Bitcoin (BTC), Ether (ETH) and cryptocurrency-linked stocks like MicroStrategy are seeing a sharp downturn after news broke that FTX announced filing for Chapter 11 bankruptcy and Sam Bankman-Fried stepping down as CEO.

Crypto-linked stocks decline

MicroStrategy (MSTR), led by the outspoken advocate of Bitcoin Michael Saylor, is down 32.57% on Nov. 11 in a 5-day period. MicroStrategy holds about 130,000 Bitcoin and, therefore, its stock price is heavily correlated with BTC/USD. Meanwhile, the tech-heavy NASDAQ has gained 0.79%.

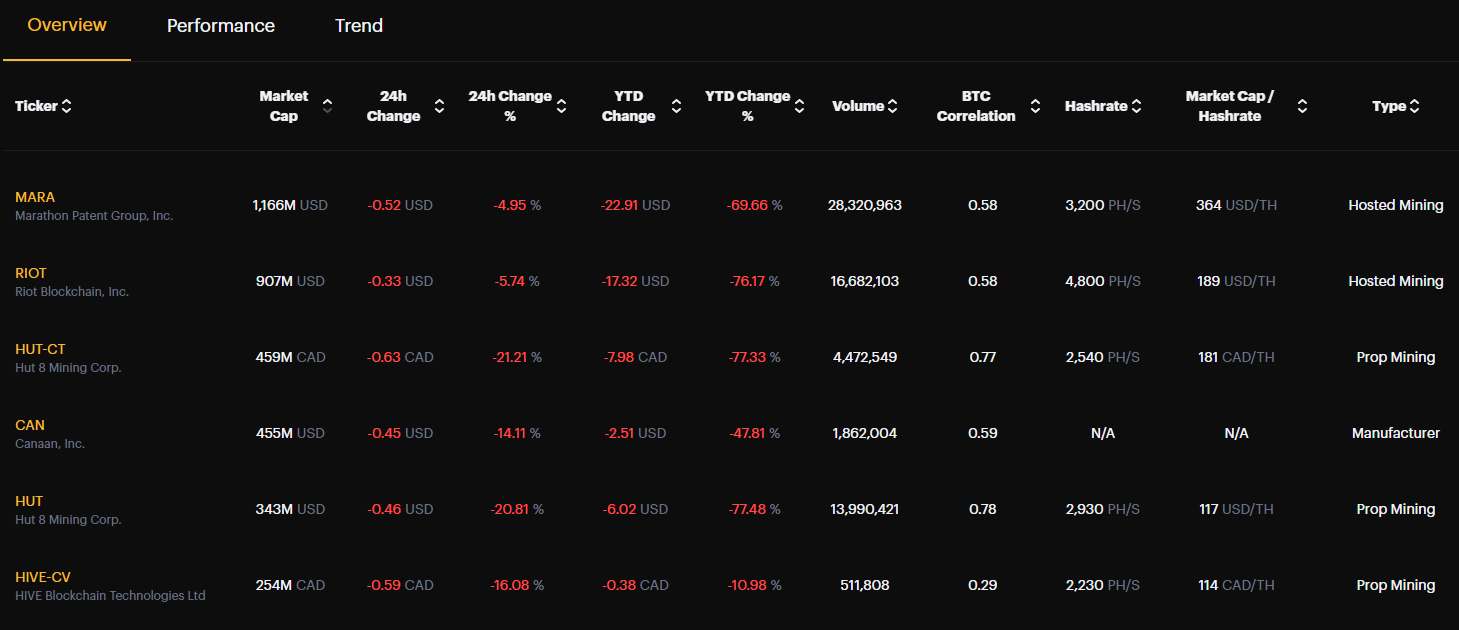

Mining stocks have seen losses today, with the Hashrate Index Crypto Mining Stock Index showing a 0.14% loss at midday Nov. 11. Top miners’ market performance is much lower. Marathon (MARA) is down 4.95%, Riot (RIOT) is down 5.74%, and Hive (HIVE) is down 16.08%.

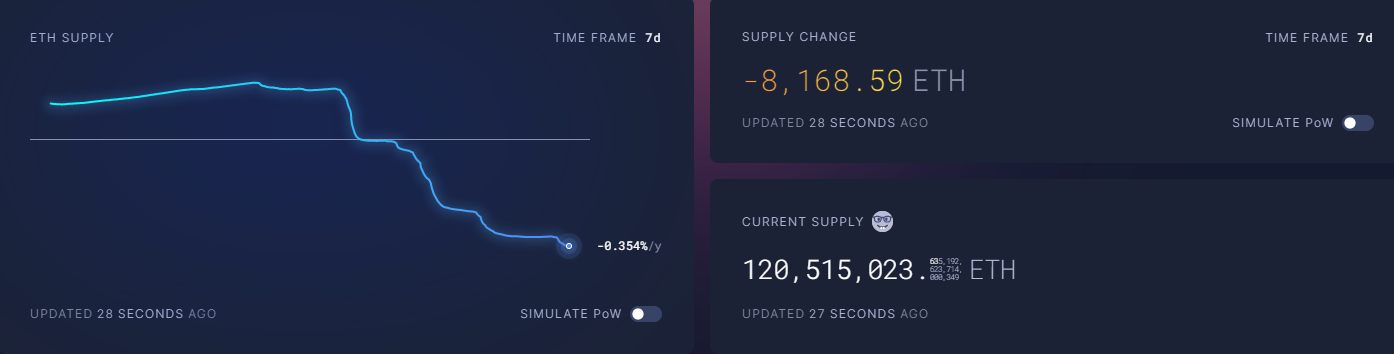

Meanwhile, ETH price saw a 22% decrease this past week despite Ether becoming deflationary for the first time since the Merge. Over 8,000 Ether have been burned in the last seven days bringing the yearly rate to -0.354%.

In addition to the FTX debacle hindering the Ether price, a mass amount of futures liquidations caused the price to hit a 4-month low of $1,070 this week.

Bitcoin price back below June lows

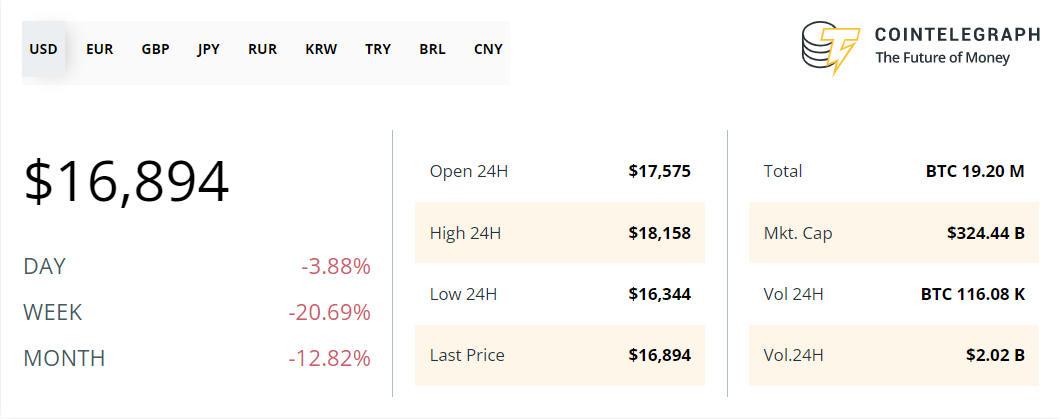

Data from Cryptox Markets Pro shows Bitcoin has lost 20% of its value in the past week as well. In addition, Bitcoin reached a new yearly low of $15,742 due to the FTX collapse.

Moreover, Bitcoin’s price crunch is leading miners to sell at an accelerated rate further increasing downward pressure.

According to Charles Edwards, founder of the Capriole Fund, Bitcoin miners reached the red level on an open-source Bitcoin Miner Sell Pressure chart, which shows the most selling in almost five years.

Bitcoin miners are in pain and selling more than they have in almost 5 years!

Introducing: Bitcoin Miner Sell Pressure.

A free, open-source indicator which tracks on-chain data to highlight when Bitcoin miners are selling more of their reserves than usual. pic.twitter.com/sXpxXXdUiW

— Charles Edwards (@caprioleio) November 11, 2022

The uptick in miner selling has also coincided with a Bitcoin whale moving 3,500 BTC for the first time since 2011.

Is BTC close to bottoming?

But analysts are mixed on whether BTC has bottomed. For instance, trader Mags sees two possibilities.

He tweeted:

“Bottom is in already ($15.5k) and we front run everyone waiting for $14k,” Otherwise, “We see a deep re-test & go way lower than $14k , maybe $11.5k – $12k.”

Other popular analysts like John Wick don’t believe the bottom is in.

“I gave everyone heads up and said if this lower end of the support broke that I would short again,”he said.” I also mentioned that I did not think the lows were in. I hope you put in your orders ahead of time”

I gave everyone heads up and said if this lower end of the support broke that I would short again. I also mentioned that I did not think the lows were in.

I hope you put in your orders ahead of time

Dots again catching the move early and have predicted every move https://t.co/FVF0aMSq3X pic.twitter.com/ADlgNyBcC8

— John Wick (@ZeroHedge_) November 11, 2022

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.