DocuSign has given a strong guidance for the second fiscal quarter anticipating revenue of $675 million to $679 million.

On Thursday, June 8, e-signature provider DocuSign (NASDAQ: DOCU) reported strong earnings beating revenue estimates for the fiscal quarter ending April 30 (Q1 2024). In the aftermarket hours on Thursday, the company’s share price is trading 5% up moving past $61.

DocuSign Inc, based in San Francisco, California, is a company that provides electronic agreement management services. Their flagship product, eSignature, enables electronic signing on various devices as part of the DocuSign Agreement Cloud.

DocuSign reported Q1 2024 earnings at 72 cents per share against the 56 cents per share as per analysts of Refinitiv. Similarly, the company reported a revenue of $661 million against the expected $642 million. This shows that during the first quarter of fiscal 2024, DocuSign’s revenue surged by a healthy 12%. Interestingly, this double-digit growth comes at a time of uncertain macro environment.

DocuSign reported a 14% spike to $22 million in the “professional services and other” category, on a year-over-year period. The company’s net income stood at $539,000 against the $27.4 million net loss, a year ago.

Additionally, DocuSign also announced new products and services such as Webforms. Using Webforms, organizations will be able to create, manage and customize their own forms. Thus, it will help in exporting as well as analyzing the data collected.

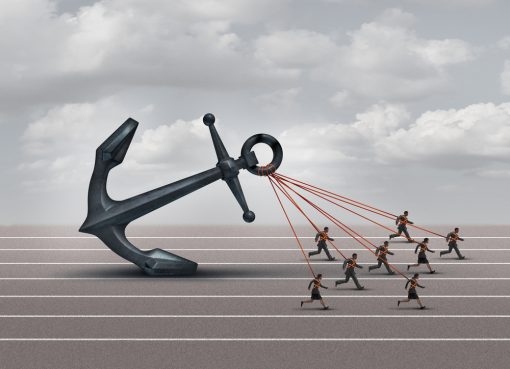

Since the beginning of the year 2023, the DOCU stock has remained quite volatile underperforming the benchmark indices. However, these strong results might serve as a catalyst for the stock price to rally from here onwards.

DocuSign User Growth in Q1 2024

DocuSign has a total of $1.4 million paying users more than 1 billion users as of April 30. The company emphasized on its international focus to investors and offers its service in more than 180 countries. DocuSign has registered 17% international revenue growth year over year.

According to Refinitiv, DocuSign anticipates revenue of $675 million to $679 million for the fiscal second quarter, surpassing analyst estimates of $667 million. For the entire fiscal year, the company predicts revenue ranging from $2.71 billion to $2.73 billion, exceeding analysts’ expectations of $2.7 billion.

Last quarter, DocuSign hired new executives for key positions in its leadership team. They appointed Blake Grayson as the new chief financial officer. Blake previously worked as the CFO at The Trade Desk and held finance roles at Amazon.

They also brought on Dmitri Krakovsky as the new chief product officer, who has previous experience at CP4, Google, SAP, and Yahoo. Additionally, Kurt Sauer joined as the new chief information security officer, having previously held the same role at Workday.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.