessary and healthy, even in a bull market.”

And those newcomers aren’t necessarily rubes. They might even be sophisticated Wall Street players who have only recently dipped their toes into crypto – a sign of bitcoin’s increasing adoption by big institutional investors as a way of betting on the currency debasement amid trillions of dollars of central-bank money printing.

“The retail-driven spot market, which was pretty much the entire market three years ago, is now part of a much more mature and diverse marketplace that includes derivatives, investment funds and other institutional involvement.” Sui Chung, chief executive of CF Benchmarks, told CryptoX.

(For what it’s worth, healthy liquidity is considered such a crucial component of any market that the Federal Reserve last year cited “smooth” functioning of Wall Street’s plumbing as a rationale for continuing its $120-billion a month of bond purchases, a form of monetary stimulus that was previously considered an emergency measure but increasingly is seen as normal.)

Alongside the flurry of activity on cryptocurrency exchanges, there has also been robust traffic in bitcoin derivatives – financial contracts such as futures, options and “perpetual swaps” that traders can use to bet on the cryptocurrency’s price.

The Chicago-based CME said Monday that its notional bitcoin-futures volume climbed to a monthly record of $30 billion in December, exceeding the then-record $20 billion traded in November. The exchange launched its bitcoin futures contract in January 2018.

At least one industry executive says that futures markets might become more critical as more investors hoard their holdings of the cryptocurrency while waiting for prices to go up.

“With ‘physical’ Bitcoin disappearing, the volumes of derivative contracts are soaring,” said Richard Byworth, CEO of the cryptocurrency exchange firm Diginex, which last week launched its own “bitcoin perpetual futures contract.”

There’s high risk too: The market was apparently liquid enough that some $410 million of long positions in bitcoin futures (bets on further price gains) were wiped out Monday after margin calls on the Binance exchange, according to the data firm Glassnode in a tweet.

All of this just makes it more likely that the bitcoin market is reflecting the wealth of opinions on where prices should be at any given time for a blockchain-based, 12-year-old peer-to-peer electronic payment system with a fixed issuance schedule that is now seen as a hedge against potential debasement of the U.S. dollar.

Simon Peters, of the trading platform, eToro, wrote Monday that “we can look to the $70,000-$90,000 range as a price target for the end of 2021.” Henrik Kugelberg, an over-the-counter bitcoin trader, told CryptoX’s Daniel Cawrey that the latest sell-off might be “just be a bump in the massive bull run – $100,000 this year is totally possible!”

Denis Vinokourov, head of research at the London-based prime brokerage Bequant, says there’s a “good deal of open options interest at the $52,000 price level.”

With trading volumes growing, it’s getting easier to place those bets, whether right or wrong.

Bitcoin Watch

Despite bitcoin’s 20% crash on Monday, some options traders are betting on a continued price rally in coming weeks.

Some 4,000 call option contracts have been bought at the $52,000 strike in the past 24 hours, according to data from the Swiss-based data analytics platform Laevitas. The $64,000 and $72,000 strike call options show buying volume of 3,250 and 2,000, respectively.

The call options carry an expiration date of Jan. 29, so they represent a gamble that bitcoin could prices could rise above that level in the next few weeks.

These deep out-of-the-money trades are relatively cheap and tend to gain significant value if the price rally materializes, yielding big returns on small investments. As such, seasoned traders with bullish price expectations often buy call options at higher strike prices, on the chance that they might pay out. So the fact that traders are actually using them could indicate bullish market sentiment.

In another indicator from the options market, the one-, three- and six-month put-call “skews,” which measure the cost of puts relative to calls, remain entrenched in the negative territory. That’s a sign of call options, or bullish bets, drawing higher demand than puts, which are bearish.

What’s Hot

Bitcoin exchange Bakkt inks deal with SPAC Victory Park Capital that will result in its becoming a publicly traded company with $2.1B enterprise value, hires Citigroup’s former consumer-bank technology chief as CEO (CryptoX)

Eye-popping projection for $3T crypto market underpins Bakkt deal (CryptoX)

Institutional investors use “refill” strategy to avoid revealing big orders for bitcoin on cryptocurrency exchanges including Coinbase (CryptoX)

Tether mints record 2B USDT in one week, pushing total to 24.6B, up five-fold over past year (CryptoX)

Crypto investment company NYDIG acquires Digital Assets Data, brings co-founders (and brothers) Mike and Ryan Alfred on board (CryptoX)

Aragon One CEO Jorge Izquierdo resigns in protest of “governance” decisions (CryptoX)

ICYMI: European eToro traders call foul over closure of leveraged crypto contracts (CryptoX)

Analogs

The latest on the economy and traditional finance

Well-known bond investor Jeffrey Gundlach says stock market’s elevated valuations are “supported by massive amounts of stimulus,” sees consumer-price inflation hitting 3% rate in May or June (CNBC)

Fewer than 40% of Americans could pay a surprise $1K bill from savings (Bankrate)

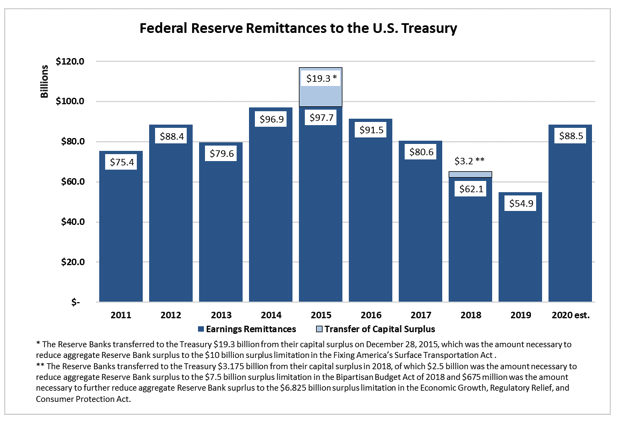

Federal Reserve system’s profit surged 60% to an estimated $88.8B in 2020, as emergency asset purchases boosted interest income, while interest expenses fell (Federal Reserve)

U.S. commercial landlords have granted billions of dollars of rent relief to struggling storefronts (WSJ)

Pandemic drives municipal borrowing to 10-year high (WSJ)

Blacklisting of Chinese stocks prompts banks to delist hundreds of derivatives (WSJ)

Apple is reportedly planning to create self-driving electric vehicles where it will outsource production via an established automaker (Nikkei Asia Review)

Small businesses to receive further help from the U.S. pandemic loan program, with $284 billion in additional funding provided to those most in need (Reuters)