While bitcoin has gained 3% so far this week, the overall trading environment remains dull with volatility hovering at multi-year lows.

Ten-day realized volatility, a historical metric, is now at just 20%, the lowest level for two years. That’s “a low that’s only preceded in Sep & Oct 2018,” the Singapore-based quantitative trading firm QCP Capital said on its Telegram channel.

Back in the autumn of 2018, the low-volatility consolidation ended with a big drop to below $6,000. This time, though, options traders are anticipating a breakout on the higher side.

“With the rise in one-month implied volatility this past week (on the back of more call buying) resulting in a notable divergence with realized volatility, a similar bang to end the lull is what option traders are betting on (this time with an upside break),” said QCP Capital.

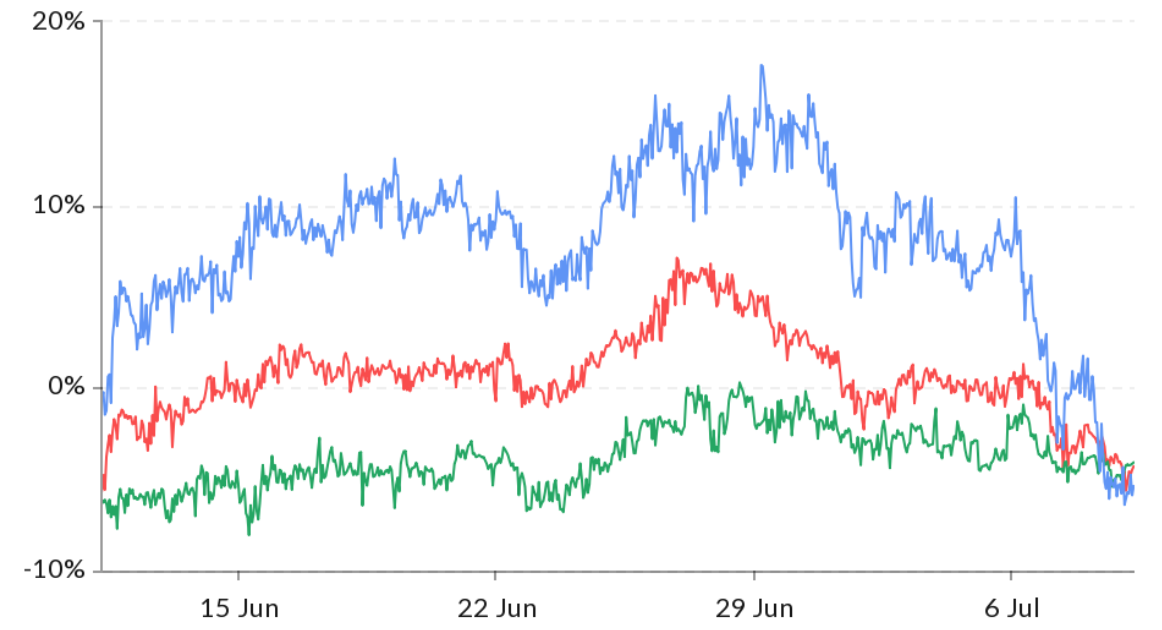

Bitcoin’s one-month implied volatility has risen from 46% to 55% over the past six days, according to data provided by the crypto derivatives research firm Skew.

Implied volatility is the market’s expectation of how risky or volatile an asset will be in the future and is calculated by taking an option and the underlying asset’s price along with other inputs such as time to expiration.

Meanwhile, the one-month realized volatility has declined from 78% to 35%. Realized volatility represents the price volatility that has actualized in the past.

The recent divergence between the two metrics is indicative of traders pricing in a transition from a low-volatility to a high-volatility trading environment over the next few four weeks.

Implied volatilities are primarily driven by the net buying pressure for options (calls/puts). The latest pick-up looks to have been fueled by increased demand for call options or bullish bets, as noted by QCP Capital.

That is evident from the fact that the one-month, three-month and six-month put-call skews are reporting negative values. Put-call skew measures the price of puts relative to that of calls.

The one-month skew has dropped sharply from 11% to -5.4% this week. Negative values indicate that call options (or bullish bets) are drawing higher prices than put options (bearish bets). So, in effect, options traders are leaning bullish right now, with calls in greater demand.

It remains to be seen if the multi-week-long trading range of $9,000 to $10,000 ends with a bullish breakout, as expected.

The technical charts are also backing that scenario. For instance, the cryptocurrency breached a month-long falling channel on the higher side on Wednesday, signaling an end of the pullback from highs above $10,400 seen July 1.

Further, the MACD histogram, a momentum indicator, has crossed above zero in favor of the bulls.

The cryptocurrency is trading near $9,400 at press time, representing a 0.57% decline on the day.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

The leader in blockchain news, CryptoX is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CryptoX is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.