After falling into one of the narrowest prolonged trading ranges it has ever seen, Bitcoin has finally incurred some volatility.

Throughout the past week, the cryptocurrency has been trading between $9,100 and $9,300, with its price mainly remaining stagnant around $9,200.

Overnight, however, buyers were able to put a firm end to this trend, sending the cryptocurrency’s price rocketing up towards $9,500.

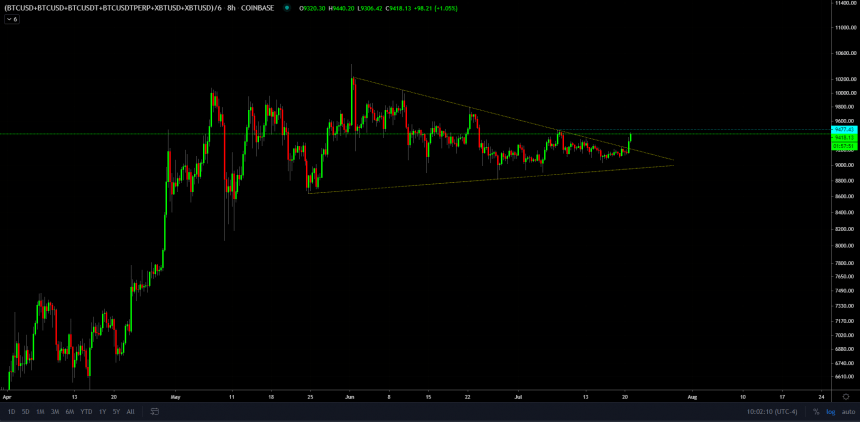

It does appear to be facing some resistance around this level, although this latest upswing allowed it to break out of a multi-month descending triangle that was previously guiding it lower.

This latest break also comes as the stock market continues showing signs of immense growth. It is likely that BTC will continue following the general trend of the traditional markets for the time being.

With promising vaccine trials and an imminent round of fresh government stimulus, this could bode incredibly well for the benchmark digital asset.

Bitcoin Rallies Past $9,400 as Buyers Shatter Previous Trading Range

At the time of writing, Bitcoin is trading up just under 3% at its current price of $9,415.

This is around the price at which it has been trading for the past few hours, and it appears that buyers are starting to face some selling pressure.

It remains unclear as to whether or not this will catalyze another rejection at this level.

One positive factor to consider in the near-term is that this latest breakout allowed Bitcoin to rally past the upper boundary of a multi-month descending triangle that it was previously caught within.

An analyst spoke about this in a recent tweet, adding that traders should “look alive” due to the significance of this movement.

“BTC ~2 month descending triangle-thing attempting upside break. Look alive gang,” he explained.

Image Courtesy of Jonny Moe. Chart via TradingView.

BTC’s Correlation With the Stock Market May Fuel Next Uptrend

The stock market has been caught in the throes of an immense bull market throughout the past several weeks and months.

Its unwavering strength comes as multiple vaccine trials begin showing promise, and as investors eye a fresh round of fiscal stimulus that is currently being drafted in Washington D.C.

These factors could continue boosting the markets, creating a tailwind that lifts Bitcoin higher.

The same analyst mused this possibility, explaining that the “SPY tether is in full effect” and that a break above $9,475 could be all that is needed to spring the crypto higher.

“Watching ~$9475 level to run some stops and spring us. The SPY tether is still in full effect for now,” he explained.

Image Courtesy of Jonny Moe. Chart via TradingView.

It is imperative that Bitcoin shatters the heavy resistance laced throughout the upper-$9,000 region for it to spark a mid-term trend that favors buyers.

Featured image from Deposit Photos. Charts from TradingView.