- JPMorgan thinks the U.S. stock market will see a different dynamic in the next six months.

- Strategists predict individual stocks will see less correlation, as fear of missing out (FOMO)-driven sentiment subsides.

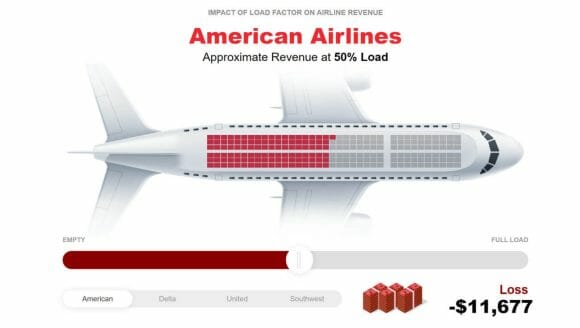

- Struggling sectors with weaker fundamentals and financials like the airline industry are expected to see a steeper downtrend.

JPMorgan thinks the U.S. stock market will likely not see a bull trend like in May again in 2020.

The U.S. stock market has seen an extended uptrend buoyed by the Federal Reserve’s liquidity injection and bond purchases.

Strategists at JPMorgan said the liquidity could only trigger the stock market to move upwards in tandem.

Some Stocks Will Outperform Others as Current Stock Market Dynamics Subside

The Fed’s robust policies and the multi-trillion-dollar stimulus of the government inflated U.S. equities.

Consequently, the U.S. stock market saw a massive upsurge from April to May. Most major stocks from tech giants to airlines benefited from a fear of missing out (FOMO)-driven rally.

In the next six months, JPMorgan says the dynamic of the U.S. stock market is likely to change.

An “indiscriminate approach” to trading stocks proved to be effective in the last two months. But, in the second half of 2020, the investment bank suggested that investors will likely spot “specific weaknesses” in the market..:

But typically these high correlations mean-revert to their long-term averages within a few months, in part because the pace of quantitative easing slows and in turn allows country, sector and company-specific factors to reassert themselves.

Stocks will likely move based on the financials and fundamentals of their respective businesses. For struggling sectors like the airline industry, it may mean a steeper downtrend in the second half of 2020.

Why Airlines May Struggle in Particular

Airline stocks have been the primary beneficiary of the strong stock market rally in Q2 2020. Stocks of the big four airlines in the U.S. performed relatively strongly, fueled by explosive retail demand.

Following the warning of JPMorgan, investors may rigorously evaluate individual stocks to determine the health of a business.

In April 2020, reports showed that American Airlines was losing about $70 million a day. In the first three months of the year, the airline giant lost $2.2 billion.

High operational costs such as airplane leases, parking, and maintenance fees mount growing pressure on airlines.

But, airlines are now beginning to seek multi-billion dollar loans. The momentum of the U.S. stock market can only carry struggling businesses to a certain point.

To top it off, the yield of the U.S. Treasury notes are on the decline once again. Fear towards the resurgence of virus cases is rattling the financial market.

The struggling attempts of economies throughout Europe and Asia to reopen in the aftermath of the pandemic only add to the pressure on equities.

Geopolitical risks continue to intensify as a result of the deteriorating relationship between the U.S. and China.

The U.S. officially rejected the request of China to allow additional flights. It comes after China reportedly are recommitting to the phase one deal with the U.S.