Bitcoin advocates call for a ban on gold as on-going investigations into Danske Bank reveal the lender offered gold bars to clients as an off-the-table service. This bypassed money laundering checks and was sold based on helping to keep the fortunes of wealthy clients hidden.

At the height of the Danske Bank dirty-money scandal, the lender started offering gold bars to wealthy clients to help them keep their fortunes hidden, sources say https://t.co/r0c0BnC7m9

— Bloomberg (@business) November 10, 2019

Danske Bank Laundered $220 Billion

Authorities in both the US and Europe are probing Danske Bank over money-laundering allegations. Investigators believe the operation spanned Denmark, Estonia, and France, with around $220 billion funneled between 2007 and 2015.

Investigations into the bank have been on-going for some time now. But recently, it emerged that representatives, from the bank’s Estonian operation, offered a select group of mostly Russian clients the opportunity to purchase gold.

While the sale and purchase of gold are not illegal, details of this service were never openly publicized, to which compliance lawyer, Jakob Dedenroth Bernhoft said:

“It puzzles me that the bank’s own report on the case didn’t discover this. This is a service that is completely against all anti money-laundering laws. It is definitely suspicious.”

According to Bloomberg, anti-money laundering checks were performed before customers collected their bars. However, if clients opted to keep the gold in long-term storage, these checks did not apply.

The fallout from this has Bitcoin advocates calling for a ban on gold. While made as a tongue-in-cheek response, the intention is to highlight the hypocrisy that exists within the banking and precious metal sectors.

Spoiler: no one will end up in prison

— hodlonaut🌮⚡🔑 (@hodlonaut) November 10, 2019

Criminals Use Bitcoin Less Than Other Methods

The fact is, criminals, launder money using Bitcoin, as well as a range of other methods. But the public at large often has a skewed opinion on the scale of the problem. Which in turn leads to an unfair representation of Bitcoin, and cryptocurrencies in general.

At the same time, money laundering by many well-known banks is a part of their daily business. And fines have done little to halt the practice.

According to Patrick Tan, CEO at Novum Global Technologies, this is because banks price in the cost of fines when doing new business. He said:

“Banks already price in the risk of a fine by the regulator when they consider these type of transactions. As long as the profits from the transaction exceed the fine, it’s more or less good to go.”

If that wasn’t enough to stir anger, Tan also brings to light the scale of the problem compared to the cryptocurrency market:

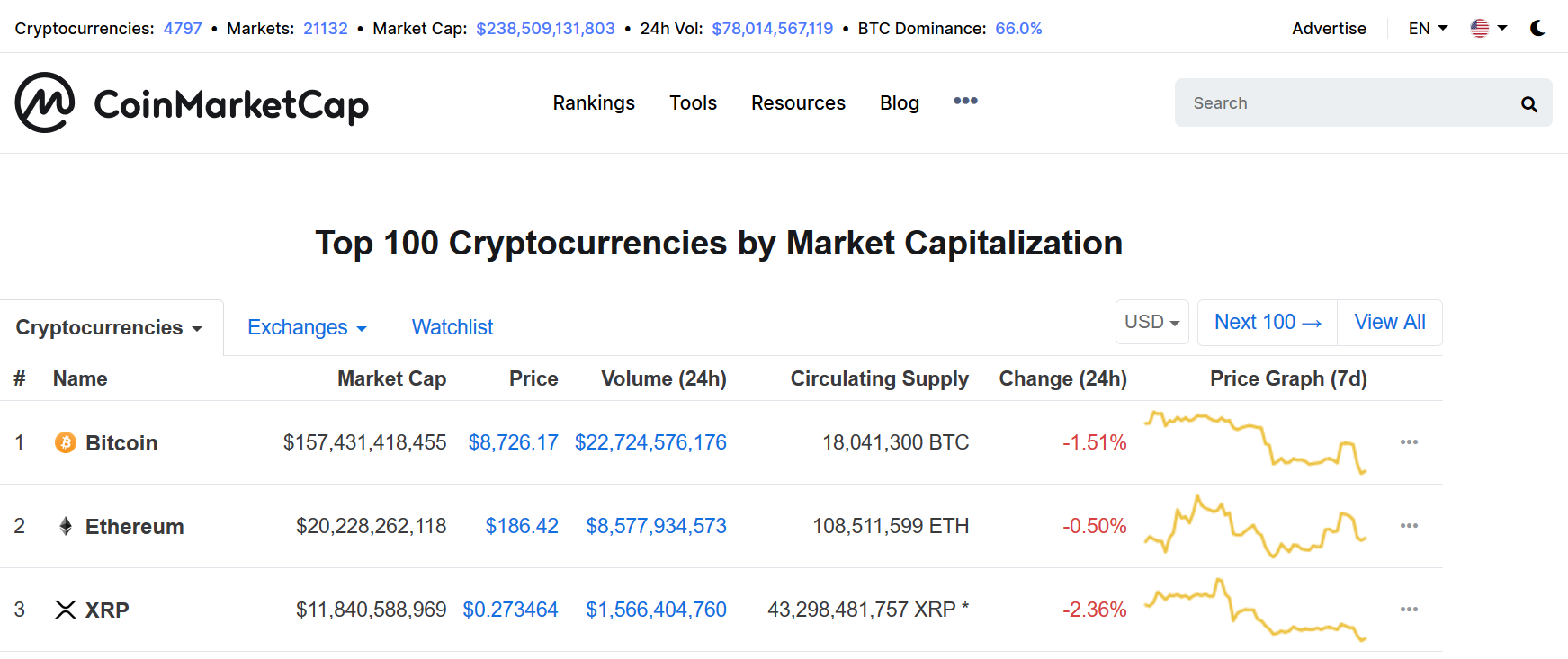

“According to the United Nations Office on Drugs and Crime, questionable transactions continue to reach as much as US$2 trillion a year. By comparison, the total market cap of cryptocurrencies is barely US$120 billion on a good day.”

Criminals will use whatever means necessary to achieve their goals. And many banks are only too happy to help in that respect. As such, the association of criminality with Bitcoin is wholly unjust. Especially when considering that cryptocurrencies are far from the number one choice for criminals.