Bitcoin (BTC) investors seem uncomfortable with adding positions after the most recent 40% correction from the $69,000 all-time high made on Nov. 10. In addition to the prolonged downtrend, remarks from the United States Federal Reserve on Dec. 15 about rising interest rates are also weighing on risk-on assets.

The Fed signaled that it could raise its benchmark rate three times this year and there are plans to increase the pace of its asset purchasing taper.

Consequently, traders are worried that these plans will negatively impact traditional and crypto markets because liquidity will no longer be “easily” available.

Cryptoasset regulation in the U.S. has recently been in the spotlight and recently a member of the Securities and Exchange Commission’s Investor Advisory Committee called for the agency to open public comments regarding digital asset regulation.

On Jan. 18, associate law professor J.W. Verret addressed the petition to SEC Secretary Vanessa Countryman and according to Verret, the current path the SEC is taking seems not to recognize that digital assets do not fit within the regulatory framework designed for equity investments.

The professor also questioned what requirements the SEC would consider in approving a Bitcoin spot exchange-traded fund.

$590 million in options expire on Friday

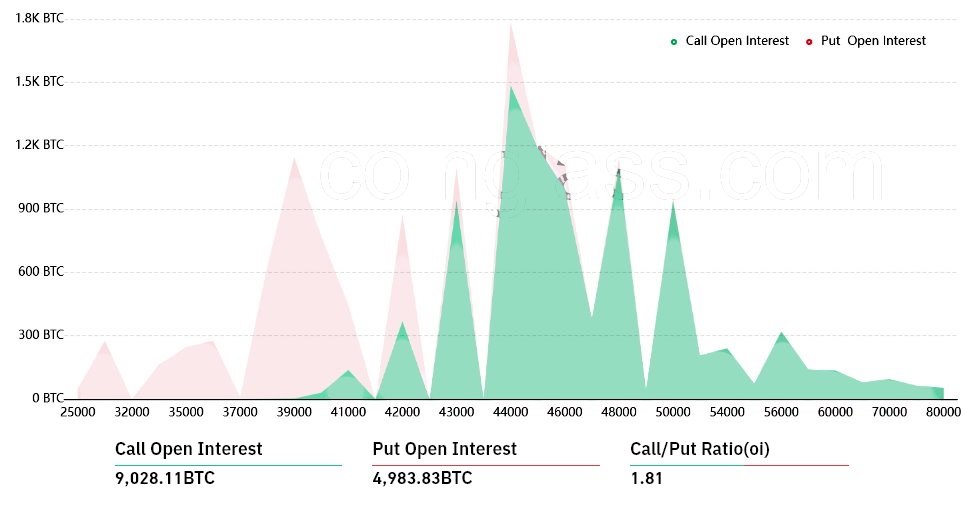

Even though Bitcoin is said to be correlated to traditional markets, BTC derivatives traders were not expecting sub-$44,000 prices according to the Jan. 21 options expiry. Friday’s $590 million open interest will allow bears to score up to $82 million if BTC trades below $41,000 during the expiry.

At first sight, the $380 million call (buy) options vastly surpass the $210 million put (sell) instruments, but the 1.81 call-to-put ratio is deceptive because the recent price drop will likely wipe out most of the bullish bets.

There is no value in the right to buy Bitcoin at $44,000 if it is trading below that price. Therefore, if Bitcoin remains below $44,000 at 8:00 am UTC on Jan. 21, only $64 million of those call (buy) options will be available at the expiry.

Bears are comfortable with Bitcoin price below $42,000

Here are the four most likely scenarios for Friday’s $590 million options expiry. The imbalance favoring each side represents the theoretical profit. In other words, depending on the expiry price, the active quantity of call (buy) and put (sell) contracts varies:

- Between $40,000 and $41,000: 30 calls vs. 3,320 puts. The net result is $132 million favoring the put (bear) options.

- Between $41,000 and $42,000: 170 calls vs. 2,180 puts. The net result is $82 million favoring the put (bear) instruments.

- Between $42,000 and $44,000: 1,480 calls vs. 1,130 puts. The net result is balanced between call and put options.

- Between $44,000 and $45,000: 2,980 calls vs. 630 puts. The net result favors call (bull) instruments by $103 million.

This crude estimate considers put options being used in bearish bets and call options exclusively in neutral-to-bullish trades. However, this oversimplification disregards more complex investment strategies.

Bulls need $44,000 to bag a $103 million profit

Regulatory uncertainty and Federal Reserve monetary policies might be reasons for the recent market weakness, but a mere 5% price pump from the current $42,000 level is enough for Bitcoin bulls to profit $103 million in Friday’s expiry.

However, if the current short-term negative sentiment prevails, bears could easily pressure the price below $41,000 and pocket $132 million gains.

Currently, options markets data slightly favor the put (sell) options, but the outcome is yet to be seen.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.