- Apple’s stock split prompted the most significant reshuffle in the Dow Jones Industrial Average in seven years.

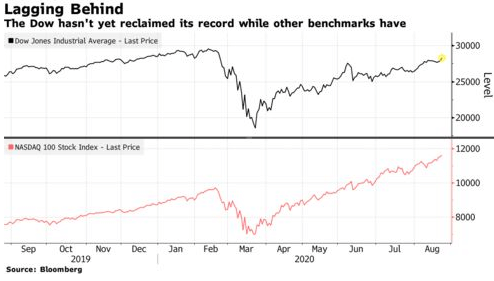

- The Dow has trailed the Nasdaq and the S&P 500, which have been boosted by tech stocks rally.

- When the tech bubble blows up, the Dow will plunge along with other indexes.

The dominance of technology companies has triggered changes in the Dow Jones Industrial Average, the world’s most famous equity benchmark.

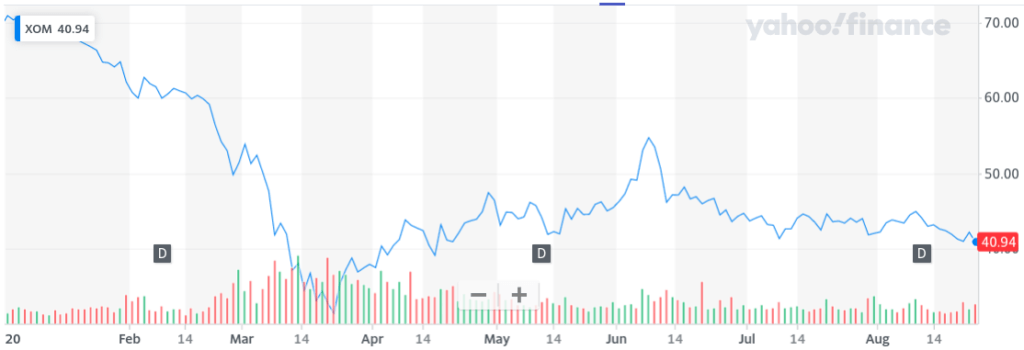

Longstanding Exxon Will No Longer Be Part of the Equity Gauge

The Dow index ditched oil giant Exxon Mobil Corp (NYSE:XOM), pharmaceutical company Pfizer Inc. (NYSE:PFE), and defense contractor Raytheon Technologies Corp. (NYSE:RTX) in the biggest shakeup since 2013.

Cloud software seller Salesforce.com (NYSE:CRM), biopharmaceutical company Amgen (NASDAQ:AMGN), and manufacturing conglomerate Honeywell International (NYSE:HON) will replace those stocks in the 124-year old index when the market opens on August 31.

Salesforce, Amgen, and Honeywell are joining the Dow Jones. Watch the video below.

What prompted the shift is Apple’s (NASDAQ:AAPL) four-for-one stock split, which reduced the sway of tech companies in the price-weighted index. The tech giant weighted 12% in the Dow before the split. The split reduced its influence in the index. S&P Dow Jones Indices said in a press release that the addition of new tech stocks would help offset that reduction.

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, said:

Those changes are a sign of the times – out with energy and in with cloud.

Exxon is the longest-serving component of the Dow and was the largest U.S. company by market cap in 2011. Its ejection reflects the steady decline of commodities in the U.S. economy in favor of tech stocks. Worth $525 billion in 2007, Exxon is now worth about $170 billion. The stock is down more than 40% year-to-date.

The Dow Is Lagging Nasdaq and S&P 500

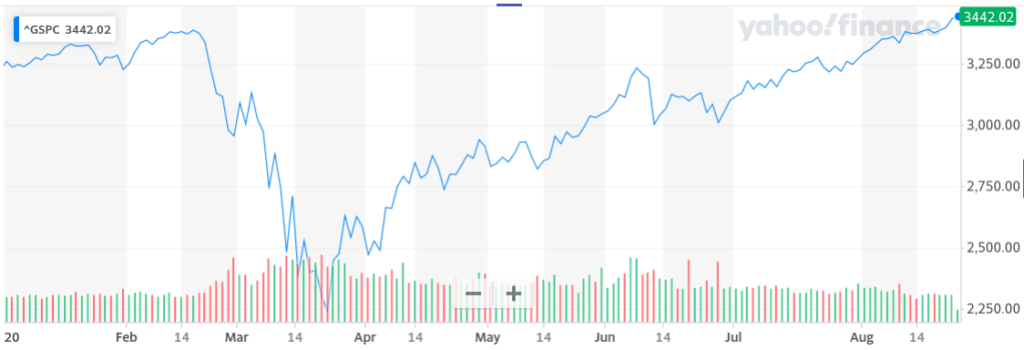

The embrace of tech companies during the pandemic has pushed the Nasdaq and the S&P 500 to new highs. The Dow has lagged as its weight in tech companies is lower.

While the Dow is still about 4% off its February highs, the Nasdaq 100 is almost 20% above its pre-pandemic record and the S&P 500 hit a new high this week.

Amazon (NASDAQ:AMZN) and Alphabet’s (NASDAQ:GOOGL) juicy returns have driven the S&P 500 higher. Neither of those companies can enter the 30-stock index as their share prices are over $1,000.

The inclusion of new tech companies should help the Dow catch up with its more tech-exposed peers. A higher concentration in tech companies might not be that positive over the longer term.

Five mega-cap stocks have driven the S&P 500 rally. Tech stocks have rallied during the pandemic as they benefited from the work-from-home shift. When the U.S. economy recovers, the interest in tech companies might fade. A vaccine should accelerate the return to normal.

An overexposure to one sector is risky. We like to be overexposed to one sector when it’s rallying, but we want to be out of it when things go south.

The hype towards tech stocks won’t last forever. For that reason, the Dow’s shift towards tech stocks might not be the best move. An index should be well-diversified and represent all spans of the economy.

Tech companies are trading at very high valuations. Billionaire Mark Cuban said the market’s tech-driven rally is very similar to the tech bubble of the 2000s. The mega-bubble could pop anytime. And when it does, it will be spectacular. Caution is advised.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.