- Long-term investors could be in for a bumpier ride than anticipated as the stock market’s previous problems have been amplified.

- The Fed’s intervention only served as a short-term bridge that inflated the asset bubble further.

- Analysts are cautioning of irrational investor sentiment ahead of a stock market meltdown.

With Donald Trump’s health still a big question mark among investors, many wonder if we’ll close out the year with another big stock market crash. Volatility is all-but-certain in the near-term amid Covid-19 and the presidential elections.

Market bulls are using this uncertainty to bet on a return to normalcy and take up long-term positions. Still, some analysts say the market outlook is rocky even beyond the pandemic.

According to University of Utah Finance Professor Matthew Ringgenberg, a recent rise in the number of short positions in the market should give investors pause. He claims that his short-selling activity index is one of the most accurate indicators of the stock market’s long-term direction.

Ringgenberg’s data show that short selling activity is approaching pre-pandemic levels. That’s significant because before Covid was a factor, traders were expecting the stock market to trend downwards. At the top of the pre-pandemic bull market, Riggenberg’s index of short-selling index read 1.28. Today it’s back up to 1.26.

The short-selling activity indicates that 12 months from now, the stock market will be lower than it is today.

70% Declines Possible as Old Problems Resurface

Ringgenberg isn’t the only one sounding the alarm about a stock market crash. Morgan Creek Capital Management CIO Mark Yusko is similarly skeptical about the market’s long-term direction. He believes the stock market could be heading for a 70% drop as irrational exuberance among investors and ultra-high debt levels threaten to topple Wall Street’s house of cards:

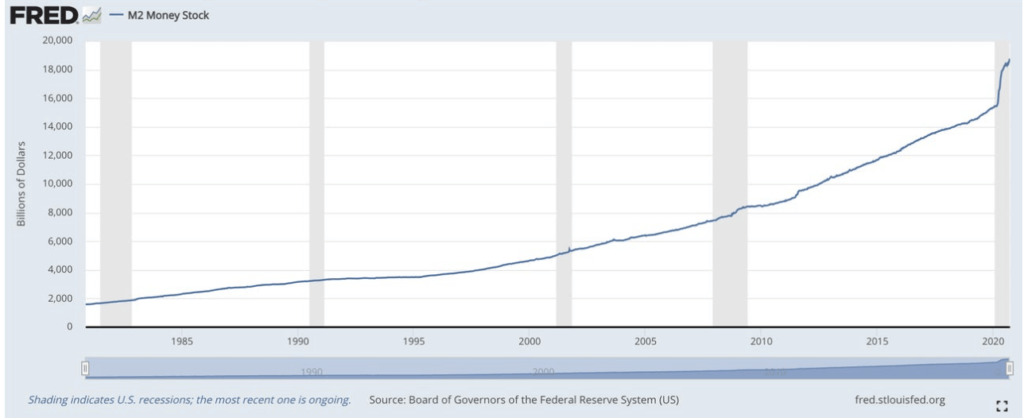

Bottom line is: The S&P is a money supply story. We basically increased the money supply; that got stocks to go up, but now money supply growth can’t grow as fast as it was — that’s just math. The rate of change is not as high, and the Fed’s got to lower their balance sheet at some point.

Like Ringgenberg, Yusko points out that the market was already nearing a tipping point before the pandemic caused it to nosedive in March. Instead of correcting, though, the stock market quickly rebounded because of the Fed’s unprecedented intervention. Looking beyond the pandemic, he notes that ultra-high corporate debt and unreasonably positive investor sentiment could come crashing down.

On top of that, he cautions that only a few mega-cap stocks are responsible for roughly 20% of the S&P 500. That on its own is something to worry about.

Tech Mega-Caps Set for Come-Down

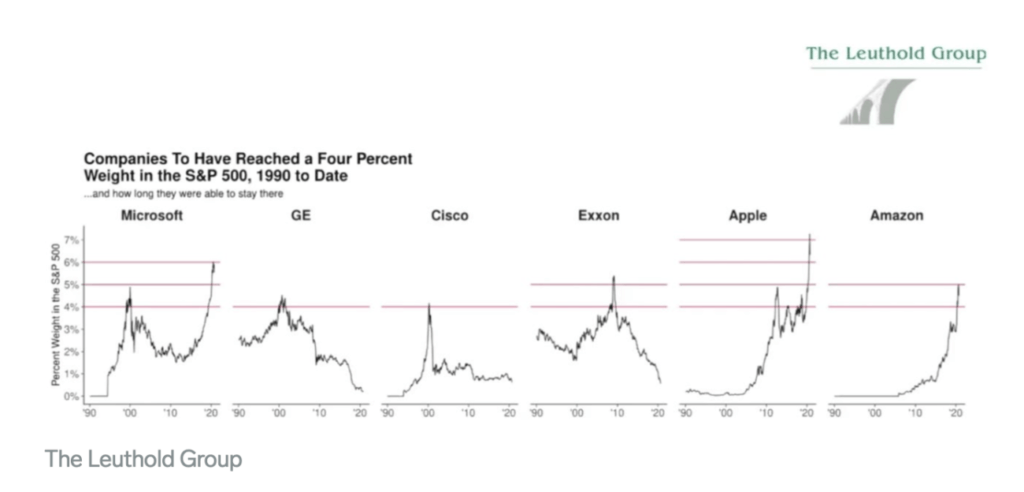

Phil Segner of The Leuthold Group isn’t quite as bearish about the entire market, but he warned that big tech is headed for a crash landing. He points to a relatively small group of stocks dubbed the “Four Percenters.” These stocks obtained a market value that afforded them a 4% or more weigh on the S&P 500.

Spoiler alert: things rarely end well for companies that grow to that size. Since the ’90s, only six firms have joined the esteemed group— today, only three remain. That’s because GE, Cisco, and Exxon have since been bumped from the Four Percenters club. Segner says it’s rare for a stock to maintain a weighting above 4% for more than a few months.

Microsoft and Apple have managed to break that norm; both companies have long overstayed their welcome in the group. Segner believes that’s a sign of trouble.

That index that in almost everyone’s mind is unquestionably diversified remains extraordinarily concentrated, pretty much any way you slice it. And looking at these weights and historical context tells us that the best days are probably behind the market cap tech rally.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.