The price of Bitcoin (BTC) has started to recover on Dec. 12 after briefly dropping below $17,700 yesterday. Whale clusters show that the $18,600 level remains the biggest short-term roadblock for BTC.

Whale clusters form at a price point where whales accumulate Bitcoin and do not move their holdings. Since whales are more likely to sell at a profit or breakeven rather a loss, clusters typically act as support or resistance levels.

In the near term, whale clusters from Whalemap show $18,600 and $18,800 as the major resistance areas for the bulls.

Bitcoin must reclaim $18,600-$18,800 to reignite rally

As Cryptox previously reported, Bitcoin initially faced a risk of a deeper correction without a strong reaction from buyers above $18,000.

Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said the $16,000 level is the last major support area before $13,000. As such, the $17,600 support area is critical because a drop below it could leave BTC vulnerable to a prolonged downtrend with even lower supports getting tested.

But, Bitcoin has started to recover and whale clusters suggest a relief rally to $18,600 to $18,800 is becoming likely. Based on technical support and resistance levels, pseudonymous trader Mayne, however, reaffirmed that $18,700 remains an area of interest for sellers. He said:

“If this reject confirms we are gonna see another leg down. Seems like the $17.2k long trade is crowded, do we get there or just nuke thru. Reclaim $18k and we might squeeze some late shorts over the weekend back up towards $18,700.”

Traders have also become more cautious in net shorting Bitcoin in the past several days. Although the momentum of BTC has dwindled since the beginning of the week, some believe that the inflow of large capital from institutional investors could offset the risk of a severe pullback.

Another pseudonymous trader known as “Salsa Tekila” noted that “irrational FOMO shorting” likely caused Bitcoin to drop. After an intense drop, a relief rally becomes more probable. He wrote:

“I’m not so eager to short hedge anymore, probably going to stay spot long and scalp quietly from here. Nice 150MM$ mint, nice down-move following good news, as if people FOMO shorted irrationally. Last good news, $BTC pumped before tanking hours later, different reaction.”

Where are the whale cluster support areas?

Above $17,000, Whale clusters show two major support areas at $17,170 and $17,700. On Dec. 12, when the price of Bitcoin dropped to $17,572 on Binance, Bitcoin saw a quick reversal and recovered above $17,700 within three hours.

Bitcoin’s rapid recovery from $17,600 to $18,400 within 24 hours shows that there is high buyer demand below $18,000. In the near term, the aggressive bidding at the whale cluster support from buyers would likely prevent a steep correction.

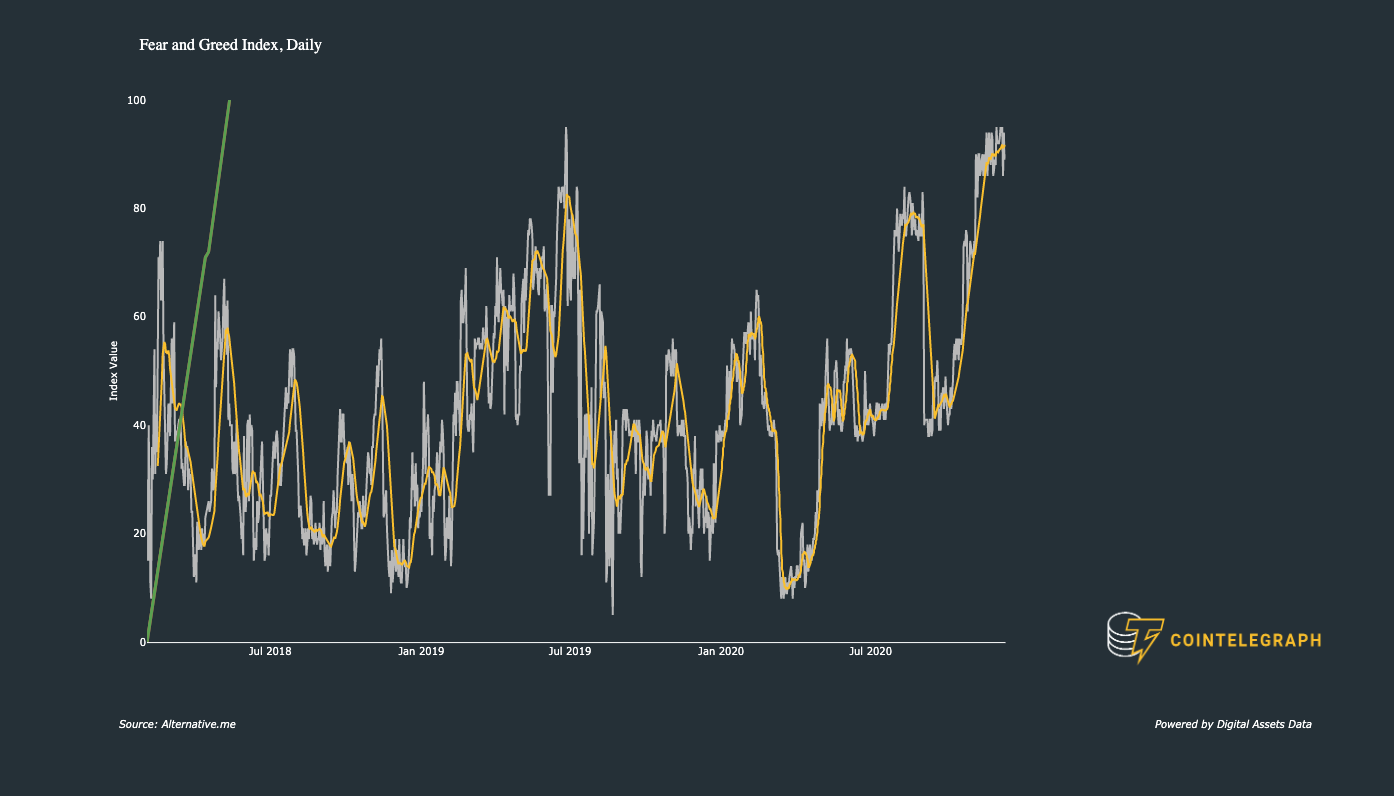

However, one concern in the foreseeable future is the Crypto Fear and Greed Index. The latest reading still shows “extreme greed” at 90 out of 100, which suggests that the downside risk remains high.