Bitcoin (BTC) is entering prime “buy the dip” territory as the clock ticks down to the 2024 block subsidy halving.

That is the conclusion of several well-known market participants this month, with Bitcoin just one year away from its “very interesting” next halving.

Bitcoin vs. the halving: Time to buy?

Bitcoin halving cycles are known to follow patterns when it comes to price activity in a given period.

These four-year “epochs” have so far contained a macro high and macro low for BTC price, with those events likewise four years apart from one another.

What’s more, in each cycle, the macro low has tended to occur a little over one year before the next halving. For longtime Bitcoin figures, including crypto media guru Pete Rizzo, there is thus little reason to believe that the future will be substantially different.

“A small reminder the world’s most valuable money is only designed to get more scarce. Plan accordingly,” he wrote in part of a tweet on May 12.

Rizzo was celebrating the three-year anniversary of the 2020 halving, and an accompanying chart underscored BTC price behavior relative to how many months remained before a halving event.

Commenting, investor and entrepreneur Alistair Milne went further, suggesting that for those looking to profit from BTC exposure, the time to buy is now, while the months before the halving are less beneficial entry points.

“Don’t short when it’s dark green and be all in before it’s blue…,” he summarized the chart’s contents.

PlanB: 2024 halving “not priced in”

Earlier in the month, meanwhile, another popular yet controversial Bitcoin industry figure used the same halving narrative to insist that the price cycles were not a matter of chance.

Related: Bitcoin Halving: How it works and why it matters

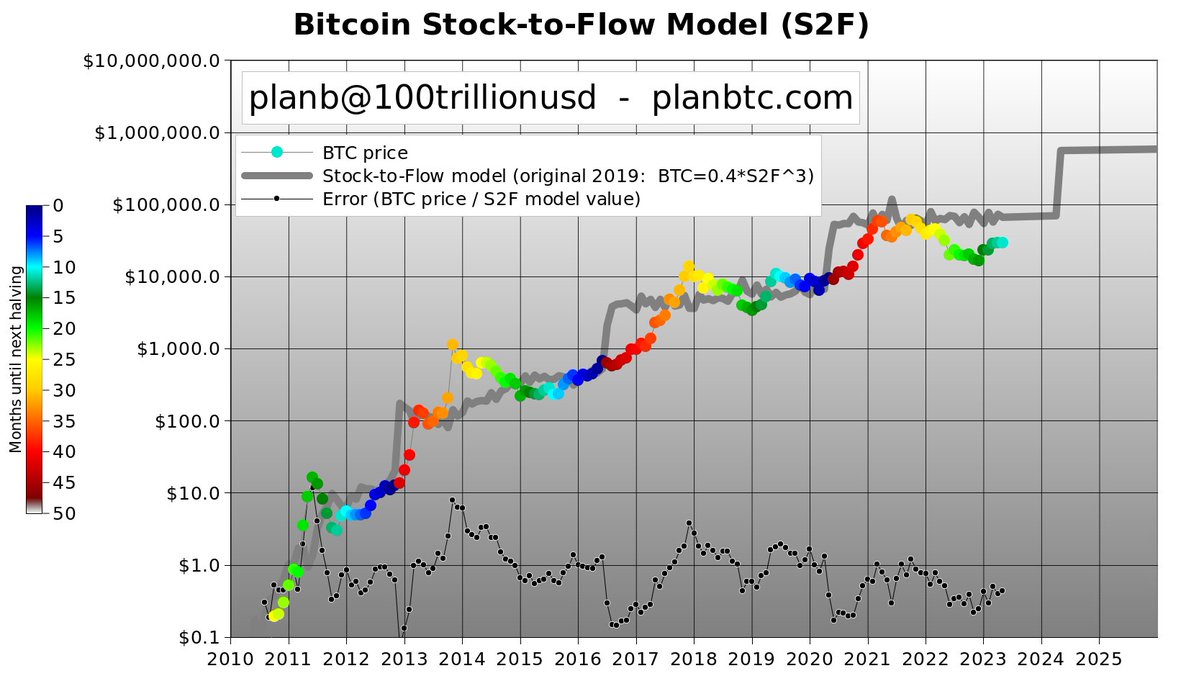

In a post of his own, PlanB, the pseudonymous creator of the Stock-to-Flow (S2F) family of Bitcoin price forecasting models, claimed that half of market participants considered the relationship between halvings and price was random.

His comments came within the context of how halvings relate to S2F, a theory that itself continues to see widespread criticism as a result of missed price targets from 2021 onward.

Nevertheless, for PlanB, too, BTC/USD remains low, with the upcoming halving not yet given sufficient market appreciation.

“Why is bitcoin S2F/halving not priced in? Because ~50% thinks the BTC price jumps after last 3 halvings (red) are a coincidence,” he wrote alongside an illustrative chart.

“Halvings are key to S2F, but these critics focus on auto-correlation between halvings and conclude there is no relation between S2F/halvings and price. I disagree, obviously. 2024 halving will be very interesting!”

In a subsequent discussion, PlanB called the idea of Bitcoin price increasing as halvings decrease available supply, or “flow,” a “no-brainer.”

Magazine: Alameda’s $38B IRS bill, Do Kwon kicked in the assets, Milady frenzy: Asia Express

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.