- Short-sellers are still shorting Tesla stock and the sentiment around the carmaker in Wall Street remains bearish.

- But there are three catalysts in September that could fuel the carmaker: stock split, S&P 500 listing, and battery technology day.

- Tesla is seeing a higher sell-rating than the average Dow Jones stock, data shows.

Tesla stock bulls anticipate three key events in September that could further fuel the carmaker. Yet Wall Street analysts are refraining from recommending the stock, which comes as no surprise.

Investors consider the stock split, the S&P 500 listing prospect, and the battery technology day as potential catalysts.

But the sentiment around the stock remains cautious and bearish despite the positive fundamental factors.

Tesla stock fell by 5.83% on September 3 and is down an additional 2.27% in pre-market.

Why the Tesla Stock Sentiment Is Bearish and Why That Will Soon Change

According to Credit Suisse analyst Dan Levy, Tesla’s S&P 500 inclusion could happen by the week’s end.

The anticipation of the S&P 500 listing and a potential battery technology breakthrough make September “catalyst rich,” Levy said.

The S&P 500 listing could take longer than investors expect, due to the market capitalization of Tesla.

Levy noted that “there is no guarantee Tesla will be included in the next,” citing Berkshire Hathaway’s listing in 2010. There are challenges in including a company that at the size of Tesla.

While the S&P 500 might delay the listing, that makes shorting the stock riskier.

The possibility that the S&P 500 could include Tesla at any moment raises the likelihood of massive volatility.

Throughout the past year, both institutions and retail investors heavily shorted Tesla stock.

An extensively shorted stock could see higher selling pressure in the near term. But when the stock begins to rally, it forces short-sellers to readjust or liquidate their positions. Over time, that could turn into large buying demand.

According to MarketWatch, if Tesla were in the S&P 500, it would be its “most panned stock.” The report speculated that Wall Street does not comprehend the carmaker’s valuation, describing the trend as “extreme” bearishness.

Barrons reported in June that the average sell-rating ratio of a Dow Jones stock is around 6%.

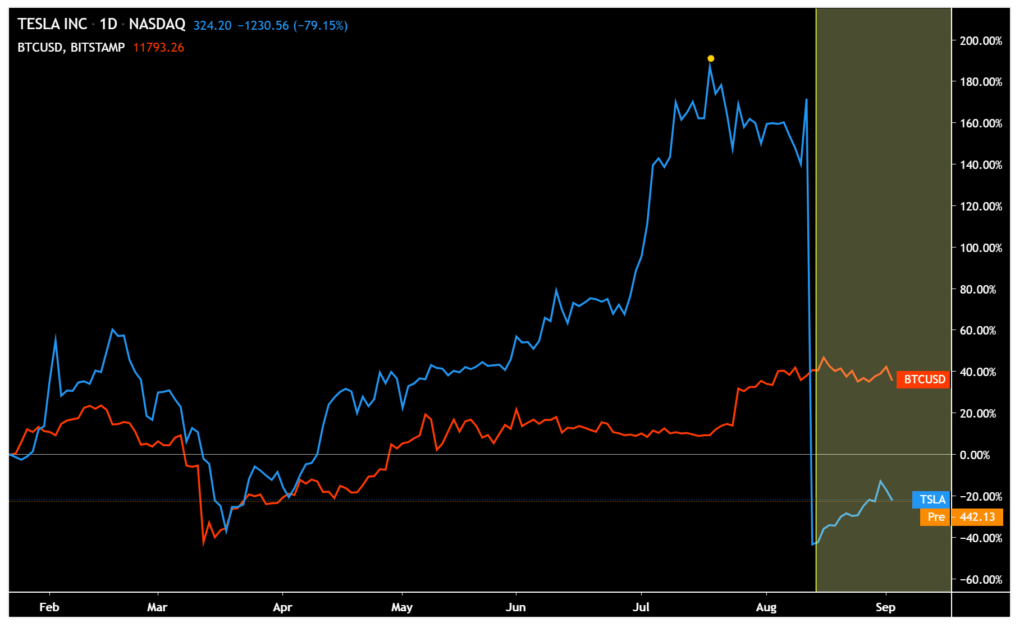

In comparison, over 33% of analysts reportedly recommend selling Tesla stock. It shows a clear bearish sentiment around the stock, despite rallying 419% year-to-date.

The price of TSLA stock fell after a major shareholder cut its position. Watch the video below:

Will Retail Traders Keep Pushing TSLA Upwards?

Since June, Tesla has seen a sharp increase in buying demand from retail traders, particularly on Robinhood.

On July 13, for instance, 40,000 Robinhood users bought the stock in less than four hours.

Since Robinhood saw a sharp increase in retail demand for Tesla in the last two months, the stock surged 63%.

TradingView.com, one of the most widely-utilized charting platforms, also reported that Tesla is the most viewed asset in America.

Emphasizing that the price of the stock quadrupled in price since January, TradingView.com wrote:

“Tesla stock is the most viewed asset in America. Our data shows that throughout July, Tesla was the most viewed stock in 31 states.”

The confluence of the high level of shorts and the likelihood of an evolving battery technology announcement on September 22 raises the probability of a rally.

Fortune reports that it expects Tesla to showcase two significant improvements to its battery technology, concerning cost and durability.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.