The infamous $10,000 resistance level has proven to be a significant obstacle for Bitcoin to overcome. From a technical perspective, this barrier is part of a descending trendline that can be drawn from each major peak since the December 2017 all-time high of nearly $20,000.

These include the late June 2019 peak of $14,000, the mid-July 2019 high of $13,200, the early August 2019 spike of $12,300, and the mid-February 2020 high of $10,500.

Bitcoin Faces Strong Multi-Year Resistance Ahead. (Source: TradingView)

Now that the flagship cryptocurrency is once again trying to move past this resistance wall, retail investors appear to be losing faith. This sense of disbelief among market participants can be seen as a positive sign for the continuation of the uptrend.

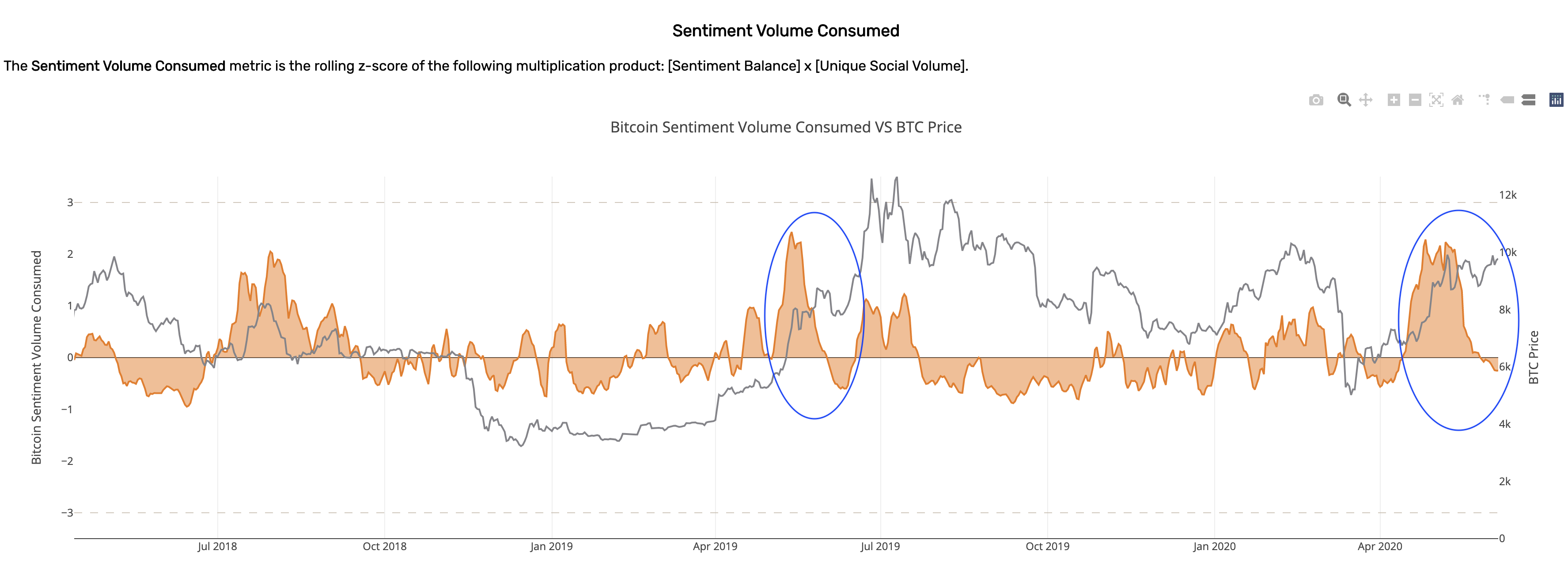

Crowd Sentiment Turns Bearish

Santiment recently noted that the chatter around Bitcoin in Twitter has entered into a “negative sentiment area.” This could be a direct result of BTC’s inability to stay above $10,000 despite the positivism sparked by the 60% rally seen between April and May.

The behavior analytics platform affirmed that the current sentiment and price action resembles what happened between May and June 2019.

“There was extreme positive sentiment seen following a nice price rally and a shift to negative sentiment after a dip [in mid-2019]. During then, this preceded a continued uptrend, could we be seeing the same play out?,” said Santiment.

Bitcoin Sentiment Volume Consumed. (Source: Santiment)

While the flagship cryptocurrency sits on the cusp of what could be its next bullish cycle, different metrics add credence to the optimistic outlook.

Bullish Signs Ahead of Bitcoin

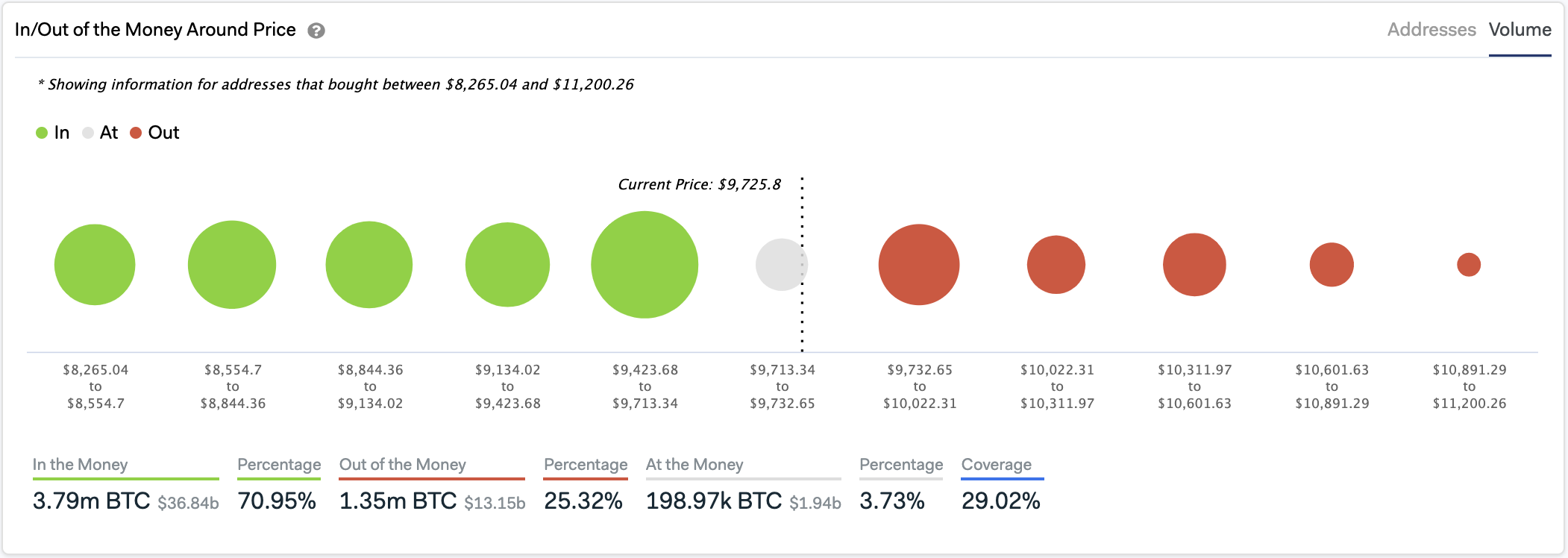

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that Bitcoin sits on top of a major support barrier that may absorb any downward pressure.

Based on this on-chain metric, approximately 1.85 million addresses bought over 1.17 million BTC between $9,400 and $9,700. Such a massive supply wall could prevent the bellwether cryptocurrency from declining if sell orders begin to pile up.

In/Out of the Money Around Price. (Source: IntoTheBlock)

Moreover, Santiment’s MVRV Long/Short Difference index has shown over the years that when it rises above 0, it marks the end of a bear cycle. At the end of May, this indicator went above 0 for the first time since the beginning of the year.

The sudden uptick may indicate that Bitcoin is preparing to resume its history uptrend.

“If the aliens don’t invade us or the world don’t face yet another black swan event, we might just continue this run,” affirmed Santiment.

It is worth mentioning that different technical patterns suggest that the pioneer cryptocurrency could see a brutal drop towards $7,000. For this reason, it is crucial to implement a robust risk management strategy when investing in Bitcoin to avoid getting caught on the wrong side of the trend.